Introduction

Why investors should shun sustainability shortcuts

For the past eight decades, studying the speed with which radioactive carbon naturally halves has transformed our vision of the remote past. Now, it is the speed with which man-made carbon emissions can be halved that will increasingly define our vision of the proximate future.

From ‘greenflation’ to the ‘green multiplier’ effect, the literature on the costs and benefits of climate action is vast and varied. We investigate below one of its underappreciated aspects – reductions in carbon footprint that have neither significant economic costs nor any significant climate benefits. Achieved through marginal changes in portfolio allocations, such reductions can be used to present an unjustifiably favourable image of the environmental credentials of a portfolio. We propose instead the use of a broader, forward-looking set of metrics.

A theory of (climate) change

Reducing the carbon footprint of investments is fraught with complexities. First, outside the direct purchase of newly issued equity and debt, trading in secondary markets does not immediately influence corporate activities (or their emissions¹). Second, whether a company or sector has a high footprint today does not mean it cannot make a contribution to a low-carbon future – consider the material requirements of clean energy – or that its footprint will always remain high – consider trial plans to produce ‘carbon-negative oil’.

Nevertheless, when climate-aware investors set environmental objectives for their portfolios, they usually choose reducing the overall carbon footprint as their main, and often, sole, target. In some cases, this is explicitly encouraged/mandated by regulators, e.g. for funds adopting certain climate benchmarks which require significant decarbonisation both upon launch and in each subsequent year. Whilst it is understandable that climate-aware investors would seek to measure – and, ideally, minimise – the contribution of their investments to climate change, we have argued elsewhere about the importance of using a broader set of forward-looking metrics. In particular, we believe implied temperature rise, which aims to take into account both companies’ historical emissions, and their stated emission targets, provides a more rounded view of companies’ climate progress. Conversely, only relying on backward-looking emissions, particularly if measured at the aggregate portfolio level, creates a potential loophole for fund managers to claim unjustified climate impact.

WACI races

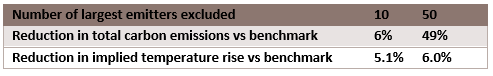

We have looked at the reductions in aggregate carbon metrics resulting from excluding a very limited number of high-emitting companies from a global equity index.

Sources: Sustainalytics, S&P Global Trucost, Bloomberg, Fulcrum Asset Management, as at March 2022. Total carbon emissions represent sum of Scope 1 and 2 issuer emissions multiplied by their weight in the parent index. Weight of excluded constituents re-allocated proportionately to remaining constituents.

As can be seen, avoiding just 50 stocks while leaving the remaining 2200 largely untouched can halve the total carbon footprint.

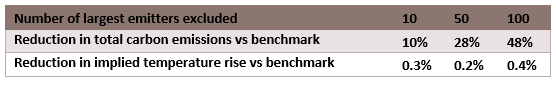

The situation is similar with another commonly used measure, weighted average carbon intensity (WACI), which scales company emissions relative to their revenues, thus removing some of the ‘penalty’ associated with being a larger company. Whilst harder than previously, it is possible to almost halve WACI by excluding just 100 companies (which represent less than 3% of the overall index by weight).

Sources: Sustainalytics, S&P Global Trucost, Bloomberg, Fulcrum Asset Management, as at March 2022.

The question is, should these be considered ‘climate-aligned’ portfolios? At first glance, since the halving of carbon emissions by 2030 is a useful heuristic for the efforts needed to meet the global 1.5°C temperature target, the numbers seem to match. But the symmetries break down upon closer inspection – in the latter, it is companies across all sectors that are all reducing their emissions (some by more than half, some by less) – in the former, it is only ‘a few bad apples’ which are targeted. The messages for investee companies are substantially different in practice.

By contrast, in both examples above the associated ‘cooling’ of a portfolio – as measured by reductions in implied temperature rise (ITR) – is no more than 6% relative to the original benchmark. A fund manager relying on this metric is unable to claim significant environmental improvements from just marginal changes to portfolio construction. The reason is that, unlike with emissions, there cannot be any single company whose temperature is tens, or thousands, of times higher than the average, as ITR measures aim to transform the vast dispersion in emission inputs into comparable outputs, whilst aiming to accommodate the sectoral or regional differences that led to the dispersion in the first place.

Thus, just as meeting global temperature targets will require sustained effort across sectors, investors who wish to halve their portfolio temperature² will need to make substantive changes to the way they allocate capital. Admittedly, the challenge of averaging does not disappear completely with ITR (the most misaligned and aligned companies may still, in some sense, cancel each other out). This is why, as we have explored in more depth in our paper on ‘the tracking error error’, aggregate portfolio metrics represent only the first step – the ultimate goal should be to have all of your portfolio’s holdings aligned.

