Introduction

This article is an essay on the various schools of thought that have developed among macro-economists on these crucial issues.

The outlook for global financial markets in 2022 will obviously hinge greatly on the behaviour of inflation, especially in the US. Some influential economists, including Lawrence Summers and John Cochrane, are arguing that inflation will prove more persistent than markets have been expecting, mainly because US fiscal policy has been too expansionary since the pandemic started.

The Fed could be forced to counter this with much tighter monetary policy, eliminating a powerful support for risk assets. If the fiscal school is right, the outlook for markets could be turbulent.

With recent inflation figures appearing to support the fiscal pessimists, the Federal Reserve has turned much more hawkish at its December and January FOMC meetings, and markets have clearly started to reflect this shift. Although market pricing is now more in line with the likely inflation path than was the case three months ago, the hawkish trend in Fed rhetoric and forward short rates may have further to run.

Author: Gavyn Davies, Chairman, Fulcrum Asset Management

31 January, 2022

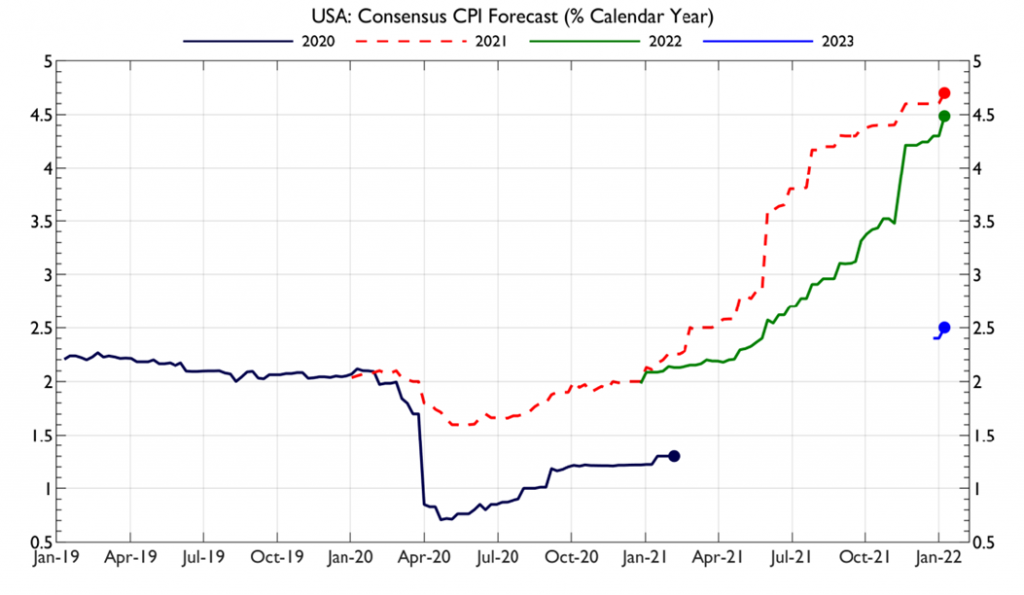

The annual US inflation rate rose to 7.0% last December, the highest rate recorded since 1982. This surge in CPI inflation, no doubt caused by various economic shocks connected to the pandemic, has been replicated in many other countries, including the EU (5.0%) and the UK (5.4%). These high inflation rates were not predicted by the central banks of the nations concerned and are well above their inflation targets. (Japan, as usual, is the important exception to the rule.)

Source: Fulcrum Asset Management LLP, Bloomberg LLP

As inflation rose last year, central banks were initially tolerant of the change, arguing that it was being driven mainly by temporary factors, including the spike in energy prices, supply chain disruptions in the goods sector, and labour shortages in the services sector. They believed that inflation would drop sharply in 2022 and – crucially – argued that inflation expectations would remain close to their targets while this process occurred.

Jerome Powell, Chairman of the Federal Reserve, was in the vanguard of central bankers in this tolerant policy response to the largest inflation shock since Paul Volcker’s era. In fact, it appeared that the Fed’s behaviour was mainly determined by a desire to raise employment, perhaps subject to an unstated target for inflation expectations, but certainly not for inflation itself.

