In Short

‘The Great Reversal’ signifies the moment when the seemingly unstoppable decline in bond yields reverses and they start rising instead (Fulcrum)

We still remember conversations with active bond managers even before the Global Financial Crisis when ‘The Great Reversal’ cropped up regularly as a concept. Now, fifteen years later, government bond yields (at least in the developed economies) are significantly lower than they were then! Economic conditions have certainly not made it easy for the more traditional government bond specialists; they have had to learn to grapple with ‘the new normal’. Will the perfect storm of a global pandemic, supply chain issues, a potential energy crisis, and years of loose policy, trigger the long-feared leap in bond yields? Have they already been triggered? Are we experiencing the start of The Great Reversal and, if so, what should you do?

The elephant in the room is getting larger and larger.

Background

Despite a modest uptick in recent months, government bond yields remain incredibly low and, in many cases, negative. Although low interest rates have sustained the economy through challenging times, government debt levels are enormous and only increasing. Several central banks have also indicated that they might increase interest rates to try to curb inflation. Indeed, several emerging market central banks (e.g. Brazil, Russia) have already acted.

Fund managers often feel like the end of a cycle is just around the corner and everyone else is behaving irrationally. When you are in your own bubble, you expect that the ‘trigger event’ (like, say, a global pandemic) should accelerate the change tomorrow, but it can often be a long and drawn-out process. Indeed, beside the handful of brave fund managers who are now well positioned for an increase in government bond yields (this has been a graveyard trade for 30+ years), economists have long theorised that changes in fundamental conditions take decades to develop.

A recent example relates to the excessive accumulation of credit and the onset of subsequent financial crises. Economists Moritz Schularick from the University of Bonn and Alan M. Taylor from the University of California have shown, using data from 14 countries since 1870, how “reckless lending” and financial speculation can go on for years or decades before eventually causing a crisis.¹

We appear to be exiting the pandemic slowly but surely. Major economies are facing supply chain challenges not just because of the pandemic but also because of other longer term shifts taking place (the climate transition, the technology revolution etc.). Is this enough to tip the balance?

Perhaps all we can confidently say is that more of the ingredients for the long-term inflection point in interest rates (or ‘The Great Reversal’) are with us than before and that the likelihood we are at the early stages of that turning point has increased.

What are the implications?

Risk-free rates are central to asset pricing and macroeconomic conditions. They are used to derive funding level calculations and equity valuations. If they rise meaningfully, there are huge implications – not simply in the world of asset management, but also for mortgage rates and the cost of living. Given the last 30-40 years of history, it would be very easy to underestimate the impact of them rising.

The most obvious impact of higher bond yields is lower bond prices, but there can be all sorts of secondary effects…

- Higher yields could have a troubling impact on equity prices, particularly those equities where the discount rate is a crucial component of the valuation methods used (so-called, long duration equities).

- Along similar lines, higher yields have knock-on consequences for credit and other fixed income assets. The longer the duration of the asset, the bigger the impact.

- By extension, many illiquid assets would also likely be impacted given inherent assumptions around ‘yield compression’ and the use of leverage.

If the next phase turns out to be a shorter-term cycle on the inexorable path towards zero (or below zero) interest rates globally, extending far into the future, then most of us will be able to take the consequences for asset prices in our stride. Indeed, the nature of this inflationary shock will be key in terms of how asset prices react. If we see huge productivity gains and rampant economic growth (as in the 1920s or early 1960s), we will likely see growth assets continue to thrive.

If, however, The Great Reversal is upon us and the ‘cost-push’ inflationary shock continues, the impact will be profound with lower returns on many of the assets profiled above. The assumptions that have been used in models will prove inaccurate, dramatically underestimating the effect of the yield/interest rate increase. In this environment, the diversifying properties of government bonds will become less powerful, an outcome that has been well covered in various articles around the future efficacy of the 60/40 portfolio. The effect is, of course, compounded wherever leverage is used.

If you are concerned about the potential for substantial bond yield rises, there are a few important asset allocation principles to consider:

- Reduce overall sensitivity to government bond yields

- Identify innovative ways of diversifying the defensive assets in your portfolio