Lowering the heat of discussion

A variety of tools, datapoints and techniques will be needed to do justice to the complexities of the transition across the different sectors, regions and timescales. The approaches advocated are not mutually exclusive, and may appropriate in different contexts. When comparing different power providers, a consumer today may not need much more information than the utilities’ average fuel mix (or carbon intensity). But a grid operator in a capacity auction, trying to deliver the lowest-emission megawatt at the lowest cost at all moments in time may need a lot more information about a company’s current and future plans.

Similarly, portfolio footprint numbers may in certain cases be a useful illustration, particularly for reporting purposes (as the concept of reducing emissions is more intuitive and much more widely understood than that of implied levels of global warming) or in asset classes where temperature methodologies do not yet exist. One might object, then – if all temperature calculations are ultimately derived from some measure of emissions, why not ‘cut the middleman’? After all, if a company’s emissions have been steadily rising over the past years and are many standard deviations higher than its peer average, one probably does not need a supercomputer running integrated assessment models to conclude that the chances of its climate alignment are low.

We share some of the concerns raised by critics of ITR approaches about the potential opacity and inconsistent approaches proliferating in the market. This is why Fulcrum have joined the Portfolio Alignment Team of the Glasgow Financial Alliance for Net Zero (GFANZ), and the derivatives working group of the Institutional Investors Group on Climate Change (IIGCC), to help improve consistency and transparency in this space. In particular, we would caution against false precision in interpreting temperature numbers – any estimate of temperature rise by the end of the century (as is standard practice in such calculations) will be inescapably probabilistic, not least since it depends on actions not yet taken.

But the key climate challenge is the imperative of action in the presence of persistent uncertainty and puzzling non-linearities. Both the coronavirus and the conflict in Ukraine have reminded us that the trajectory of global emissions may yet surprise us, as both record falls and record rises in global emissions happened in two successive years. This makes separating the noise from the signals increasingly important. Which companies are truly taking steps to future-proof their business models, and which investment solutions are designed to reward them for it? The road to sustainability is long, and with few shortcuts. We believe a forward-looking approach can be a useful guide in this journey.

1 – ‘Immediately’ is the key word – if a growing number of investors avoid a company due to its environmental performance, a falling share price may motivate executives partly paid in shares to change company strategy. Similarly, changes in the cost of capital can affect a company’s willingness to pursue high-carbon projects (or the ability to ‘green’ its operations). But these longer-term mechanisms are unlikely to be triggered by any single investor’s trade.

2 – We estimate the current implied temperature rise of major global equity indices to be circa 3°C by 2100 relative to pre-industrial levels, roughly double the Paris Agreement’s 1.5°C ambition. Source: S&P Global Trucost, Fulcrum Asset Management, as at March 2022.

This material is for your information only and is not intended to be used by anyone other than you. Information provided does not constitute investment advice and should not be relied upon as a basis for investment decisions. Where necessary, speak to a financial advisor It is directed at professional clients and eligible counterparties only and is not intended for retail clients. The information contained herein should not be regarded as an offer to sell or as a solicitation of an offer to buy any financial products, including an interest in a fund, or an official confirmation of any transaction. Any such offer or solicitation will be made to qualified investors only by means of an offering memorandum and related subscription agreement. The material is intended only to facilitate your discussions with Fulcrum Asset Management as to the opportunities available to our clients. The given material is subject to change and, although based upon information which we consider reliable, it is not guaranteed as to accuracy or completeness and it should not be relied upon as such. The material is not intended to be used as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client’s account should or would be handled, as appropriate investment strategies depend upon client’s investment objectives. Funds managed by Fulcrum Asset Management LLP are in general managed using quantitative models though, where this is the case, Fulcrum Asset Management LLP can and do make discretionary decisions on a frequent basis and reserves the right to do so at any point. Past performance is not a guide to future performance. Future returns are not guaranteed and a loss of principal may occur. Fulcrum Asset Management LLP is authorised and regulated by the Financial Conduct Authority of the United Kingdom (No: 230683) and incorporated as a Limited Liability Partnership in England and Wales (No: OC306401) with its registered office at Marble Arch House, 66 Seymour Street, London, W1H 5BT. Fulcrum Asset Management LP is a wholly owned subsidiary of Fulcrum Asset Management LLP incorporated in the State of Delaware, operating from 350 Park Avenue, 13th Floor New York, NY 10022.

©2022 Fulcrum Asset Management LLP. All rights reserved

FC068W 060622