In Short

The Alternative Solutions Team at Fulcrum have been managing Fund of Hedge Funds (FoHFs) since 2004, and during that time we have been thinking deeply and working hard to navigate the changing marketplace for active management in its purest form: hedge funds.

In this thought piece, we outline our thoughts and observations on the current state of play in hedge fund allocations and what we think are some of the best practices that will become even more important in the coming years. But first, let’s examine the past, in order to understand where we are today.

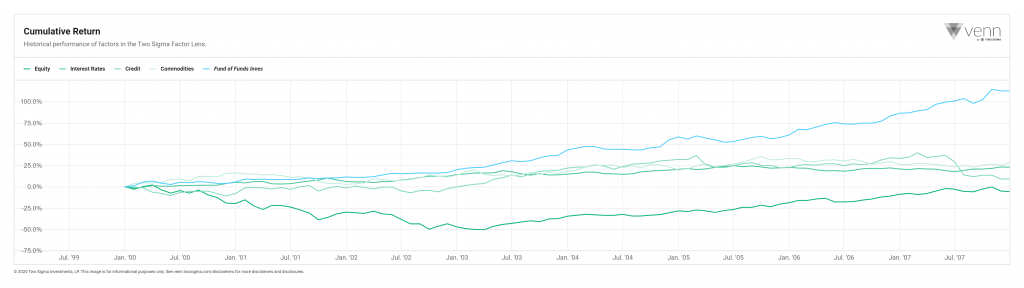

Would you buy the light blue asset? It made 9.9% p.a. over the first 7 years of the century at a Sharpe of 1.2x at a time when Equities lost 0.7% p.a. In that same period, Credit made 1.1% p.a., Interest Rates made 2.6% p.a. and Commodities made 3.2% p.a.*

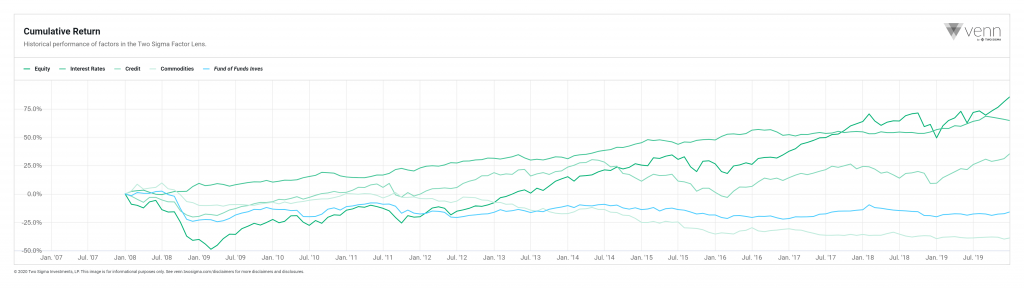

Well, if you had bought it, like so many institutions in the post-TMT bubble who made Fund of Hedge Funds their first port of call when including Alternatives into their asset allocation, you would have subsequently realised a return of -1.4% p.a. over the ensuing 12 years at a Sharpe of -0.2x. This was during a 12-year period in which Equities delivered +5.2% p.a., Interest Rates 4.2% p.a., Credit returned 2.6% p.a., with Commodities being the only underperformer, losing -4.0% p.a.* Ouch.

So, what happened? How did a strategy predicated on allocating to the “best of the best” doing what they do best falter so much? And, more importantly, looking forward; is the strategy doomed from ever achieving its dual-stated goals of diversification and delivering risk-adjusted returns?

We think not. Let’s first unpick why the FoHF industry fell out of favour and then cover how we believe investors can address a decade plus worth of issues:

Alpha Deterioration

During the ten years that followed the GFC, FoHFs realised a -2.5% p.a** loss net of fees after accounting for all other statistically significant factors. This was a large deterioration from their first decade, when realised “alpha” was +2.5% p.a. There are several steps that can be taken to overcome this structural reduction:

- Early stage investing. First mover advantage is a powerful force in investing. Managers are less constrained and nimbler when they have lower assets under management. Although not a silver bullet, we believe investors should worry less about the ramifications of being alone and “wrong” and more about being wrong in a crowd of blue chip funds (and if asset-weighted industry returns offer anything to go by, being wrong in a crowd is one of the most expensive behavioural traits).

