In Short

The Discretionary View: Investing in an era of Normalisation

In this article, we provide our current macro outlook in the context of policy and economic normalisation and its implications for asset markets.

Four trends that would need to be maintained for our theme of normalisation to continue: the return of global activity to a higher level than has prevailed over recent years, inflation reverting towards higher levels more consistent with central bank objectives, interest rates (including term premia) gradually increasing and volatility across financial markets settling at higher levels as central banks withdraw stimulus. We review the progress on these four areas below and assess their implications on financial markets and our discretionary portfolio.

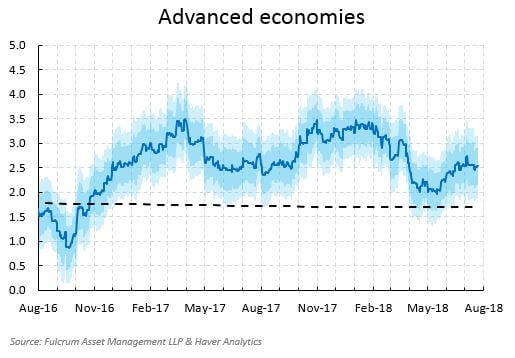

Firstly, global economic activity, according to Fulcrum’s nowcasts, remains robust, with broad-based improvements in real data across world economies. Consensus expectations of global growth have been revised higher both for this year and 2019 which continues to go against the trend of previous years and is consistent with growth returning to more “normal” levels.

Despite a soft patch in the April data, global economic activity continues to track above trend at +4.0% annualised with advanced economies at 2.5%. Underlying growth in the US remains significantly above trend, and has accelerated to 3.5%. In Europe, the latest economic indicators and survey results are weaker, but remain consistent with ongoing solid and broad-based economic growth. Worries about slowing credit growth notwithstanding, indicators of real economic activity in China have tended to be volatile but emerging economy growth also remains close to trend.

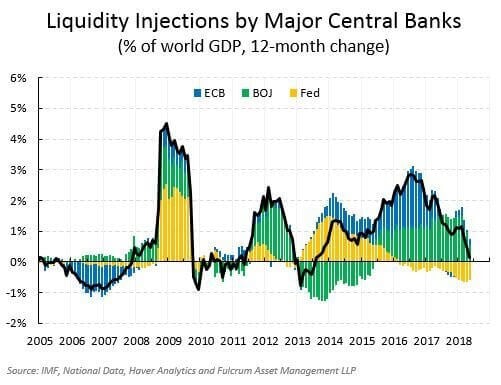

Secondly, the theme of interest rate and policy normalisation continued in the second quarter of 2018, with the Federal Reserve increasing the Fed Funds rate again to a range of 1.75-2%, the European Central Bank laying out plans to end its asset purchase programme, the Bank of England preparing to tighten policy and even the Bank of Japan looking for ways to adjust its yield cap policy. As the chart below highlights the major central banks are reducing liquidity back to more normal levels, consistent with the improving global growth backdrop.

Thirdly, the progress on inflation continues to be very gradual. Oil prices pushed up headline inflation over the second quarter, but over the medium term inflation forecasts in the main advanced economies remain at or below central bank targets and are likely to remain at similar levels for the foreseeable future. This appears to be particularly the case in Japan more recently with inflation numbers falling back and remaining well below central bank targets. Importantly, inflation remains at levels that do not warrant concerns about price stability. As a result, we continue to view monetary policy as still predominantly responding to robust activity rather than trying to fend off higher inflation. The latter would probably be more negative for markets.