While longer run inflation expectations remained broadly stable, the Fed’s official “average inflation target (AIT)”, introduced in August 2020 to eliminate undershoots in the price level over lengthy periods, was substantially exceeded by the summer of 2021. But the Fed turned a blind eye, continuing instead with its huge programme of asset purchases.

Remarkably, the asset purchasing programme was still running at $60 billion a month in January (ie at an annual rate of 3.2 % of GDP). However, net asset purchases will halve in February and will likely stop in March.

Furthermore, Chairman Powell’s press conference after the January 2022 FOMC meeting made it clear that the first increase in policy interest rates will probably start in March, immediately after the asset purchase programme ends. Chairman Powell also hinted that the subsequent run-down in the balance sheet might start sooner, and proceed more rapidly, than in the last cycle.

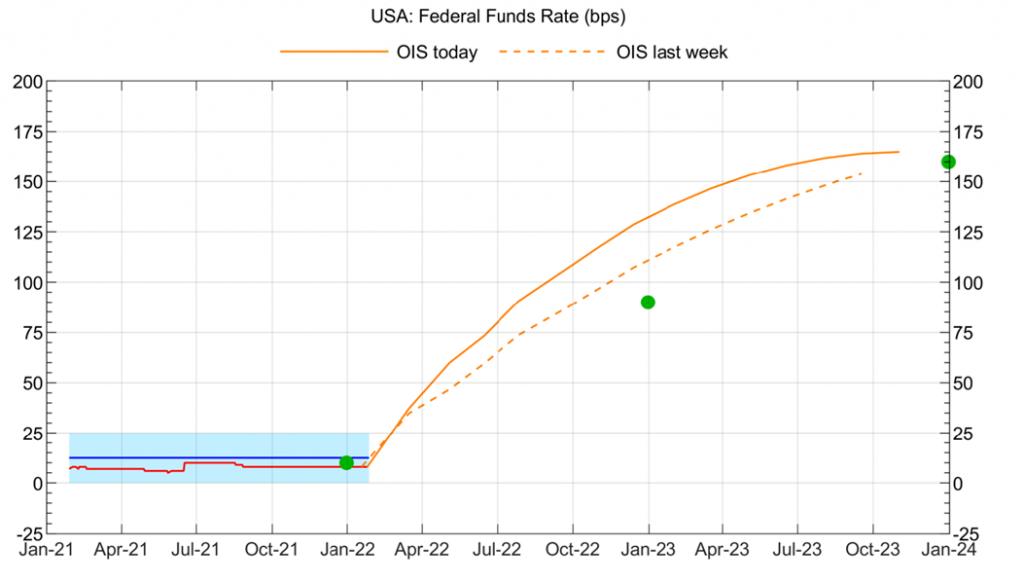

This sudden, hawkish shift in the Fed’s thinking has taken the markets by surprise. The futures markets now expect almost five increases of 25bp each in 2022. As recently as last October, the futures market expected only one 25bp increase in the whole of 2022.

This graph shows market expectations (OIS) compared with the FOMC’s latest view (green dots):

Source: Fulcrum Asset Management LLP, Bloomberg LLP

Market commentary has attributed the change in Fed thinking to recent economic data, including higher wage and consumer price inflation and rising inflation expectations for the immediate future. No doubt that has played an important role.

However, some economists have looked deeper than these symptoms of rising inflation pressure and have focused on the underlying causes of inflation. In particular, the stance of fiscal policy has come into sharper focus as a prime causative factor. If these economists are right, the consequences for Fed policy in coming years could be alarming.

Two versions of the fiscal story

Ever since Milton Friedman claimed in 1963 that “inflation is always and everywhere a monetary phenomenon” markets have accepted his view as axiomatic in advanced economies. After a prolonged, fundamental review of its communications strategy in January 2012, led by Janet Yellen, the Fed concluded that:

Successive members of the FOMC have repeated this statement, usually unanimously, on an annual basis ever since. Note that there is no mention whatever of fiscal policy in this statement. The central bank is unequivocally responsible for inflation.

But is this always true? Since the pandemic started in March 2020, fiscal expansion has added about 25 percentage points to the US government debt/GDP ratio, and the general government budget deficit touched 15% of GDP in 2020. Surely it is not just a complete coincidence that inflation has risen at exactly the same time as fiscal policy has been eased so much.