- Use less leverage

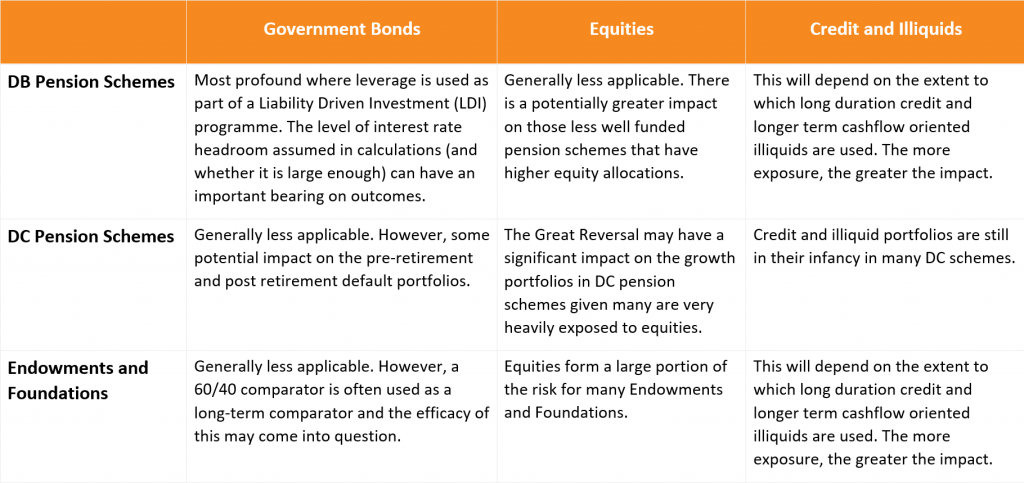

It is key to relate these observations back to various investor groups. Below, we provide an overview of the potential impact for DB Pension Schemes, DC Pension Schemes as well as Endowments and Foundations.

*Indicative Examples. The information provided does not constitute investment advice and should not be relied upon as a basis for investment decisions.

To use a drastic oversimplification, an instantaneous 2% increase in yield on an asset with 10 years of duration represents a c.20% fall in price. A few turns of leverage and we are faced with some very large numbers.

Identifying good diversifying assets to equities and government bonds is a real challenge. We offer further perspectives on this topic in our recent thought piece “What to do when bonds do not diversify”. To summarise: some selective combination of real assets, defensive currency exposures, hedging techniques and Macro/Hedge Fund strategies are worthy of consideration from a strategic perspective, in our view. Some of these assets will have been out of favour for some time, which stands to reason given how long market conditions have persisted. Furthermore, some of these strategies will not have a direct positive correlation to increasing interest rates. In several cases, outcomes will depend on the dynamic positioning at the time. As such, the structure of the overall portfolio is critical.

Is there a good hedge?

It is worth digging into hedging techniques in more depth, since in many cases it may be very difficult for investors to make wholesale portfolio shifts into the asset classes we allude to above, and it may also take time to implement those decisions.

Hedging government bond yields (to clarify, by hedging, we mean shorting government bonds, most likely through futures or possibly options) has been a dangerous game. Nonetheless, we feel this is certainly worth considering given the magnitude of the risk that lies ahead. We would observe that the sizing decision for this type of position is of paramount importance and requires some careful scenario modelling.

Hedging equities is another prime consideration. There are numerous important dynamics to contemplate here including premium spend, maturity, strike point, geographic/index exposure etc. This is one of those situations where embracing this complexity is a necessary evil. The reward is that convex payoff profiles may be achievable.

Is this geography specific?

Large disparities across regions and countries mean these phenomena play out divergently according to where you reside. Many of the developed market economies (including Japan) are all prone to this risk to different degrees. One of the most vulnerable may be the UK thanks to more acute supply chain issues. In contrast, there is clearly a different dynamic in China, which neatly leads us on to the fault lines in the thesis.

Risks to the thesis

A big interest rate rise is not a foregone conclusion. A slowdown in China could offset some of the issues in the supply chain. Perhaps we are still ‘in denial’ about the ability and willingness of central banks to manage economic conditions over time. Inflation could be transitory after all and some of the issues could self-correct.

To finish…

Rudi Dornbusch said, “crises take longer to happen than you think they will, and then they happen faster than you thought they could”. History tells us that interest rate rises can occur quickly (and are sometimes implied by the market even faster). We can only suggest that advance planning for The Great Reversal seems like a sensible course of action.

¹See Schularick, Moritz, and Alan M. Taylor. 2012. “Credit Booms Gone Bust: Monetary Policy, Leverage Cycles, and Financial Crises, 1870-2008.” American Economic Review, 102 (2): 1029-61.

About the Author

Matthew is Head of Fulcrum Alternative Solutions. Before joining Fulcrum in 2018 to run Fulcrum Alternative Solutions, Matthew had been a Portfolio Manager for the Towers Watson Partners Fund since 2014 and before that a manager researcher in fixed income, hedge funds and other alternatives since 2005. Matthew holds a BSc in Economics and Finance (2005) from University of Bristol. He has been a CFA charterholder since 2009.