In Short

Much has been written about the collapse in UK equity dividends this year, but what about future levels?

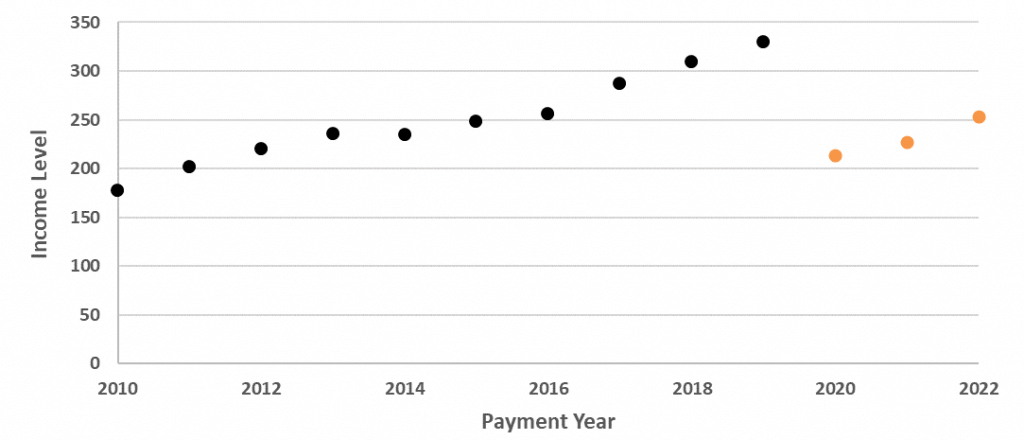

Figure 1 is a plot of the dividends paid by the FTSE 100 over the last 10 years alongside market forecasts out to 2022. We witnessed a 35% drop in dividend income in 2020 back to levels seen in 2012, but the market is expecting growth of 6% next year followed by 12% in 2022. Investors may only have to wait until around 2025 to reach the cash payment levels of 2019 as companies naturally grow their dividends and companies that cut dividends reinstate them. These estimates are particularly dependent on the dividend policy of the major banks and it is possible they surprise to the upside.

Figure 1: FTSE 100 historic dividend payments and forecasts out to 2022

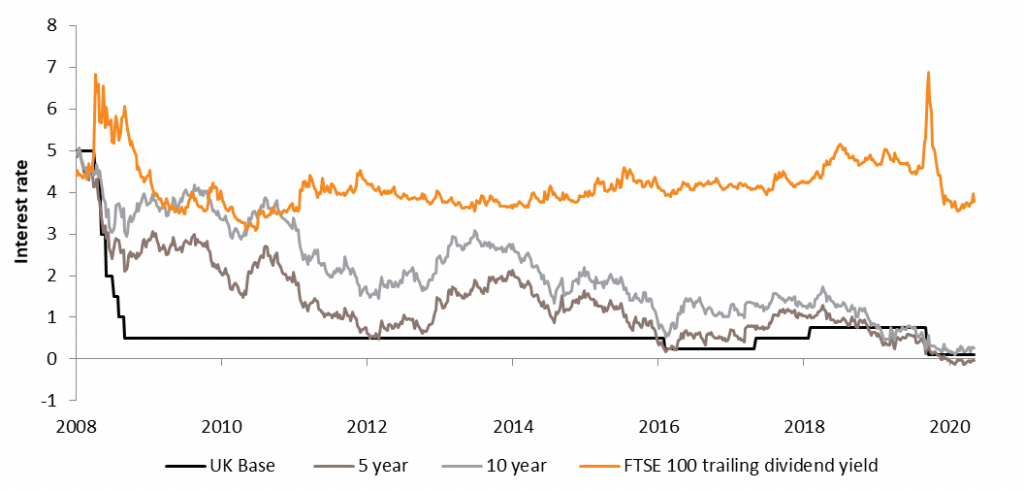

Figure 2: FTSE 100 trailing dividend yield versus UK Gilts and Base Rate

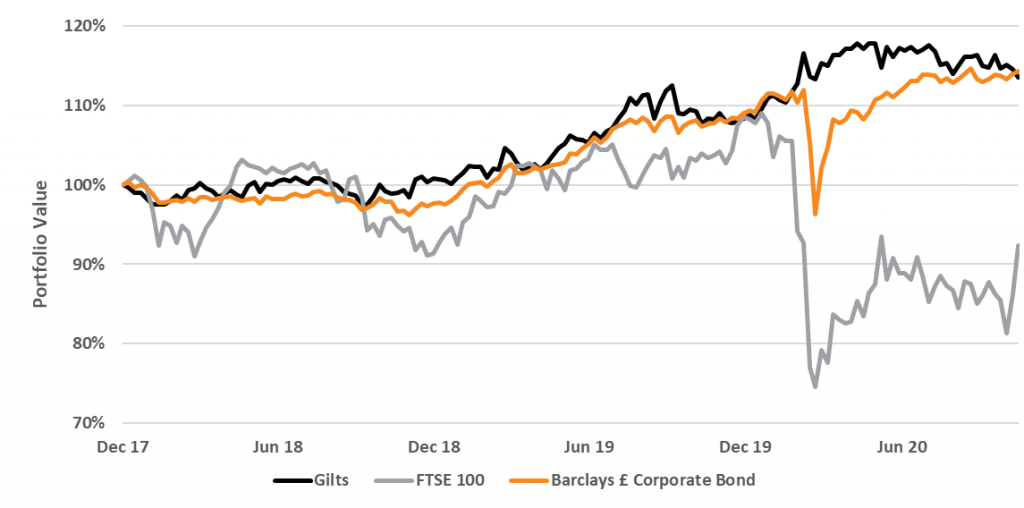

Looking back at the performance of UK assets this year, it is corporate credit that is potentially the standout performer as demonstrated in Figure 3. The duration component of credit has made a positive contribution, but after a sharp selloff in March, expectations of a rapid increase in the default rate have subsided.

Figure 3: Recent UK equity, credit and gilt performance

Based on the data, both equity and credit have a role to play in generating income in a diversified income fund. A harder question to answer is what degree of portfolio protection interest rates will provide in the next market correction. During the 2008 financial crisis, 5 year gilt yields fell 2% against around 0.6% during the period covering the COVID-19 pandemic. With the 5 year gilt yield now hovering around 0%, it is hard to see a scenario where a gilt portfolio can generate a positive return much greater than it did during Covid-19 without rates having reset considerably higher in the meantime. The scenario where rates reset higher could possibly have significant implications for asset valuations and be a worst-case scenario for a balanced fund.

Fulcrum’s favoured solution to providing a stable, enhanced level of income is a multi-asset diversified income strategy. By not being corralled into high yielding assets further up the risk spectrum, the Fund avoided large allocations to the more challenged markets back in March such as UK equity and high yield corporate debt. Avoiding drawdowns is particularly important for income funds due to path dependency arising from income payments and from a fund management point of view, the fund can take advantage of opportunities at attractive prices if one is not already on the back foot.