Global markets have been hit by a series of large shocks in 2022 – higher commodity prices triggered by the war in Ukraine, Covid lockdowns in China, inflation from the post-pandemic recovery in the advanced economy, and a sudden tightening in real monetary policy, especially in the US. Although all these shocks have been important at different times, market behaviour in April has been driven mainly by the extremely hawkish rhetoric from the Federal Reserve, especially relative to monetary policy shifts in a dovish direction in China and Japan. Until the Fed shock is fully priced, global bonds and equities both remain vulnerable. We expect this process to take several quarters to play out.

Author: Gavyn Davies, Chairman, Fulcrum Asset Management

25 April, 2022

Markets have continued to be driven by major macro-economic shocks in April. Some asset prices have become very volatile (with the extraordinary crash in Netflix being a specific example), while others (real and nominal bond yields) have been trending strongly in one direction, with little short term volatility.

Some thoughts:

- Most commentators believe that the main market driver during April has been a further large hawkish shock from the Fed (See Unhedged in the FT). Three successive 50bp rate hikes are now priced by the markets in the next three FOMC meetings, with policy rates expected to peak at 3.0-3.5% in 2024. The FOMC has also warned of an early end to QE. The Fed will start to sell bonds at a pace of around $95bn per month in June, and the central bank balance sheet is likely to decline at almost twice the pace seen in the last period of QT from 2017-19.

- Recently, this policy shift has been reflected in a major uptrend in real bond yields, with expected inflation remaining broadly constant since early March (see Appendix below for our model’s latest results on this). The markets seem to believe that policy interest rates will “normalise” rapidly, without this causing a recession in the US or EU. Meanwhile, US fiscal policy is also likely to start tightening from now on. This combined tightening of interest rate policy, Fed balance sheet policy and fiscal policy represents an unusually sharp reversal in demand management policy.

- Nevertheless, there is general agreement that the US economy remains strong for now, with a low probability (15%) of a recession this year. By contrast, there is increasing recognition that a recession in 2023 is fairly likely. Goldman Sachs says the probability is 35%, while Fed Chairman Powell says that he hopes to avoid a recession, but this will not be easy. Larry Summers, the leading pessimist, argues that a recession will now be hard to avoid. Bill Dudley (former President of the New York Fed) agrees with Summers and contends that it could be a deep recession. He compares the current situation to the mid-1970s, and concludes that any delay in tightening monetary policy now will lead to a deeper recession later.

- Our view remains towards the more pessimistic end of this wide spectrum of opinion, though there is huge uncertainty on this call, given the unique economic circumstances that are in play. Experience from previous cycles does not give a very dependable guide to the likelihood of recession in the next 2 years.

- If the US and EU are to avoid recessions, the inflation shock needs to start reversing soon, so that the annual rate of inflation can decline automatically, and the Fed/ECB can become less hawkish. This will depend on the labour market, the recovery of supply chains from China and developments in the Ukraine war. All still look problematic.

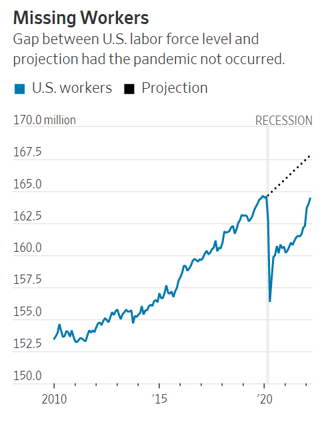

- The US labour market is much tighter than it has been at any time since 1945, and the labour force still remains well below pre-pandemic trends (see graph below from the Wall Street Journal). This has caused wage inflation to rise to around 5.5%. This rate of increase is clearly incompatible with the Fed’s 2% inflation objective and is the major issue that the central bank is trying (belatedly) to address. It will be difficult to achieve a “small” rise in unemployment without this turning into a large correction in the labour market and therefore a recession.

