Investment Innovation

Macro Foundations

Guided by innovative macro research, a disciplined investment

process and effective risk management, we aim to be our clients’

most trusted long-term partner

What’s New

Fulcrum’s Investment Process Explained

In this video, Suhail Shaikh, Chief Investment Officer, discusses:

- An overview of Fulcrum Asset Management

- Fulcrum’s investment committee and process

- Fulcrum’s key strengths and differentiators

What’s New

One dot makes the difference

Read our Executive Chairman, Gavyn Davies’ current market views as at 21 March 2024:

- Soft landing remains FOMC’s most likely scenario

- Powell chose not to emphasise the concerns raised by the latest two inflation prints

- The longer run dot rose by only 0.1%, much less than expected

- The mean policy rate dot for end-2024 rose from 4.7% to 4.81%

What’s New

March 2024 wrap-up: global growth accelerates as central banks diverge

The month of March saw a continuation of recent trends, with a further improvement in market sentiment alongside an acceleration in global economic activity.

Views & Research

March 2024 wrap-up: global growth accelerates as central banks diverge

One dot makes the difference

February 2024 wrap-up: growth optimism, inflation concerns dominate markets

Videos & Podcasts

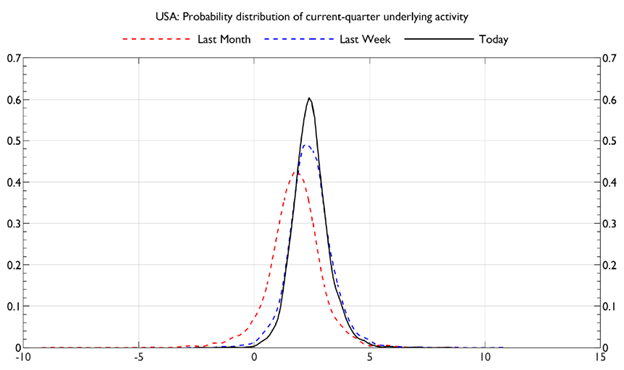

Chart of the Week

As at 12 February 2024

Source: Fulcrum Asset Management

A career with us

Fulcrum offers exciting opportunities for talented people looking for professional development and career growth, no matter what stage you are at in your working life. Our commitment to diversity and inclusion creates a welcoming and supportive environment where employees from a variety of backgrounds can bring their unique perspectives and experiences to the table.

About Fulcrum

Founded in 2004, we are a global, independent asset manager investing across all major asset classes and geographies. Ultimately, our aim is to deliver on our clients’ investment objectives, providing a range of innovative solutions that put macroeconomic research at the heart. We are not only disciplined by economic theory and empirical evidence, but also stringent risk management which is a vital component of our success.

Our focus is on uncovering investment opportunities wherever they are; our unconstrained investment universe provides the flexibility to implement what we observe as being the best investment strategies.

AUM £6.4bn (8.1$bn) as at 31 January 2024

Diversification

is not a constant;

it is a function

of the macro

environment

Discover more

Hear the latest from us

Sign up to receive our latest macro insights and news