In Short

What should investors do when bonds no longer diversify? The benefits of diversification within a risky portfolio are well known and understood. But now may be the time to consider diversification within the defensive parts of portfolios.

One of the most important and timeless issues for investors is how to protect portfolios from falls in the equity markets. Traditionally there have been several ways people approach this, with the use of government bonds the most popular; a decision supported by historically attractive yields, simplicity, familiarity, and unconventional monetary policy, including a decade of quantitative easing.

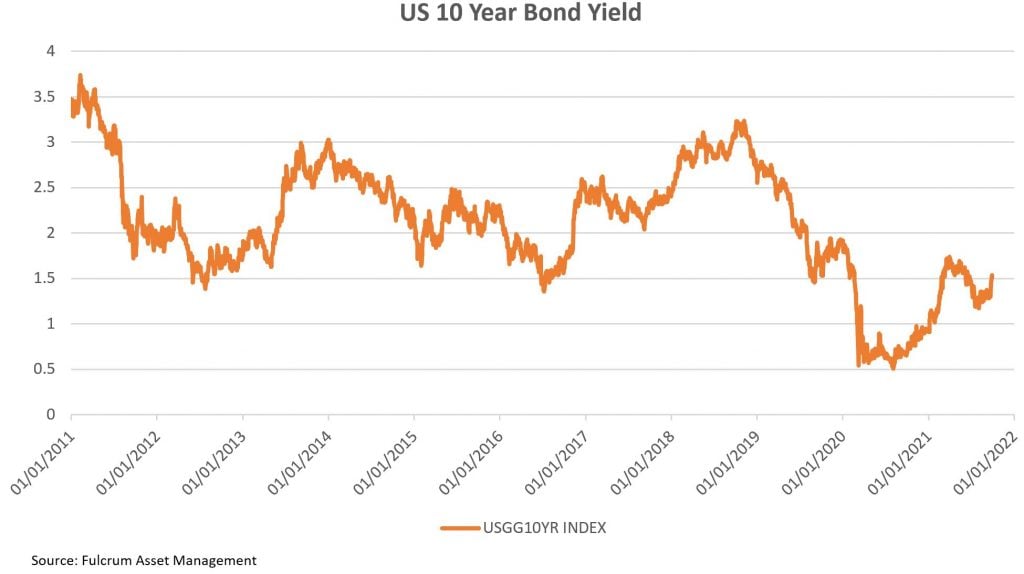

More recently, though, low nominal yields, negative real yields and a potential re-pricing have made bonds a much less reliable portfolio diversifier. However, in spite of all the negative sentiment towards bonds, there are certain scenarios where we believe that they can still offer effective diversification, namely a deflationary and/or negative interest rate environment. By and large, a diversified portfolio of bonds remains the most favoured choice in such scenarios.

Past performance and the reliability of diversification are no guide to the future, however, and all that can be reasonably certain is that returns generated from bonds in the last few decades cannot be extrapolated into the next. Worse still, there is a real risk – and plenty of historical precedents – of bonds exacerbating equity losses, something especially likely if we enter an unexpected period of much higher inflation.

In our view, the recent re-pricing of yields is a healthy development, not something to be feared. Interest rates remain considerably below longer-term history and have simply unwound the downward overshoot that occurred during the early phase of the pandemic. However, with yields still so low and facing the prospect of continued repricing, it is more of a challenge to find the right balance between risk and reward.

This does not necessarily mean that bonds are to be avoided, but only that it is sensible to explore the wide range of other options for effective diversification and portfolio protection. We view alternatives to bonds through the twin lenses of risk mitigation and return enhancement, that is, investments that can act in harmony to either protect portfolios when equities are falling, or to provide the return that bonds have achieved in the past.

Diversification within Fixed Income. Investors in the fixed income space can diversify their portfolio by incorporating different strategies. Countries with steeper yield curves can still offer significant diversification when risk assets fall due to the fact that they have more room to compress, for example.

Alternative sources of real returns. Investors can look to multiple non-traditional sources of real return and diversification such as infrastructure, listed real estate, commodities and inflation-protected bonds, to name just a few. Such assets can play a critical role in portfolios and, not least, offer protection against high inflation, which is an environment in which government bonds are unlikely to be able to diversify. However, caution needs to be exercised around those real assets that have already been excessively bid up in the search for yields by investors – of which there are quite a number.

Defensive currencies. Some currencies like the Japanese yen and Swiss franc have historically acted as buffers during risk-off episodes owing to their persistently negative-to-low interest rate environment; carry strategies, where investors borrow currencies in low rate jurisdictions to invest in currencies with a higher rate, tend to be unwound during risk-off episodes. While the pandemic has had the effect of normalising interest rates around the globe, the current rate repricing is creating interest rate divergences, bringing to the fore once again traditional defensive currencies. The US dollar has also acted as a defensive currency in past risk-off episodes, with the March 2020 liquidity event being the starkest example.

Diversified tail risk hedging. Tail risk strategies, where investors seek to protect portfolios against extreme market moves by purchasing protection at the expense of some returns, can be designed to offer modestly positive excess returns over the very long term, with a negative correlation to equity markets. A winning tail risk strategy might use a variety of instruments, including futures, swaps, vanilla options, more exotic options such as digitals and contingents, as well as variance swaps, equities, fixed income, and credit. Generating convexity, whereby hedges become increasingly effective as their value increases, is necessary, but successful tail hedging depends on a real-time assessment of market positioning and detailed evaluation of market complacency or readiness for tail events.

Global macro diversified absolute return strategies. Liquid macro-oriented diversified absolute return strategies, somewhat more simply referred to as target return strategies, are capable of employing most of the above approaches – which can be complex for some investors to deploy – to provide a target return with a stable risk profile. Historically, their unconstrained approach has enabled them to not only enhance the low expected returns from bonds, but also to protect portfolios during market drawdowns.

While government bonds are unlikely to offer the same source of returns and diversification that they have been over the past decade, they remain a crucial part of an asset allocator’s defensive toolkit. However, in the current market environment, investors need the latitude to implement investment opportunities across different asset classes, strategies, and time horizons to provide alternative sources of returns and necessary diversification.

About the Author

Nabeel is Deputy CIO and a member of the Fulcrum Investment Team. Prior to joining Fulcrum in 2011 Nabeel worked at Goldman Sachs for four years in the Investment Strategy Group. Nabeel graduated from Warwick University in 2007 with a BSc in Mathematics, Operational Research, Statistics and Economics. He has been a CFA charterholder since 2011.