Source: Labor Department; projection is researchers’ estimates based on 2015-19 trends

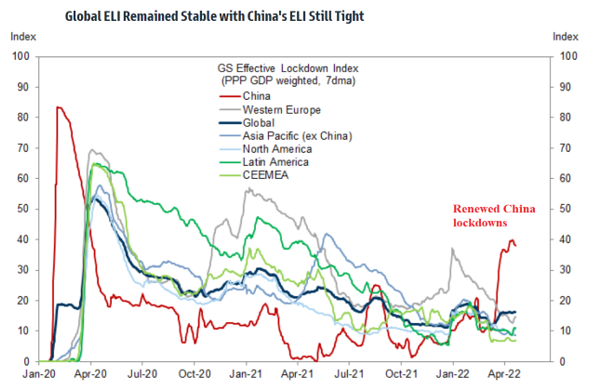

- Economic activity in China has dropped sharply in March/April, reflecting the almost complete shutdown in Shanghai and some other cities. For now, the authorities are maintaining the zero Covid strategy which will cause further lockdowns in many other regions in coming months. The government is maintaining its GDP target of “around 5.5%” this year, but this looks increasingly unlikely to be attained. Having said that, progressive easing in monetary and fiscal policy – the exact opposite of the policy stance in the US – should prevent any further decline in the annualised growth rate after the second quarter.

Source: Goldman Sachs Investment Research, University of Oxford (covidtracker.bsg.ox.ac.uk), Google LLC “Google COVID-19 Community Mobility Reports”, Wind

- In currency markets, the dollar has strengthened further during April, reflecting the relative hawkishness of the Fed compared to other central banks. Recent weakness has been particularly notable in the yen and sterling, where the central banks are clearly less hawkish than the Fed. Importantly, the Chinese RMB has suddenly started to weaken in recent days, and this has been tolerated (or even encouraged) by the PBOC. The decline in the RMB reflects the impact of a depreciation in the yen, weakness in economic activity in China, and capital outflows linked to bond market stress. This reversal in the RMB could be a major factor in currency markets in coming months, fueling further dollar strength.

- After a few weeks in which equity markets seemed surprisingly resilient to Fed tightening, there has been some marked weakness in the last few days. The S&P 500 is now down 10.7% this year; the Nasdaq is down 17.9% and the GS Future Tech Leaders ETF is down 30.0%. These markets are now close to their low points for the year.

- Last week, the major shock was obviously the outright collapse in the Netflix share price, which may cause a general rethink of long term equity valuations in “tech” sectors, given the rise in real bond yields. (See Unhedged in the FT, and Katie Martin, FT.) Equities are likely to remain vulnerable until the Fed shock is fully priced, and recession risks are seen to drop. This process could take several quarters to play out.

