Introduction

As COP26 sets out the direction of travel towards a low-carbon economy, we consider the risks and opportunities

At first, the 26th Conference of the Parties (COP) held in Glasgow might not look so different to seasoned observers of the process: late-night negotiating sessions, flurry of press releases from governments and the counterpoint of protests from civil society frustrated with the pace of progress. However, amidst all the commotion, we see a silver lining for the world and huge opportunities for investors. We offer some of our key take-aways on the implications of COP26 for investors below.

Taking stock

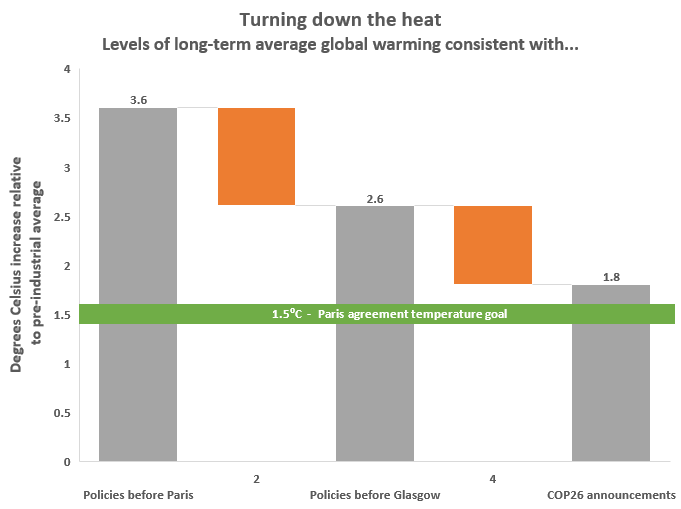

COP26 was seen as the first milestone since the Paris Agreement in 2015, COP21, where countries would provide a stocktake of their existing and planned policies in relation to keeping the planet’s temperature well below 2⁰C compared to pre-industrial levels. The suite of policies and pledges in the run-up to and during Glasgow, if implemented in full and on time, may turn the heat down to around 1.8°C.

Source: International Energy Agency

While we recognise that the pledges are mostly voluntary and a huge divide remains between emerging and developed economies, Glasgow represents a clear milestone for the world to begin bending the curve of emissions towards net zero¹. Indeed, recent news that global emissions may have been flat over the past decade point, tentatively, to a process that is no longer in the future, but already happening.

Crucially, investors need to be able to measure the progress of countries and companies in aligning to a net zero world. Temperature alignment, though not without its limitations, is one such metric that is increasingly being used. It allows investors to combine companies’ past track record of reducing their emissions footprint with a forward-looking assessment of the path they are likely to be on.

COP26 promoted a global consensus around net zero emissions which provides investors with a clear direction of travel. At the international level, it allows greater harmonisation and consolidation around climate disclosure rules: the newly formed International Sustainability Standards Board, the EU-China cooperation on a green ‘taxonomy’ and the Glasgow Financial Alliance for Net Zero (Gfanz) which brings together more than 450 banks, insurers and asset managers across 45 countries with committed capital of up to US$130 trillion to hitting net zero emissions targets.

While just a few years ago at COP24, there was diplomatic pushback against even ‘welcoming’ the findings of the United Nations (UN) special report on 1.5°C, the tone of the conversation this time around has clearly changed, as has the awareness and urgency of climate risks among investors, companies, regulators and the general public.

Show me the money

Finance continued to be at the heart of this year’s COP, with pledges from developed countries to at least double finance for climate adaptation in emerging markets (and some modest progress on the thornier issue of compensation for loss and damage). Regardless of the disbursement speed of public money, it is believed that demand on investors’ capital to finance climate solutions will only increase, as will the pressure for actors across the capital chain to outline their transition plans.

The reorientation of capital towards climate friendly solutions provides a tremendous opportunity for investors spanning multiple thematic areas, namely renewables, green hydrogen, carbon capture and storage, water, biodiversity, sustainable farming, forestry, energy storage, transportation, to name a few. In the energy sector alone, the International Energy Agency (IEA) estimates some US$4-5 trillion would be required annually between 2030-2050, primarily for clean electrification (generation, networks, end-user equipment).

In addition, one important development at COP was to broaden the focus beyond the “usual carbon suspects” to include pledges to curb methane and deforestation, US-EU cooperation on green steel and aluminium, and partnerships for technological innovation. Indeed, as the chart below illustrates, COP26 is deemed to have increased the likelihood of success across most policy areas critical to the achievement of the Paris goals, according to analysts at Bloomberg New Energy Finance.

Source: BloombergNEF

However, the chart also illustrates one key uncertainty: will the world reach global net zero by 2050, or it will miss its collective 1.5⁰C goal, thereby exposing itself to the climate risks that increase, non-linearly, with every additional degree of warming?

