Investor Types

We have been working in close partnership with a wide range of institutional investors since our formation in 2004. Clients are at the centre of everything we do, and we recognise and value the trust clients place in us to help them meet their investment objectives.

Since our inception in 2004, we have worked with a very broad range of pension scheme investors with the objective of helping them to meet the investment objectives for their members. Whilst our underlying investment philosophy and process has been consistent, our investment funds and capabilities have evolved by working with and understanding the needs of our clients. We will continue to gradually evolve our fund offerings and investment solutions in the years ahead.

While in the early years, our clients were predominantly Defined Benefit Pension Funds, over the last decade, as Defined Contribution Schemes have grown and developed their investment approach, so too has our role in their default investment strategies across accumulation, consolidation and decumulation investment stages. Today, we have a broad range of pension scheme clients – in terms of size, geography, corporate sector, and governance model, who trust us to help them meet their members’ financial goals.

We aim to be a partner for our clients and to deliver returns that help Defined Benefit (DB) schemes on the flight path towards full funding as well as being a core component of the default strategy for Defined Contribution pension schemes. Please get in touch with us if you would like to understand more about how we think, our investment philosophy and how we can help you best meet your investment objectives.

Defined Benefit Pension Schemes

We have been running money on behalf of DB Pension Schemes since our inception. Today, we still have clients pursuing a growth oriented strategy. However, increasingly, we have seen our clients gradually de-risk as they mature with improved funding ratios. As a consequence, we have found that our DB pension scheme clients have increasingly favoured our Diversified Absolute Return capability. This solution (initially developed in 2008) has been carefully designed with the aim of generating consistent positive returns whilst preserving capital. We aim to gradually improve our investment process and implementation over time, with the goal of helping our clients meeting there long-term objectives.

Defined Contribution Pension Schemes

We have gradually developed a collection of solutions for Defined Contribution (DC) pension schemes over time always keeping scheme members front of mind with the aim of improving end outcomes. The DC landscape is home to several different types of scheme (single employer trusts, master trusts, stakeholder schemes etc). With our differentiated approach, we have something to offer each client. For larger investors like DC Master Trusts, we are also able to offer bespoke solutions, using any number of our capabilities.

We recognise that every pension scheme is different and so we have designed our innovative investment solutions to meet a variety of different needs. Our Climate Change equity and Diversified Private Markets (launch subject to regulatory approval) strategies seek to achieve high returns so are best suited to the DC saver’s growth phase. Diversified Core Absolute Return and Diversified Liquid Alternatives can be used throughout the glidepath whereas Fixed Income Absolute Return is generally more appropriate close to and post-retirement.*

* Note – not all solutions are available in all jurisdictions.

When developing our DC solutions we have had a number of practical considerations in mind:

Cost-effectiveness – Most DC pension schemes require a complete look-through understanding of costs (for example, to abide by the charge cap in the UK) and avoid any surprises in their disclosures to members. We charge competitive, transparent rates for our investment strategies while providing high-quality differentiated exposures.

Transparency – We always aim to work in a transparent way with our clients, whether this relates to costs, providing underlying holding information or through open access to our investment team. We pride ourselves on ensuring our clients genuinely feel they understand how we operate and what they ultimately invest in.

Platform Suitability – All our key investment strategies are available in a platform-friendly format. Indeed, several of our funds are already available on a wide range of platforms. If your preferred fund isn’t already available on your chosen DC life platform, we will work with you to ensure it is as soon as possible.

Integrated Responsible Investment – Sustainability is one of our core values. DC members want to save in a responsible way and for their investments to facilitate positive real-world change. With this in mind, we adapt our approach according to the strategy and asset class in question. Further information on our approach to Responsible Investment can be found here.

Innovation – We are constantly looking to improve outcomes for DC savers by identifying differentiated investment opportunities and, where appropriate, new solutions. As an example, we have identified our Siversified Private Markets solution to have a flat fee throughout.

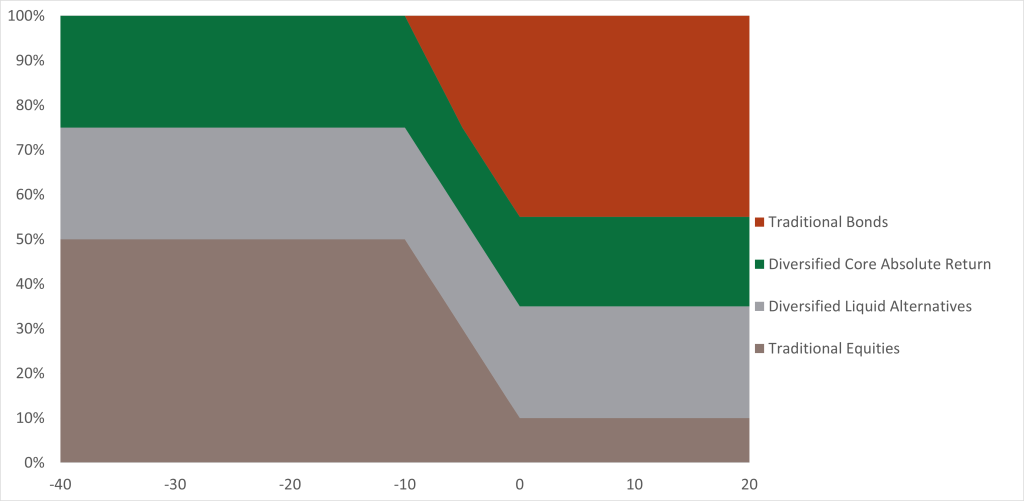

Complementarity – The below graph shows how our strategies are intended to fit into a DC member’s glidepath with ‘0’ being their year of retirement. Our solutions seek to improve member outcomes, be that through minimising transaction costs, introducing new asset classes, improving on sustainability characteristics, and/or creating a more efficient portfolio.

As at 31 December 2023.

We have been trusted by a wide range of Charity, Endowment and Foundation clients since our inception in 2004. The reason for this is that our investment philosophy, in managing risk and focusing on delivering a consistent and stable profile of investment returns in a wide range of underlying investment markets, is well aligned with that of their ultimate investment objectives.

Over the years, we have successfully delivered risk-adjusted returns that have helped Charities, Endowments and Foundations to grow their investment portfolio in real terms whilst also ensuring we preserve capital in times of extreme market movements.

Please do get in contact with us if you would like to hear more about how we think might be a good fit with your specific investment aims and objectives.

Our focus on creating solutions to meet client needs is central to creating a genuine partnership, with the overarching aim of understanding their specific challenges and investment goals from the very outset. In particular, we have tailored solutions in relation to integrating specific return requirements, for example the need for income, and the addition of specific ESG considerations that clients have outlined as being particularly important to them.

Our focus on risk-management and in delivering a smooth profile of returns for clients over the long-term underpins our investment philosophy and process. All our investment strategies are designed to deliver superior risk-adjusted returns over the long term in a way that complements a client’s existing allocation to traditional equity and bond markets.

Recent News

Fulcrum completes climate-alignment of strategic equity allocation

Two strategic advisers added to Fulcrum’s Alternative Solutions team

Fulcrum’s Diversified Liquid Alternatives Fund celebrates five-year Milestone

Fulcrum bats for diversity announcing sponsorship with Middlesex Cricket