APPENDIX ON SHOCKS AND THE FINANCIAL MARKETS

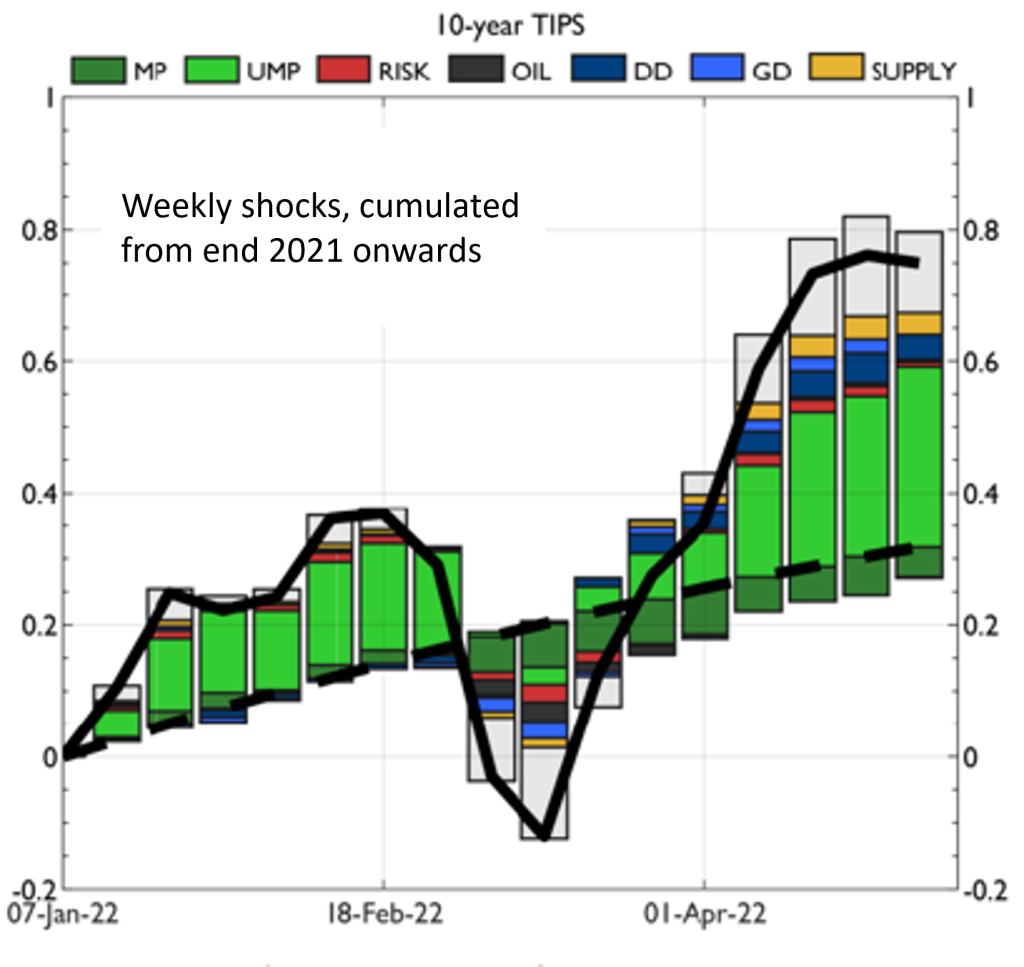

Fulcrum economists, led by Juan Antolin-Diaz, have developed a VAR model of the US financial markets that enables us to track on a daily basis the fundamental macro shocks that are moving the major asset prices over any given time period.

This model has been very useful in helping us to understand asset market behaviour in the past few years. It enables us to identify the following major shocks in the US and global economies: Fed conventional monetary policy (MP); unconventional monetary policy (UMP); financial market risk aversion (RISK); oil supply (OIL); US domestic demand (DD); global demand (DD); and US non oil supply (SUPPLY). It also shows a residual (grey boxes) that represents unidentified market shifts, not attributable to any of the specific shocks.

The graph below shows the model’s estimates of the impact of weekly shocks on real yields in the TIPS market, cumulated from end 2021 onwards. The shocks are compared with the path for real yields expected by the model at end 2021, which is shown by the dotted line. Therefore the graph shows how the model has been “surprised” by new shocks in 2022, and identifies the main categories of these shocks.

At the end of last year, the model “expected” real TIPS yields to rise by 0.3% by the end of April 2022. This mainly reflects the fading out of extremely easy monetary policy that was pursued by the Fed throughout last year. On top of this “expected” rise in yields, we have seen a further 0.5% increase, much of which has happened in April. About half of this further increase has been due to unconventional monetary tightening, which represents the change in Fed balance sheet policy. The model suggests that this has been the main driving force in the increase in real (and therefore nominal) bond yields in the past few weeks.

Source: Fulcrum Economics Department

This material is for your information only and is not intended to be used by anyone other than you. It is directed at professional clients and eligible counterparties only and is not intended for retail clients. The information contained herein should not be regarded as an offer to sell or as a solicitation of an offer to buy any financial products, including an interest in a fund, or an official confirmation of any transaction. Any such offer or solicitation will be made to qualified investors only by means of an offering memorandum and related subscription agreement. The material is intended only to facilitate your discussions with Fulcrum Asset Management as to the opportunities available to our clients. The given material is subject to change and, although based upon information which we consider reliable, it is not guaranteed as to accuracy or completeness and it should not be relied upon as such. The material is not intended to be used as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client’s account should or would be handled, as appropriate investment strategies depend upon client’s investment objectives. Funds managed by Fulcrum Asset Management LLP are in general managed using quantitative models though, where this is the case, Fulcrum Asset Management LLP can and do make discretionary decisions on a frequent basis and reserves the right to do so at any point. Past performance is not a guide to future performance. Future returns are not guaranteed and a loss of principal may occur. Fulcrum Asset Management LLP is authorised and regulated by the Financial Conduct Authority of the United Kingdom (No: 230683) and incorporated as a Limited Liability Partnership in England and Wales (No: OC306401) with its registered office at Marble Arch House, 66 Seymour Street, London, W1H 5BT. Fulcrum Asset Management LP is a wholly owned subsidiary of Fulcrum Asset Management LLP incorporated in the State of Delaware, operating from 350 Park Avenue, 13th Floor New York, NY 10022.

©2022 Fulcrum Asset Management LLP. All rights reserved

FC065W 270422

About the Author

Gavyn Davies

Gavyn Davies is Chairman of Fulcrum Asset Management and co-founder of Active Partners and Anthos Capital. He was the head of the global economics department at Goldman Sachs from 1987-2001 and Chairman of the BBC from 2001-2004. He has also served as an economic policy adviser in No 10 Downing Street, and an external adviser to the British Treasury. He is a visiting fellow at Balliol College, Oxford.