Two highly respected US macro-economists, both of whom went against the “Fed consensus” in warning about inflation dangers last year, long before the adverse trend became plain in the data, claim that this is far from a coincidence. Lawrence Summers and John Cochrane, who are normally on different sides of the policy divide, both argue that fiscal policy has boosted aggregate demand to such an extent that, in conjunction with supply constraints from the pandemic, sharply higher inflation has been inevitable. Although monetary policy has been permissive in this regard, it has not been the primary cause, in their view.

Summers and Cochrane agree on the importance of fiscal policy in causing recent inflation, but they do not agree on the mechanism involved. This difference is important in understanding the policy and market implications of their arguments.

The Summers version

Lawrence Summers is, of course, a distinguished New Keynesian economist from the “saltwater” school of American academia. His thinking on the inflationary impact of fiscal policy is profoundly Keynesian in nature, reflecting the boost to aggregate demand stemming from the high budget deficit. This, says Summers, has led to growth in demand above the growth in aggregate supply, which itself has been curtailed by the effects of the pandemic on supply chains and labour participation rates.

Summers’ concerns about inflation in recent months sharply contrast with his longstanding worries about “secular stagnation”. The latter is a polar opposite economic condition, in which aggregate demand falls chronically short of aggregate supply, forcing a long-term downward trend in real interest rates. The massive expansion in fiscal policy in 2020-22 seems to have been the main reason for his change of heart.

In an important article on 4 February 2021, Professor Summers argued that the planned fiscal stimulus under incoming President Biden would be far larger than that implemented by the Obama administration after the GFC in 2009:

Whereas the Obama stimulus was about half as large as the output shortfall, the proposed Biden stimulus is three times as large as the projected shortfall. Relative to the size of the gap being addressed, it is six times as large.2

He warned that this huge stimulus might lead to significant inflation pressure in the economy:

There is a chance that macroeconomic stimulus on a scale closer to World War II levels than normal recession levels will set off inflationary pressures of a kind we have not seen in a generation, with consequences for the value of the dollar and financial stability. This will be manageable if monetary and fiscal policy can be rapidly adjusted to address the problem. But given the commitments the Fed has made…there is the risk of inflation expectations rising sharply.3

In the event, President Biden’s fiscal plans have been partially blocked by Congress, so the fiscal stimulus was smaller than contemplated by Professor Summers in February. Nevertheless, inflation soon surged, and, on 24 May, Summers warned that “the inflation risk is real”, in part because of the $3 trillion in fiscal stimulus passed by Congress, along with other important factors, including a highly expansionary monetary stance by the Fed.

Summers was right. As inflation continued to surprise the Federal Reserve in the summer, Summers argued on 26 August that the FOMC should begin to withdraw quantitative easing, adding that an important part of the rise in inflation would not prove transitory, but would be sustained.

Then, on 15 November, Summers directly rejected Jerome Powell’s view that inflation would prove temporary, and demanded that “it is past time for team transitory to stand down”. Even after the FOMC’s belated change of stance in December, Summers said that they were still behind the curve, and that “there is significant reason to think inflation may accelerate”.

