Fulcrum Climate Change Fund (FCC)

An innovative long-only, global equity strategy that explicitly seeks to mitigate climate change through investment in, and engagement with, listed companies.

INVESTMENT OBJECTIVES

returns

Introduction

The Fulcrum Climate Change Fund has been designed to contribute to making financial flows aligned with the Paris Agreement’s temperature target. It seeks to generate excess returns above global equity markets as climate-alignment gets priced into the valuation differentials between companies, sectors, and countries. It is highly diversified across sectors and regions and invests in approximately 200 companies.

The Fund is based on a rigorously researched climate alignment temperature metric developed by environmental experts, and is committed to a weighted average portfolio temperature of below 2⁰C, with no individual company exceeding 2⁰C. It aims to play an important role in the reallocation of capital within and between companies and sectors in order to facilitate the green transition that furthers the Paris Agreement.

investing

Key Differentiators

- Paris Agreement Temperature Target: Explicitly designed to contribute to making financial flows aligned with the Paris Agreement’s temperature target

- Highly Diversified: Provides strong diversification across regions and sectors with moderate levels of tracking error relative to traditional global equity market indices

- Thematic Approach: Provides exposure to a wide range of long-term themes that include the green economy whilst also allowing investors to take a diversified and global perspective in tackling the challenges of climate change

- Climate-Aligned: Uses a market leading climate alignment metric, enabling clear measurement of the alignment with global warming targets

- Engagement: Has a strong engagement component focused on encouraging science-based target setting and emission disclosure through direct and collaborative engagement

- Markets Have Not Priced in Climate Alignment Yet: Has the potential for “transition alpha” by being aligned with the transition to a low-carbon global economy

Investment Philosophy

Mitigating climate change is a long-term economic challenge that is likely to remain on political agendas for decades to come. We believe asset allocators can invest strategically in a globally diversified portfolio of global equities and tackle climate change. The Fund has similar country and sector exposures as the MSCI ACWI Index, with moderate tracking error and minimal single stock risk.

Our solution thoughtfully balances climate alignment, return expectations and diversification benefits. It’s designed to have an impact by allocating capital to companies that are aligning with a low-carbon future. We also engage to encourage decarbonisation target setting.

Investment Process

Idea Generation (the Why)

Proof of Concept (the How)

Research Project

Review by Investment Committee

Implementation into the Fund

Investing based on temperature alignment

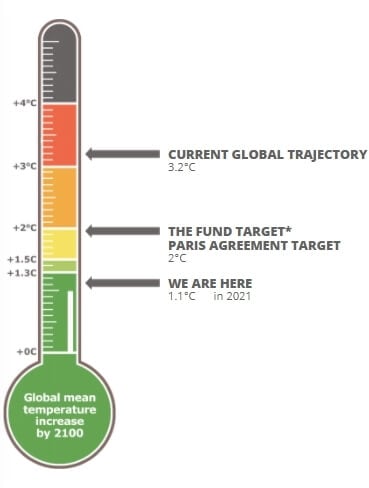

By using an innovative climate alignment measure, denoted by a temperature metric in degrees Celsius, we can measure the extent to which any individual company in our investment universe is aligned with the Paris Agreement’s temperature target. This is achieved by comparing a company’s decarbonisation pathway with the required carbon reduction pathway of its sector, allowing us to create a proxy for how prepared a company is for the low-carbon transition. The metric we use considers both historic Greenhouse Gas emissions and forward-looking net zero targets set by listed companies. The Fund has committed to maintaining a portfolio temperature of below 2⁰C.

Current global trajectory

3.2°C

The Fund target*

Paris Agreement target

2°C

We are here

1.1°C in 2021

Investment Universe

Equities

- Global Equities

Responsible Investing

We strongly believe the integration of Responsible Investing will further enhance return outcomes for clients over a long-term investment horizon and have explicitly embedded this in the Fund’s investment process. The Fulcrum Climate Change Fund directly targets Sustainable Development Goal (SDG) number 13: Climate Action. Climate change is an issue that will have dramatic consequences for nature and society, and touches on many of the other SDGs.

Please see our latest FCC Sustainability Report, which summarises our Responsible Investment voting, carbon footprint and, proprietary investment scores.

Collaborating

Leveraging Fulcrum's Capabilities

Our team draws on the investment capabilities of Fulcrum’s deep resource of investment professionals. This long-only equity Fund uses Fulcrum’s thematic equity market expertise to identify a wide range of long-term megatrends.

Discretionary

Strategies

Alternative

Solutions

Quantitative

Strategies

Thematic

Equities

Climate-Aligned

Investing

The Team

The Fund is managed by the Fulcrum Equity Team, led by Fawaz Chaudhry. In addition, for impact management and engagement the team is supported by Matthew Roberts, Chair of Fulcrum’s Responsible Investment Committee.

Fawaz Chaudhry joined Fulcrum in 2017 and, as Head of Equities, is responsible for building the firm’s equity capability. A key member of the broader investment team, Fawaz is also the lead portfolio manager for the Fulcrum Thematic Equity Market Neutral Fund and Fulcrum Climate Change Fund. Prior to joining Fulcrum, Fawaz spent over fifteen years developing his long-term, thematic investment approach, including at Hadron Capital and Moore Capital.

Contact Us

If you have any questions, do contact us and we would be happy to have a chat.

Related Articles

Hear the latest from us

Sign up to receive our latest macro insights and news