- A new fee model. A leading hedge fund industry survey has claimed that “fees have reached an equilibrium” in the post-GFC era, settling at 1.6% management and 17.4% performance fees paid, respectively, asset-weighted***. Management and performance fees for hedge fund strategies in the more liquid UCITS space on the other hand, cluster between 0.5% and 1.0% in management fees and close to half of the funds don’t charge a performance fee****. Furthermore, at Fulcrum, we find we can achieve 30% better terms than headline fees on quality UCITS funds by underwriting robust strategies when they initially come to market, and increasingly, flat fee-only hedge fund portfolios are implementable. Importantly, in our experience this benefit in terms of both fees and liquidity has not been at the expense of realised returns.

- More on that fee model… Fulcrum charges no performance fee and a modest management fee at the fund of hedge fund level, thereby delivering to our investors more “alpha per unit of total fees”, in keeping with our explicit goal of delivering 70% of gross alpha to our clients, with the balancing 30% going to the hedge fund managers who generated that alpha. This is consistent with other “finder’s fees” revenue models outside of the asset management industry.

Risk-free rates fell

Risk-free rates accounted for just under half of FoHF returns during their heyday but during the post-GFC era this amounted to only a +0.6% p.a. tailwind. Moreover, in real terms after expected inflation, the risk-free rate has turned into return-free risk. What about the outlook from here?

- Well, at least it can’t get much worse as the zero bound has now been tested in terms of policy outcomes in Japan, Switzerland and other places. We propose that there are reasons risk free rates will ultimately revert higher, from changing demographics to re-shoring of production and supply chains, to a global repricing of the accumulated debt on government and corporate balance sheets. There’s good reason to be optimistic about the future.

- The effect of low rates has ramifications on asset prices more generally. We believe it is important to manage portfolios holistically, managing risk with a keen eye on dynamic forward-looking expected returns; both at the index and cross-sectional or spread level. At Fulcrum, we are nimble to the ever-changing market opportunity set across liquid alternative strategies. Our clients can track this by holding our manager selection to account.

- Whether risk-free rates rise or not, it is key that investors scrutinise manager risk-taking in excess of this and other factors, i.e., seek to avoid mistaking positive returns for active returns. That way, investors have a better chance of paying only for economic value-added. This is certainly not an easy task and it requires creativity and skill though we see it as essential if investors want to avoid repeating the mistakes of the 2010s.

Non-transparent fee structures are winning in the war for talent

While traditional FoHFs have struggled, a variant hedge fund allocation model has thrived: the multi-strategy fund. These funds allocate to risk takers, but pass-through their overhead costs directly to investors in the fund (instead of paying for it as a cost flowing through the asset management company’s income statement). We would submit that this practice amounts to a worsening of transparency for end investors, and our model, while less remunerative over the short term for investing talent, is more sustainable in the long-run. We believe that better governance emerges out of better transparency. Our clients rightfully care to understand where their dollars are going and we pride ourselves on our levels of transparency and ability to help clients in this regard.

- It takes a special individual to want to deal with running a hedge fund business while also managing a hedge fund portfolio, especially in the current regulatory environment. However, we would submit that in terms of long-term career satisfaction, nothing beats doing well for clients when you really get to know and understand them; these aspects take time. Labouring for 15% of gains but under the constant threat of an unceremonious firing because tight drawdown triggers were tripped begins to look less attractive in the middle years of an investing career, and turnover is very high at these firms. As a differentiated FoHFs manager we seek nurtured talent and underwrite that talent for the long-term, recognizing that sometimes it is best to allocate after a skilled manager has learned a particularly painful lesson.

- Investors should take a few elements from the multi-strategy firms’ playbook to heart, though, we think: diversify and stay liquid. For example, one of the great falsehoods widely accepted in FoHF circles is that credit selection strategies are diversifying to equity selection strategies. We have looked long and hard at this from a statistical, fundamental and operational point of view, and have concluded the opposite. This has helped us achieve greater risk-adjusted returns and liquidity in our solutions with less “left-tail” risk.

In summary, we’ve pointed out some aspects of funds of hedge funds that have disappointed investors since the GFC and how we address them at Fulcrum. We are focused on sourcing alpha with aligned, transparent fee structures and we build targeted portfolios of high conviction ideas. We are proud to be viewed as a market leader in identifying and seeding new UCITS hedge funds, with a focus on being both liquid and transparent. And now more than ever, our solutions diversify standard equity and fixed income exposures while enhancing expected returns. We’d love to hear your thoughts.