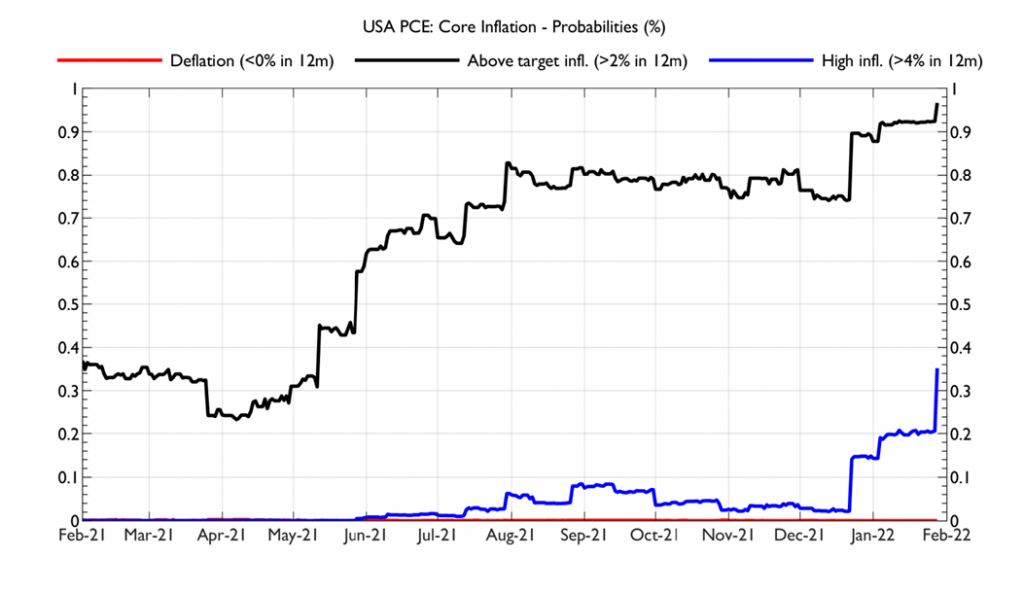

Summers’ consistent warnings about inflation have been vehemently criticised by other New Keynesians like Claudia Sahm and, much less vehemently, by Paul Krugman. However, the inflation data have unarguably been consistent with his belief that fiscal policy was too expansionary last year, and that the Fed was slow to recognise this. Fulcrum models suggest that the risk of sustained high inflation is uncomfortably high:

Source: Fulcrum Asset Management LLP, Bloomberg LLP

The Cochrane version

A different but connected story about the impact of fiscal policy on inflation comes from John Cochrane, a “freshwater” school macro-economist, now at the Hoover Institute at Stanford. For many years, Cochrane has been a disciple of the “fiscal theory of the price level (FTPL)”, an approach that dates back to the seminal work of Thomas Sargent and Neil Wallace on “unpleasant monetary arithmetic” in 1981. All macro investors are recommended to become familiar with this approach to the analysis of government debt and inflation, since it is now highly topical.

Cochrane’s recent work on the FTPL, which is impressive and voluminous, often appears in his blog (which is named The Grumpy Economist, though he is anything but grumpy). The main conclusions are well summarised in this introductory paper and video.

On 18 November, Cochrane’s blog argued as follows:

Inflation is entirely about „demand,“ not „supply.“ Fixing the ports, the chips, the pipelines, the labor disincentives, the regulations, are all great and good, and the key to economic growth. But they will not on their own do much to slow inflation. We are having inflation because the government printed up a few trillion dollars, and borrowed a few trillion more, and wrote people checks. People are spending the checks.4

While this argument seems familiar to all followers of Milton Friedman in the 1970s, and indeed Lawrence Summers more recently, the underlying mechanism is rather different.

The core problem, according to Cochrane, is the sustainability of government debt after the fiscal injections during the pandemic. He warns that monetary policy might be forced by the government to help debt sustainability by keeping interest rates so low, or by creating such a significant increase in central bank balance sheets, that inflation rises suddenly and sharply. This situation is known as “fiscal policy dominance” and is the reverse of the “monetary policy dominance” which has applied in most advanced economies since the 1980s. Cochrane again:

All prices and wages rising together means that one thing is falling in value — money, and government debt. Inflation is a change in the relative price of money and government debt relative to everything else. Inflation comes thus, fundamentally, from the overall supply vs. demand for money and government debt.5

Gross federal debt held by the public has been rising in the US for several decades and it now stands at about 110 per cent of GDP, four times the level when Paul Volcker killed inflation in 1981. This rise in debt has occurred without any rise in inflation, so why has it suddenly become a problem?

Cochrane believes that the extreme shift in fiscal policy in 2020-21, along with the fact that it was financed by the issuance of central bank reserves, rather than longer term public debt (i.e. treasuries), may have caused the market to believe that the surge in public debt will not be fully financed by an increase in future budget surpluses (or reduced deficits) by the federal government. This is really at the heart of the argument that “fiscal inflation” can emerge under the FTPL.