The transition will not be linear…

Over and above timing and implementation risks, the process to net zero remains fraught with other risks. Inflationary pressures, for one. There is still significant underinvestment in the enablers of decarbonisation, thus opening a potential gap between energy supply and demand, which could put upward pressure on energy, commodity and consumer prices, as we are currently seeing in many parts of the world.

Uncertainty also remains around the role of carbon pricing; the trilemma of ensuring high enough prices to trigger an industrial shift to lower-carbon products, but without creating an undue burden on consumers or pushing industry into lower-regulation jurisdictions. Using a carbon border adjustment mechanism – where imports from countries with stronger climate policies are treated more favourably, an idea gaining increased traction, including from the EU and US – may play a role, but not without macro risks: one country’s border adjustment may well be another’s trade war.

…but the direction of travel is clear

A clear and predictable policy environment can help avoid some of these pitfalls: one positive development from COP26 has been progress around carbon markets and other forms of international cooperation (‘Article 6’, in the lingo of the Paris Agreement). With concern around ‘greenwashing’ mounting across both regulators and civil society, more stringent rules have been introduced around carbon offsetting (including limits around the use of past credits for future emissions cuts, adjustments to avoid double-counting, and restrictions around project eligibility and use of proceeds).

Although short of establishing a global and high carbon price, the current proposals set the scene for further linkages between the various national, supranational and subnational carbon pricing regimes around the world. This will receive a further tailwind from the growing number of corporates pledging to reduce emissions across their entire value chain (Scope 1, 2 and 3 emissions) – with carbon trading and offsetting potentially playing a role for ‘hard-to-abate’ sectors like cement.

At different ends of the spectrum, the past weeks have seen no shortage of activists and climate sceptics criticising Glasgow on whether it is too lenient on large polluters in the East, on large historical polluters in the West (or both). A more moderate position would acknowledge that, despite shortcomings, Glasgow credibly reaffirms the direction of travel towards a net zero world with tremendous opportunities for investors to allocate capital efficiently to those companies decarbonising their operations and those companies enabling such decarbonisation.

Indeed, on the first day of trading after COP26, carbon prices hit a record high, jumping almost 6 per cent. Whether this is entirely attributable to Glasgow or not, the market, it seems, can increasingly tell the difference between hot air and a warming planet.

Source [1] Net zero refers to the equilibrium between the amount of greenhouse gases (GHG) produced and the amount removed from the atmosphere. For the world to only warm up by 1.5⁰C as compared to pre-industrial times, scientists believe that we need to reach at least net zero carbon dioxide emissions by 2050

This material is for your information only and is not intended to be used by anyone other than you. It is directed at professional clients and eligible counterparties only and is not intended for retail clients. The information contained herein should not be regarded as an offer to sell or as a solicitation of an offer to buy any financial products, including an interest in a fund, or an official confirmation of any transaction. Any such offer or solicitation will be made to qualified investors only by means of an offering memorandum and related subscription agreement. The material is intended only to facilitate your discussions with Fulcrum Asset Management as to the opportunities available to our clients. The given material is subject to change and, although based upon information which we consider reliable, it is not guaranteed as to accuracy or completeness and it should not be relied upon as such. The material is not intended to be used as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client’s account should or would be handled, as appropriate investment strategies depend upon client’s investment objectives. Funds managed by Fulcrum Asset Management LLP are in general managed using quantitative models though, where this is the case, Fulcrum Asset Management LLP can and do make discretionary decisions on a frequent basis and reserves the right to do so at any point. Past performance is not a guide to future performance. Future returns are not guaranteed and a loss of principal may occur. Fulcrum Asset Management LLP is authorised and regulated by the Financial Conduct Authority of the United Kingdom (No: 230683) and incorporated as a Limited Liability Partnership in England and Wales (No: OC306401) with its registered office at Marble Arch House, 66 Seymour Street, London, W1H 5BT. Fulcrum Asset Management LP is a wholly owned subsidiary of Fulcrum Asset Management LLP incorporated in the State of Delaware, operating from 350 Park Avenue, 13th Floor New York, NY 10022.

©2021 Fulcrum Asset Management LLP. All rights reserved

About the Author

Rahil Ram

Rahil Ram is a Director at Fulcrum Asset Management and is involved in portfolio strategy, portfolio implementation, research, sustainability and idea generation for the discretionary macro and thematic strategies. Prior to joining Fulcrum, Rahil was a strategist within the Asset Allocation team at Legal & General Investment Management for five years, during which time he completed his Masters’ in Actuarial Management from Cass Business School and qualified as an Actuary in 2017.

About the Author

Iancu Daramus

Iancu works on the development of Fulcrum’s responsible investment capabilities. Prior to joining Fulcrum in 2021, Iancu was at Legal & General Investment Management where he led the stewardship team’s work in the energy sector and advised institutional clients on low-carbon investment solutions. Iancu graduated from the London School of Economics and holds degrees in philosophy and public policy.