At Fulcrum, we are well into our 16th year managing FoHF portfolios and have evolved our process purposefully during that time. Our solutions are available in a liquid, weekly dealing UCITS format.

*Source: Venn, Fulcrum. FoHF returns consist of the Morningstar Fund of Hedge Fund Investment Category, which are net of fees, while factor returns are gross of fees.

**Source: Venn, Fulcrum

***Deutsche Bank 2020 Alternative Investment Survey, p. 58

**** Kepler q2’20 Alternative UCITS Report, p. 30

This material is for your information only and is not intended to be used by anyone other than you. It is directed at professional clients and eligible counterparties only and is not intended for retail clients. This is not an offer or solicitation with respect to the purchase or sale of any security. The material is intended only to facilitate your discussions with Fulcrum Asset Management as to the opportunities available to our clients. The given material is subject to change and, although based upon information which we consider reliable, it is not guaranteed as to accuracy or completeness and it should not be relied upon as such. The material is not intended to be used as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client’s account should or would be handled, as appropriate investment strategies depend upon client’s investment objectives. The price and value of the investments referred to in this material and the income from them may go down as well as up and investors may not receive back the amount originally invested. Past performance is not a guide to future performance. Future returns are not guaranteed and a loss of principal may occur.

It is the responsibility of any person or persons in possession of this material to inform themselves of and to observe all applicable laws and regulations of any relevant jurisdiction. Fulcrum Asset Management does not provide tax advice to its clients and all investors are strongly advised to consult with their tax advisors regarding any potential investment. Opinions expressed are our current opinions as of the date appearing on this material only. Any historical price(s) or value(s) are also only as of the date indicated. We will endeavor to update on a reasonable basis the information discussed in this material.

References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time (“benchmarks”) are provided by Fulcrum Asset Management for your information purposes only. Investors cannot invest directly in indices. Indices are typically unmanaged and the figures for the indices shown herein do not reflect any investment management fees or transaction expenses. Fulcrum Asset Management does not give any commitment or undertaking that the performance or risk profile of your account(s) will equal, exceed or track any benchmark. The composition of the benchmark may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change over time.

Simulated, modeled, or hypothetical performance results have certain inherent limitations. Simulated results are hypothetical and do not represent actual trading, and thus may not reflect material economic and market factors, such as liquidity constraints, that may have had an impact on actual decision-making. Simulated results are also achieved through retroactive application of a model designed with the benefit of hindsight. The results shown reflect the reinvestment of dividends and other earnings and other expenses a client would have paid, which would reduce return. No representation is being made that any client will or is likely to achieve results similar to those shown.

Funds managed by Fulcrum Asset Management LLP are in general managed using quantitative models though, where this is the case, Fulcrum Asset Management LLP can and do make discretionary decisions on a frequent basis and reserves the right to do so at any point.

Certain transactions, including those involving futures, options and high yield securities and investments in emerging markets may give rise to substantial risk and may not be suitable for all investors. Foreign currency denominated investments are subject to fluctuations in exchange rates that could have an adverse effect on the value or price of, or income derived from, the investment; such investments are also subject to the possible imposition of exchange control regulations or other laws or restrictions applicable to such investments. Investments referred to in this material are not necessarily available in all jurisdictions, may be illiquid and may not be suitable for all investors. Investors should consider whether an investment is suitable for their particular circumstances and seek advice from their investment adviser.

For US Investors: This document is not intended for distribution to, or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. In particular this document is not intended for distribution in the United States or for the account of U.S. persons (as defined in Regulation S under the United States Securities Act of 1933, as amended (the “Securities Act”)) except to persons who are “qualified purchasers” (as defined in the United States Investment Company Act of 1940, as amended), “accredited investors” (as defined in Rule 501(a) under the Securities Act) and Qualified Eligible Persons (as defined in Commodity Futures Trading Commission Regulation 4.7).

This material has been approved for issue in the United Kingdom solely for the purposes of Section 21 of the Financial Services and Markets Act 2000 by Fulcrum Asset Management (“Fulcrum”), Marble Arch House, 66 Seymour Street, London W1H 5BT.

Fulcrum Asset Management LLP is authorised and regulated by the Financial Conduct Authority (No: 230683) © 2020 Fulcrum Asset Management LLP. All rights reserved.