Cochrane:

Inflation comes when government debt increases, relative to people’s expectations of what the government will repay. If the Treasury borrows, but everyone understands it will later raise tax revenues or cut spending to repay the debt, that debt does not cause inflation…The 2020–2021 borrowing and money episode was distinctive because, evidently, it came without a corresponding increase in expectations that the government would, someday, raise surpluses by $5 trillion in present value to repay the debt.6

The suggested mechanism is that the private sector starts with an expectation of how much government debt will eventually be repaid by future budget surpluses (in real, inflation-adjusted terms). If the debt level rises suddenly, without a credible increase in future budget surpluses, then the private sector assumes that inflation will rise until the original real level of public debt is restored. In an attempt to get ahead of this expected rise in prices, public debt is sold to finance purchases of goods and services. This causes the rise in inflation, which is needed to restore the appropriate level of real public debt.

More from Cochrane:

If the government borrows or prints $5 trillion, with no change in its plan to repay debt, on top of $17 trillion outstanding debt, then the price level will rise a cumulative 30 percent, so that the $22 trillion of debt is worth in real terms what the $17 trillion was before. In essence, absent a credible increase in future surpluses, the deficit is financed by defaulting on $5 trillion of outstanding debt, via inflation.7

Can this rise in inflation be prevented by tightening monetary policy, as the Fed is now doing? Yes and no.

To control inflation, the Fed needs to increase real interest rates. This raises the government’s debt servicing costs, implying a need for still higher budget deficits in the future. To make policy credible, the government now needs to tighten fiscal policy enough to finance the original rise in debt, plus the further rise needed to finance the extra interest payments. If the government is not willing to announce credible fiscal reforms to achieve this, then the monetary tightening does not work; in fact, it might well cause still higher inflation, because the market sees that as the only way to make the extra debt sustainable.

In this view of the world, the Fed can control inflation by tightening policy, but only if the government is willing to co-operate by raising future budget surpluses. It is extremely unlikely that the Biden administration would be willing to contemplate doing this, in which case the inflation problem could just get worse as monetary policy is supposedly “tightened”.

The Fed would be chasing its own tail. It cannot successfully act alone.

The Future of “Fiscal Inflation”

Building on the intellectual approaches described above, there are now essentially three main views about the future course of inflation in the US this year.

In ascending order of severity, the leading proponents among macro-economists are Paul Krugman, Lawrence Summers and John Cochrane. The Federal Reserve has recently travelled from the benign end of the spectrum towards the middle, and the key question for markets is whether this direction of travel still has further to go.

The view associated with Paul Krugman is that much of the surge in inflation last year was due to the temporary effects of the pandemic, implying that inflation will fall back rapidly towards the Fed’s target when these effects are reversed. He has been one of the most influential members of “team transitory”. Recently, Krugman has admitted that the path for inflation in 2021 was much higher than he had expected, and he has suggested that he now has a more open mind about the possibility that inflation may prove more persistent. As a result, he does not oppose the Fed’s obvious intention to raise rates several times this year.

He has not been overly concerned about the impact of fiscal easing on the inflation rate, and that remains the case. His present views seem to be close to what is priced into the forward rates, or maybe slightly more dovish. In the longer term, he believes that “secular stagnation” will remain in place, implying that long term interest rates will settle at fairly low levels, once the transitory effects of the pandemic are over.

His market view is that financial asset prices will be subject to periods of volatility (as seen in January), but he does not appear to be calling for a major crash in markets. He is not really a believer in “fiscal inflation” of any variety, even in the longer term.

Next comes Lawrence Summers. Having been proved right about inflation in 2021, he says that his views are now not as different from Krugman’s as they were a year ago. However, he still appears to believe that inflation may prove more persistent than expected by the consensus, unless the Fed substantially tightens monetary policy to prevent this.

He says that he is very sceptical whether the combination of inflation, unemployment and interest rate levels shown in the Fed’s latest projections will occur. In his view, history indicates that the tightening that the Fed needs to undertake in order to bring inflation back to target may cause a recession to occur.

In the longer term, he is now beginning to question whether “secular stagnation” may begin to reverse. This seems to be because the combination of much higher public debt and somewhat higher budget deficits that has emerged from the pandemic years may eliminate part or all of the shortfall in demand relative to supply that has fundamentally caused secular stagnation. This would imply that equilibrium interest rates will not continue to fall and may even start to rise.

