In Short

A simple method to assess currency expected returns.

The increasing risk of a trade shock is pushing the Federal Reserve towards an “insurance” interest rates cut this year, just as it did in 1995. While a Fed cut will have various effects on the global financial markets, we look here at potential implications for the expected return on the US dollar.

According to Fulcrum’s model of expected currency returns we see a negative return on the US dollar over the medium term, with the expected depreciation of the currency now large enough to offset higher US interest rates relative to other countries.

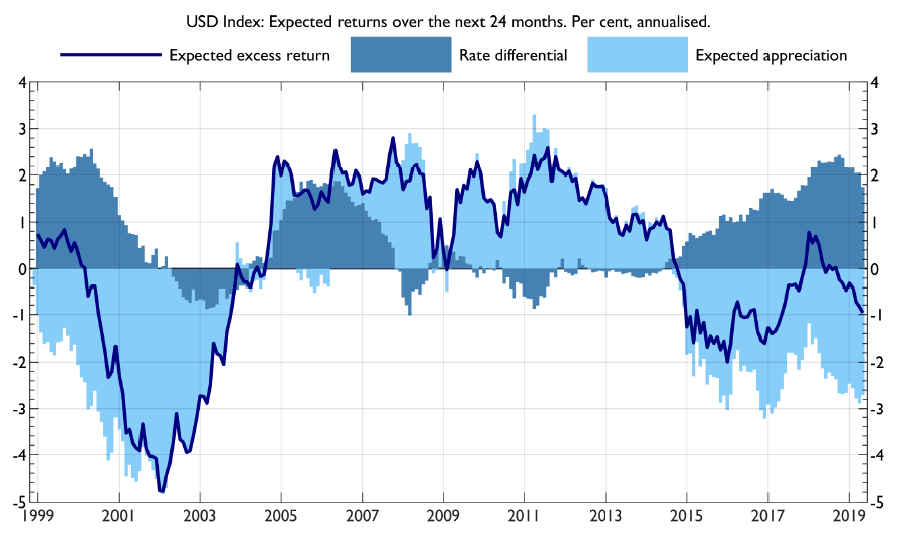

The two-year expected return of the dollar (shown by the solid line in the chart below) is composed of two parts: (i) the difference between the US interest rate relative to a trade-weighted average of advanced economies’ interest rates, known as the “carry” and represented by the dark shaded area; and (ii) the expected appreciation of the trade-weighted dollar, represented by the light shaded area (explained below). In the last few months, the carry has been narrowing, while US dollar valuations have extended further, resulting in an increasingly negative net expected return.

While the expected depreciation of the dollar against a basket of advanced economies’ currencies over a two-year horizon has been ranging between 1% and 3% per annum in the last few years, an investor trying to exploit this predictability in the foreign exchange market by shorting the dollar would have faced a large negative carry. Now, this offsetting force has abated.

A simple model of expected appreciation/depreciation

According to the theory of purchasing power parity (PPP), the exchange rate should in the long run revert to mean, so that the dollar has the same purchasing power as other currencies. While this idea has been at the centre of a lively debate since it was first formulated by Gustav Cassel in the 1920s, most modern economists still think of it as a useful yardstick to assess the value of a currency. Indeed there is some empirical evidence to support the theory, and the consensus view is that it takes between three and five years for deviations of the real exchange rate to halve (e.g., Rogoff, 1996); while the consensus has been challenged and many variations of the PPP theory have been put forward, it provides a useful benchmark*. Another empirical regularity is that this adjustment takes place mainly via changes in the nominal exchange rate, rather than inflation differentials (Eichenbaum, Johannsen, and Rebelo, 2017).

Our model is based on more recent research by economists at the European Central Bank (Ca’ Zorzi and Rubaszek, 2018) combining these two empirical regularities to produce a very simple, but powerful, forecast of nominal exchange rates. Using their methodology, one can reasonably expect that over the next three years the US dollar will depreciate by half of the real exchange rate deviation from the long-run average.

* For a survey of the literature, see, e.g., Taylor and Taylor, 2004.