Nearly four in ten professional investors (38%) believe that the current level of risk in markets high with 23% stating ‘somewhat high’ and 15% very high, according to a survey carried out on behalf of Fulcrum Asset Management.¹

When asked to name a time when markets were last this risky², 41% of investors responded since quantitative easing was implemented, while others cited the 2007/8 Global Financial Crisis (18%), the 2016 China devaluation (15%) and the Dotcom bubble (13%).

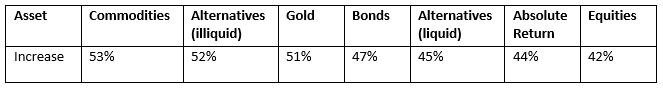

When asked to consider their asset allocation for the next six months in light of market risks, commodities came out as the asset class most likely to be increased, closely followed by illiquid alternative investments and gold.

Fewer investors were planning decreases, but of those who were, nearly one third said they were eyeing up cuts to equities in light of the current market conditions.

Questioned more specifically on absolute return strategies, and given the outlook for markets, 72% said they would be more inclined to think about them.

Commenting on the survey’s findings, Nabeel Abdoula, Deputy CIO, Fulcrum Asset Management said:

“There’s no doubt that investors are experiencing a more risky market environment in more traditional asset classes (i.e. equities and bonds), and sensing that, it’s no surprise that commodities, illiquid alternatives and gold are in favour as investors look to mitigate the current conditions.

Fulcrum’s Diversified Absolute Return strategy has been going since 2004 and has safely navigated many of the previous ‘crisis points’ highlighted by investors such as the dotcom bubble and the Global Financial Crisis. We therefore think it is a very sensible strategy for investors to hold something like this which is designed to help protect capital during times of great uncertainty.”

Fulcrum’s Diversified Absolute Return strategy is an all-weather multi-asset Investment strategy which follows an extremely robust and repeatable process, guided by economic theory and backed by empirical research.

- Findings are based on a survey from independent research consultancy, Censuswide, between 6th June – 10th June 2022 with a sample of 102 Professional Investors including 51 IFAs and 51 Institutional Investors / Consultants / Pension Fund Managers / Trustees. Censuswide is a member of ESOMAR – a global association and voice of the data, research and insights industry. Censuswide complies with the MRS code of conduct based on ESOMAR principles.

- The sample size represents a snapshot of those who were ‘favourable’ to absolute return, of 36 respondents which is lower than Censuswide’s usual minimum of 50 to ensure data resilience.

- The sample size represents a snapshot of those who were ‘not favourable’ to absolute return of 35 respondents, which is lower than Censuswide’s usual minimum of 50 to ensure data resilience.

This material is for your information only and is not intended to be used by anyone other than you. It is directed at professional clients and eligible counterparties only and is not intended for retail clients. This is not an offer or solicitation with respect to the purchase or sale of any security. The material is intended only to facilitate your discussions with Fulcrum Asset Management as to the opportunities available to our clients. The given material is subject to change and, although based upon information which we consider reliable, it is not guaranteed as to accuracy or completeness and it should not be relied upon as such. The material is not intended to be used as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client’s account should or would be handled, as appropriate investment strategies depend upon client’s investment objectives. The price and value of the investments referred to in this material and the income from them may go down as well as up and investors may not receive back the amount originally invested. Past performance is not a guide to future performance. Future returns are not guaranteed and a loss of principal may occur.

It is the responsibility of any person or persons in possession of this material to inform themselves of and to observe all applicable laws and regulations of any relevant jurisdiction. Fulcrum Asset Management does not provide tax advice to its clients and all investors are strongly advised to consult with their tax advisors regarding any potential investment. Opinions expressed are our current opinions as of the date