While Summers still seems to think that expansionary fiscal conditions will be a significant economic force in the long term, possibly raising inflation and equilibrium rates, he does not have any concerns about fiscal dominance or debt default crises in the US.

Although Summers has not spelled out the implications of these views for financial asset prices, his views on recession risk and higher equilibrium interest rates are clearly worrying for markets, especially given the extremely low level of long-term interest rates and high equity valuations that are still plain, even after the January market correction.

This leaves John Cochrane. Although he does not spell out a concrete view on inflation in the immediate future, he does indicate that there are severe risks ahead, stemming from the FTPL.

Recall that Cochrane believes that there was a 6% jump in the CPI last year because the market believed that 6 percentage points of the 30% rise in the government debt/GDP ratio would not be covered by future increases in the primary budget surplus.

He suggests that this shock will be carried further if the market decides that the unsustainable part of the rise in government debt is not 6 percentage points but (say) 15 points. That would produce a further large inflation shock of 9 percentage points.

He clearly believes that the Biden administration’s plans for the budget deficit are too large to be sustainable in the long term and is concerned that this could eventually cause a serious further bout of inflation. To prevent this, he recommends a combination of higher interest rates, tighter fiscal policy, and growth-friendly micro-economic reforms in the tax and regulatory fields.

Cochrane does not believe that an attempt by the Fed to act “independently” to control inflation, in the absence of fiscal and regulatory reform, is likely to work. Clearly, any such attempt could involve a major market dislocation while the required combination of policy reforms is imposed on reluctant politicians.

Although Cochrane has been highly influential with some groups of academic economists, and although he is pointing to a problem that has reared its ugly head in many foreign economies, the markets have not acted in line with the implications of the FTPL since the pandemic started. Under the FTPL, fears of higher inflation and debt defaults would be expected to show up in the bond, credit and foreign exchange markets. These signs have been conspicuous by their absence.

Since the end of 2019, the nominal 10-year yield on treasury notes has been roughly unchanged at just below 2%. There has been a rise of around 0.7% in 10-year breakeven inflation expectations, but this has been cancelled by a similar drop in real rates on these securities.

This is consistent with a belief in the markets that the Fed will adopt easier monetary policy (i.e. real rates) while accommodating slightly higher inflation. However, it does not seem consistent with fears of an American debt crisis under the FTPL, which should raise long term risk premia in the long end of the yield curve. This has hardly happened at all during the pandemic. Nor has the nominal value of the dollar fallen during this episode.

Cochrane claims that inflation, under the FTPL, can rise suddenly, and apparently out of nowhere. That may be true, but it has not happened yet.

Current Fed Views

In the past two months, both the Fed and the markets have shifted away from the original Krugman view, and therefore away from the optimism of “team transitory”, because actual inflation data have been much higher than expected. It is not clear that this shift has carried the Fed and the market as far as the Summers view, and certainly nowhere near as far as the Cochrane view.

