In Short

Until the sharp movements in equities and bonds from the middle of February 2020, investors had enjoyed benign returns from traditional assets such as equities and bonds.

Now many are asking just how long this can last.

The future direction for these asset classes is far from certain, and some may find it worth considering protecting capital now to consolidate the gains made.

The roots of the absolute return fund sector can be traced back to the need to differentiate from traditional markets in order to add an element of defensive protection to an investment portfolio.

It resulted in a wide-ranging sector, with the Investment Association’s Targeted Absolute Return sector numbering more than 118 funds. Yet in a decade of benign market conditions, and with a range of different approaches to managing an absolute return portfolio taken, sector performance on the whole has often been patchy.

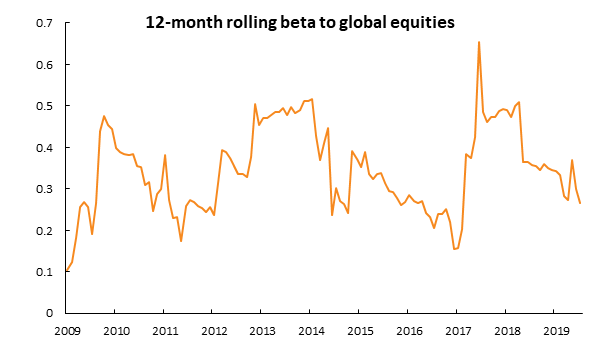

The chart above compares the 12–month sensitivity of the Fulcrum Diversified Absolute Return Fund with Global Equities (MSCI World TR GBP Hedged), showing a low to negative sensitivity on average.

The performance of some in the sector has been disappointing, but it is important not to tar all with the same brush. Absolute return funds play a key role in diversifying a portfolio, so, when measuring what an absolute return can do for you it is essential to be aware of several characteristics.

Firstly, we believe that investors should consider the length of the track record as well as judging how it deals with volatile market conditions.

Ideally this would mean a strategy with a record dating back to the 2008/09 Global Financial Crisis, which offered a real test of how a manager could perform during a very volatile environment. It was, until very recently as we have seen with the outbreak of Covid-19, the last key data point to examine how a strategy might behave when markets move sharply. This also means looking for some continuity in the team, showcasing experience at dealing with difficult market conditions.

Investors should also look for a fund with a portfolio displaying a low correlation to equity and bond markets. This can be done by adopting ‘directional’ strategies – in which the manager varies bond and equity exposure dependent on the market environment – and ‘relative value’ strategies. The latter is a strategy where the manager adopts a range of themes, and trades by putting one asset class against another. For example one theme could be that US equities are going to perform better than European equities, and so the portfolio will position itself accordingly. It is the difference between the performance of the two assets, rather than the absolute numbers, which is important in this case. Both strategies help differentiate the portfolio from wider markets, hopefully enough to avoid sharp rises and falls. We believe a combination of the two will prove to offer a more robust performance over time.

The current environment has been incredibly interesting from an investment perspective. At Fulcrum, we are currently focusing our efforts on relative value. This has meant that we are increasing exposure to the US bond market rather than others because the high yields in the asset class offer us greater protection. Similarly, one of the big themes in stock markets is seeking companies that are benefiting from tech disruption, so we have prioritised stocks benefiting from disruption, such as the move to Cloud-based software, and have negative views on the stocks that are missing out on this growing trend.

It is vital that investors look to the long-term when it comes to deciding the make-up of a portfolio. To maintain performance over five, ten or even 30 years, diversification is key. No one can say for sure what the next decade will hold for investors, but adopting a strategic perspective now will ensure a portfolio that is robust in the good time, as well as during the inevitable bad times.

Absolute return funds should be viewed as part of a wider portfolio and as an important component needed to ensure a balance of investments, and differentiate from traditional markets. The world is likely to be more volatile in the next ten years than it has in the past decade, and the traditional investor – who has enjoyed relatively stable market conditions recently – may not be as comfortable as they have been. To them we say, don’t write off absolute returns just yet, they may well come into their own.