Responsible Investing

Fulcrum has made a firm commitment to being a responsible investor and to actively consider clients’ sustainability objectives. We are also committed to achieving net zero by 2050 in line with the Net Zero Asset Manager Initiative.

A Responsible Investor

Sustainability is one of Fulcrum’s core values and we are committed to embedding this on an enterprise and investment level. We are aware of the challenges facing the natural environment and believe that financial markets have an important role to play in creating a more sustainable world. We believe that the allocation of capital can affect society and the environment, and we aim to play a positive role in this change.

We are conscious that we do not operate in isolation and that the way we invest or manage our assets might impact, positively or negatively, environmental and social sustainability objectives. If we invest in a responsible manner, our partners, colleagues and clients can all be proud of their association with Fulcrum. This is a strong motivation.

As a firm, we aim to act as responsible investors. For us, this means enabling our investment professionals to:

- Consider and integrate ESG risks and sustainability issues in their investment decision-making

- Act as good stewards of capital in the way we exercise our voting rights; engage with companies, stakeholders and industry initiatives in a targeted and meaningful manner

- Communicate and interact with our clients on these issues through transparent disclosures

The pillars of our approach:

ESG Integration

Stewardship

Clients' values

Timeline

Responsible Investing at Fulcrum

Over the past years we have integrated responsible investment in a holistic way across the firm and developed strong relationship with industry initiatives.

Capability

Climate-Aligned Investing Capability

We have developed a range of innovative solutions to address the sustainability challenges of our time.

Stewardship

Engagement

We engage with companies by highlighting the importance we place on their approach to environmental and social issues. In particular we focus on climate change and decarbonisation.

The reduction of GHG emissions is crucial in order to prevent further global warming. This is why we are signatories to Climate Action 100+, which engage with the most polluting companies – encouraging them to drastically reduce their emissions.

Moving from a fossil fuel reliant economy to a low-carbon one is a challenging task. This is why our main engagement target is to encourage companies to set science-based targets so that it is clear how they intend to make this transition.

The foundation of any climate metric is credible and extensive carbon emission disclosure. CDP is the market leader and we are supportive of their work to improve how companies report.

VALUES

A Focus on Climate Change

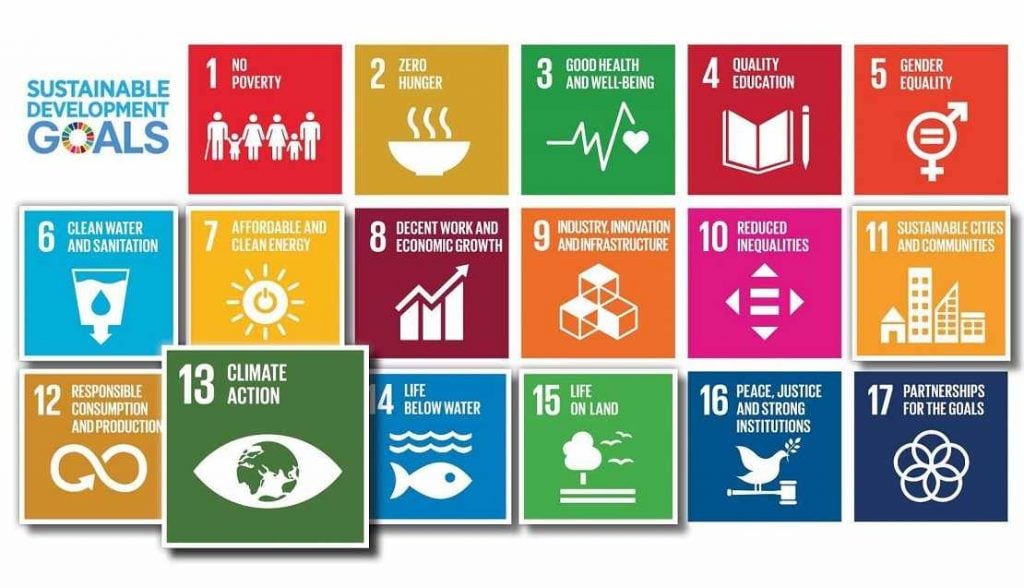

Climate Change is an urgent and catastrophic issue. It is considered one of the biggest risks to our way of life, and as a multiplier issue, Climate Action also affects many of the other Sustainable Development Goals as the physical consequences of an altered climate affect weather patterns, reducing access to food (2) and clean water (6), challenging both life below water (14) and on land (15).

The firm has a particular concern about the devastating consequences of accelerating climate change, and an awareness of how this both poses a risk to investments as well as the important role the financial sector must play to mitigate climate change. Consequently, investing in a climate-aligned manner is important for us and we aim to embed this holistically across the firm. In particular, we focus on how the financial industry can contribute to shifting financial flows to fund the green transition.

We believe strongly that climate change considerations should be integrated into investment decision making, both as a risk consideration and from an impact point of view. This is why we became signatories to TCFD in 2019.

Our Fulcrum Climate Change Strategy is designed to be aligned with the Paris Agreement’s below 2°C global warming target by allocating capital to companies that are well positioned for the low-carbon future and by engaging with companies that are not.

stewardship

Voting

We aim to act as good stewards of assets in the way we exercise our voting rights. Our focus on climate change means that we aim to vote in support of climate change mitigation efforts.

Our Fulcrum Diversified Liquid Alternatives Strategy provides exposure to Real Assets, Alternative Credit and Diversifiers, integrates Responsible Investing and offers daily liquidity with no performance fees at any level.

POLICIES

Sustainable Financial Disclosure Regime

We have implemented SFDR as per the EU Regulation as outlined in our Sustainability Risk Policy.

Hear the latest from us

Sign up to receive our latest macro insights and news