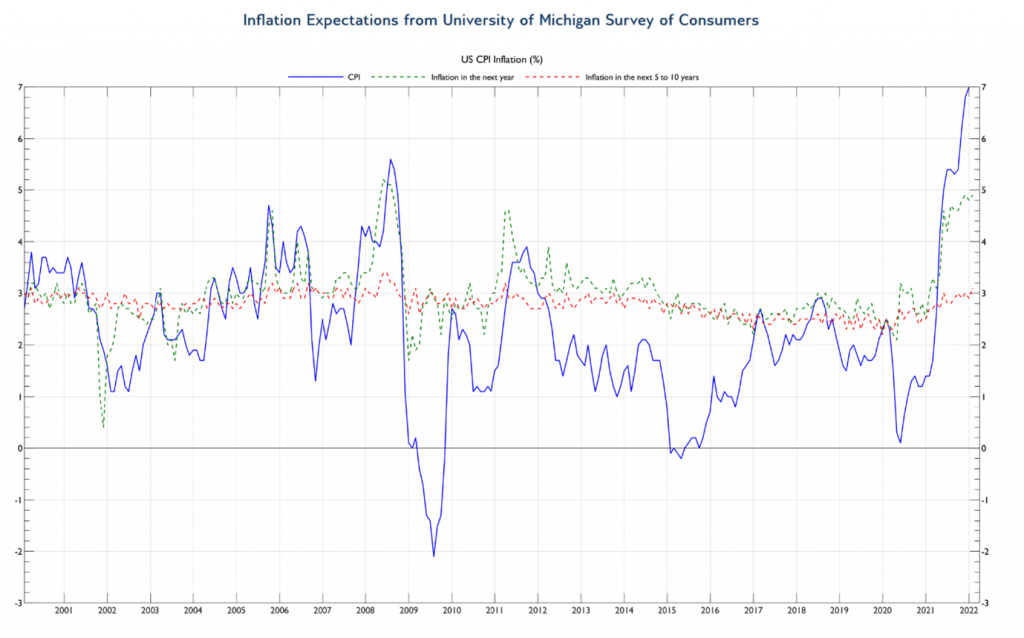

Fed Chairman Powell seems to have decided that his original forecasts for inflation were too optimistic, and that the “transitory” part of the problem will last longer than anticipated. Surprisingly, he seems to have accepted that this jump in prices should be built into the baseline for the price level permanently. He specifically states that he does not want to see inflation falling below 2%, even though the average inflation target is clearly already being exceeded. In fact, he seems to have retired the AIT almost entirely, which is remarkable. It is not surprising that inflation expectations have risen in this policy environment.

The Chairman now says that he will offer no formal forward guidance about the pace of rate increases, which will be data determined. The central bank balance sheet will be reduced in line with a pre- announced timetable. This timetable is not yet determined but is likely to be faster than in the previous cycle. In deciding on the pace of overall tightening, including rates and the balance sheet, the behaviour of price expectations will probably be much more important than that of inflation itself.

Source: Fulcrum Asset Management LLP, Bloomberg LLP

Does the Fed have any sympathy at all for the FTPL? The Chairman has generally followed the traditional Fed line that monetary policy is independent from fiscal policy. He says that the latter is simply accepted as a “something that arrives at our front door”, sent by Congress, and is not the legitimate province of the central bank.

However, in the December 2021 press conference, he did say that inflation rose partly because of “fiscal stimulus into an economy that was recovering rapidly”.

This suggests that he may share some of Summers’ concerns about the fiscal stance, but there is no public hint of any concern about Cochrane’s thinking, or the FTPL.