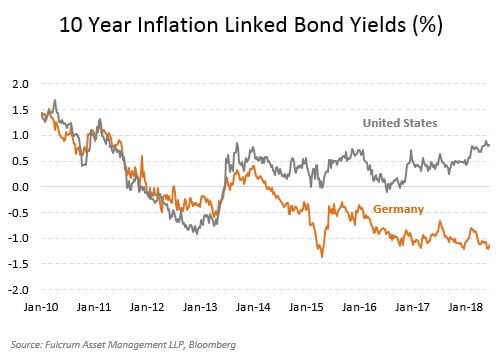

The current environment of solid global growth and anchored inflation should be supportive for equities and emerging markets, while posing modest upside risks to fixed income yields. In the US, bond yields have already risen to levels more consistent with normalisation, but yields in other core markets, such as Germany, have retraced to prior depressed levels; the spread between US and European yields is at highly attractive levels (chart below) and we remain positioned for convergence.

Fourthly, the road towards normalisation is not without challenges and consequent dislocations, which in turn creates opportunities. While the increase in volatility in the first quarter was concentrated in developed market equities, the second quarter saw a more widespread increase. Once again, concerns about trade wars dominated the fluctuations in investor sentiment and triggered a broad-based loss of confidence in emerging market assets, which were perceived to be the most damaged by trade wars and US dollar strength. We will expand our views further on this topic as well as China’s economy in another Discretionary View.

So far, this loss of confidence does not reflect underlying macroeconomic fundamentals, but a reassessment of “Margins of Safety”: investors now require additional compensation to hold emerging market assets – a phenomenon that is consistent with normalisation. Therefore, when allocating to emerging markets, we have selected countries that offer high real yields, have solid fundamentals and attractive valuations. Our favoured regions continue to be South Africa, Indonesia, Mexico and Brazil.

As mentioned above we will be covering different topics in the next Discretionary View notes but will no doubt return to the theme and implications of normalisation in coming months and quarters.

Disclaimer

This document represents a marketing communication (non-independent research). It has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Fulcrum Asset Management LLP (‘Fulcrum’), Fulcrum defines marketing communication as market commentary consisting of illustrative, critically educational explanatory notes written to discuss or equally support an article or other presentation previously published. This document is also considered to be a minor non-monetary (‘MNMB’) benefit under Directive 2014/65/EU on Markets in Financial Instruments Directive (‘MiFID II’). Fulcrum defines MNMBs as documentation relating to a financial instrument or an investment service which is generic in nature and may be simultaneously made available to any investment firm wishing to receive it or to the general public. The following information may have been disseminated in conferences, seminars and other training events on the benefits and features of a specific financial instrument or an investment service provided by Fulcrum.

Information provided does not constitute investment advice and should not be relied upon as a basis for investment decisions, nor be considered a recommendation to purchase or sell any particular security or fund. In addition, the views expressed do not necessarily reflect the opinions of any investment professional at Fulcrum, and may not be reflected in the strategies and products that Fulcrum offers.

This document does not represent valuation judgments with respect to any financial instrument, issuer, security or sector that may be described or referenced herein. It is being provided merely to provide a framework to assist in the implementation of an investor’s own analysis and an investor’s own views on the topic discussed herein.

Any views and opinions expressed are for informational and/or similarly educational purposes only and are a reflection of the author’s best judgment, based upon information available at the time obtained from sources believed to be reliable and providing information in good faith, but no responsibility is accepted for any errors or omissions. The information contained herein is only as current as of the date indicated, and may be superseded by subsequent market events or for other reasons. Charts and graphs provided herein are for illustrative purposes only. The information in this document has been developed internally and/or obtained from sources believed to be reliable; however, neither Fulcrum guarantees the accuracy, adequacy or completeness of such information.

Nothing contained herein constitutes investment, legal, tax or other advice nor is it to be relied on in making an investment or other decision. Some comments may be considered forward-looking statements; however, future results may vary materially.

By accepting this document, the recipient acknowledges its understanding and acceptance of the foregoing statement. Redistribution or reproduction of this material in whole or in part is strictly prohibited without prior written permission of Fulcrum Asset Management LLP, authorised and regulated by the Financial Conduct Authority (No: 230683) © 2018 Fulcrum Asset Management LLP. All rights reserved.