17 February 2022

Authors: Rahil Ram, Iancu Daramus

Trade-offs lie at the heart of investing; the preference of more risk-averse investors for the stability of bonds relative to more volatile, but potentially more profitable equities is one classic example. Yet there are no guarantees – as ever, much will depend on investment beliefs.

Investment beliefs also play a key role in the context of climate-aligned and impact investing. For some, applying any climate-related restrictions to the investment universe will necessarily lead to suboptimal capital allocation, as shunned stocks compensate new investors through higher returns. For others, companies lagging on sustainability may be at risk of obsolescence, as changes in technology, regulation and consumer preferences contribute to permanently depress their cash flows – so restrictions can serve as downside protection.

The reality, as always, is nuanced. Investors ‘restricting’ themselves to the tech sector would have generated oversized returns over the past decade; whilst those avoiding energy may have missed out on the oil and gas price rally of recent months.

Rather than search for a single, definitive answer, the ESG for Investors platform equips investors with tools to explore a variety of scenarios and stress-test their beliefs. It provides a big-picture view of the trade-offs investors face when thinking beyond the risk-return framework.

The Climate Optimiser leverages academic research and investment expertise to capture the trade-offs between risk, return and climate impact (measured as the implied temperature rise of a portfolio). Simply put – what is the cost of ‘turning down the heat’ in my portfolio?

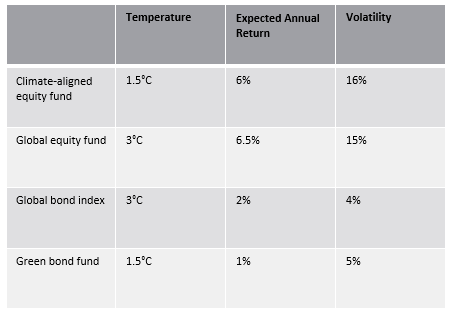

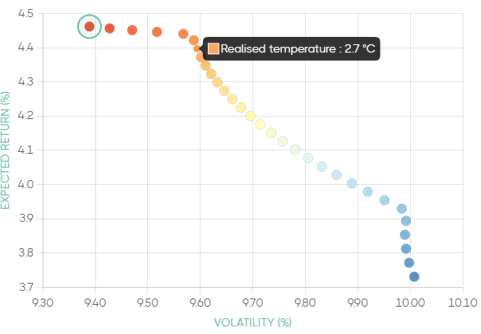

Let us start with a conservative assumption – the existence of a ‘greenium’, whereby climate-aligned equity and bond funds have lower returns and higher volatility than their ‘standard’ counterparts.

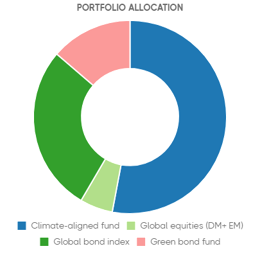

Source: Fulcrum Asset Management LLP, Bloomberg, Trucost. We have assumed that broad market indices are aligned with the circa 3°C of global warming implied by the window of uncertainty around current government policies, and modelled historical correlation between representative funds.

Source: ESG for Investors, Fulcrum Asset Management LLP

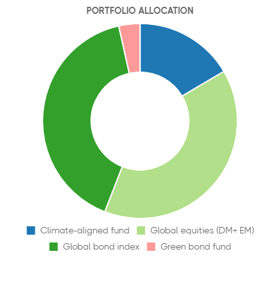

Investors can thus begin to build their climate allocation upon such ‘low-regret’ areas. But they may wish to go further. In a previous post, we have argued that markets are already starting to reward companies taking action to address their emissions and working to provide low-carbon solutions.

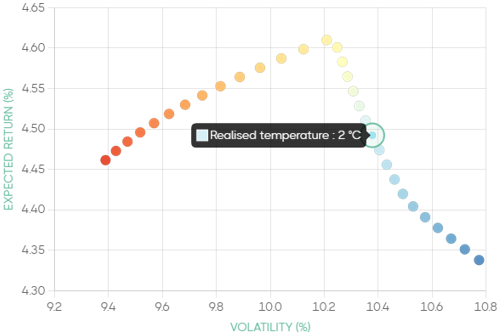

One might thus believe that reducing the implied temperature can help position a portfolio for future upside – or at the very least, not require a sacrifice in return. A slight change in this one assumption – bringing the expected annual return of the climate-aligned equity fund in line with the 6.5% assumed for the global equity index fund, keeping all else equal – leads to a wholly different opportunity set. Here, temperature alignment is actually a driver, rather than a detractor of return, at least up to the point of meeting the upper temperature target (2°C) of the Paris Agreement.

Source: ESG for Investors, Fulcrum Asset Management LLP

Yet it is precisely under uncertainty that the need grows for tools to navigate the transition. We believe the Climate Optimiser can help investors demonstrate to regulators and their beneficiaries how they are considering climate change mitigation as part of their investment process and strategic asset allocation.

As with all optimisers, the tool is sensitive to the assumptions used, but instead of focusing on the micro (assumptions), we believe that the tool highlights the macro, bringing climate change at the heart of portfolio construction.