Conclusion

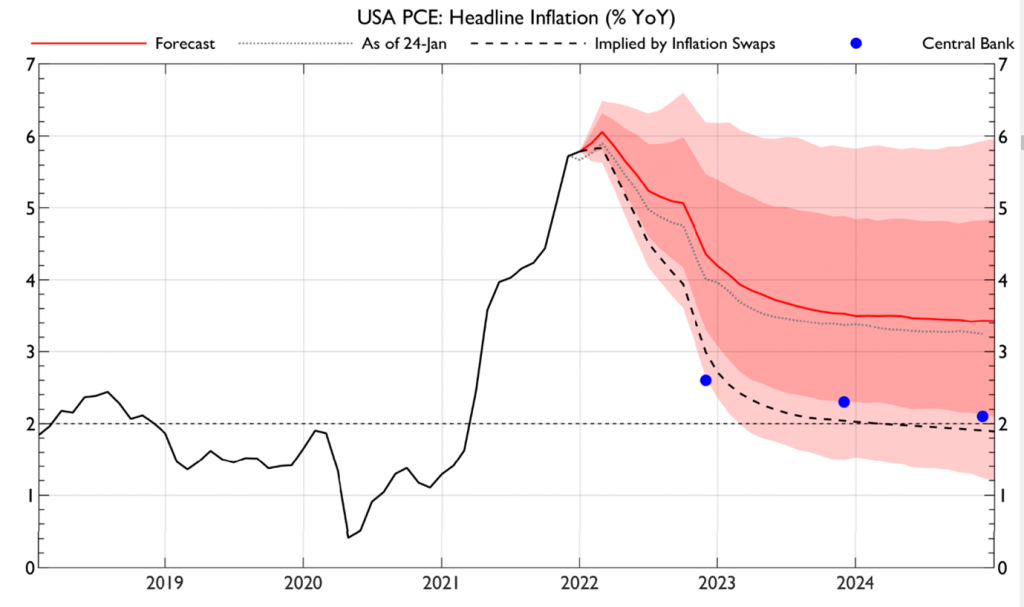

While this essay has discussed the underpinnings for each of the main views about US inflation, and its connection with fiscal settings, it has not commented specifically about Fulcrum’s view about the most likely path ahead. Our economics team, and its models, are more closely in line with the Summers view than either Krugman or Cochrane.

The Fulcrum models incorporate more persistence in the inflationary process than the Fed’s forecasts seem to reflect. This implies that inflation may remain above Fed and market expectations for a further period. Our latest forecast, for example, shows annual PCE inflation still running at over 4% at end 2022, compared to the latest published Fed forecast of 2.6%. Furthermore, our models show inflation staying above 3% until at least 2025.

Source: Fulcrum Asset Management LLP, Bloomberg LLP

Chairman Powell has said that the Fed’s forecast has been increased since December, but only slightly. This leaves the latest Fed view for the future path of inflation very considerably below the Fulcrum view, which is a highly unusual situation, and makes us concerned that further inflation and short rate shocks may occur this year.

Finally, what about Cochrane and the FTPL? We agree with Krugman and Summers that this strand of thinking has not been a major factor in the inflation episode in 2021 and believe that the US will be given the benefit of the doubt on debt sustainability by the markets for quite a while.

However, if this mechanism kicks in sometime in the future – as it did in the late 1970s – it would inevitably spell doom for financial asset prices for several years. This is a risk that the US fiscal and monetary authorities must now avoid.

Source:

(1) Statement on Longer-Run Goals and Monetary Policy Strategy (federalreserve.gov) January 25, 2022.

(2,3) The Washington Post: Opinions – Larry Summers Biden Covid Stimulus, February 4 2021.

(4,5,6,7) The Grumpy Economist: Inflation meditation (johnhcochrane.blogspot.com), November 18, 2021.

This material is for your information only and is not intended to be used by anyone other than you. It is directed at professional clients and eligible counterparties only and is not intended for retail clients. The information contained herein should not be regarded as an offer to sell or as a solicitation of an offer to buy any financial products, including an interest in a fund, or an official confirmation of any transaction. Any such offer or solicitation will be made to qualified investors only by means of an offering memorandum and related subscription agreement. The material is intended only to facilitate your discussions with Fulcrum Asset Management as to the opportunities available to our clients. The given material is subject to change and, although based upon information which we consider reliable, it is not guaranteed as to accuracy or completeness and it should not be relied upon as such. The material is not intended to be used as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client’s account should or would be handled, as appropriate investment strategies depend upon client’s investment objectives. Funds managed by Fulcrum Asset Management LLP are in general managed using quantitative models though, where this is the case, Fulcrum Asset Management LLP can and do make discretionary decisions on a frequent basis and reserves the right to do so at any point. Past performance is not a guide to future performance. Future returns are not guaranteed and a loss of principal may occur. Fulcrum Asset Management LLP is authorised and regulated by the Financial Conduct Authority of the United Kingdom (No: 230683) and incorporated as a Limited Liability Partnership in England and Wales (No: OC306401) with its registered office at Marble Arch House, 66 Seymour Street, London, W1H 5BT. Fulcrum Asset Management LP is a wholly owned subsidiary of Fulcrum Asset Management LLP incorporated in the State of Delaware, operating from 350 Park Avenue, 13th Floor New York, NY 10022.

©2022 Fulcrum Asset Management LLP. All rights reserved

FC038W 013122

About the Author

Gavyn Davies

Gavyn Davies is Chairman of Fulcrum Asset Management and co-founder of Active Partners and Anthos Capital. He was the head of the global economics department at Goldman Sachs from 1987-2001 and Chairman of the BBC from 2001-2004. He has also served as an economic policy adviser in No 10 Downing Street, and an external adviser to the British Treasury. He is a visiting fellow at Balliol College, Oxford.