Introduction

Having recently renewed our accreditation as a signatory to the Stewardship Code, we share our reflection on the past year’s proxy season and the evolution of our voting approach.

Voting at general meetings is a centuries-old practice, but recent years have seen a sea-change in the breadth of issues investors are asked to opine on. Going beyond procedural problems such as appointing of auditors and the issuance of shares, topics such as ending fossil fuel financing, conducting a ‘racial equity audit’ or quantifying the monetary benefits of diversity initiatives are increasingly present on the ballot. And with contentious meetings that may lead to congressional hearings as well as activist a capella listening, the scrutiny on shareholder behaviour has also increased. In what follows, we share our reflections on the past year and the evolution of our own voting approach.

Scorned proposals?

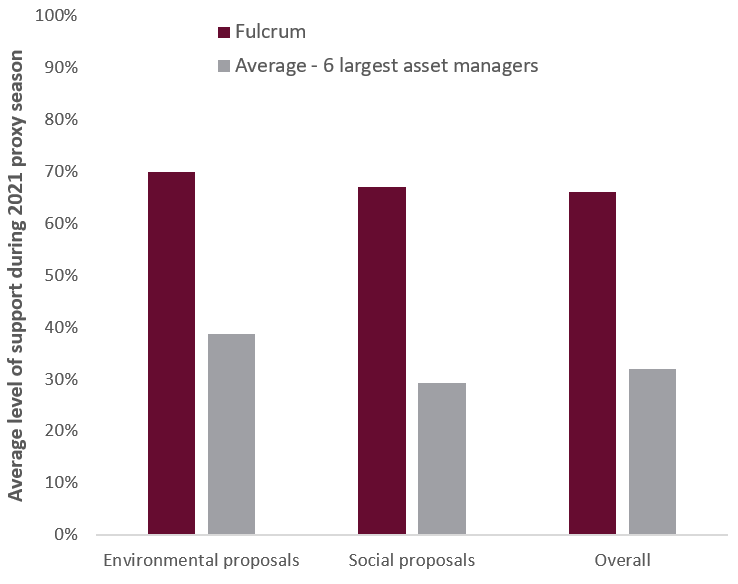

In 2022, we have continued to encourage companies to step up on sustainability through our votes, by supporting resolutions calling for reduction in emissions or plastic packaging, action on labour standards and human rights, or improved transparency with regards to political lobbying. We illustrate this below, showing Fulcrum’s high levels of support across the universe of shareholder proposals selected by responsible investment NGO ShareAction as the basis of their recently released ‘Voting Matters’ report.

Fulcrum supported more proposals than many of the world’s largest asset managers during the 2020-2021 proxy season…

…and the 2021-2022 proxy season…

Chart data sources: ShareAction (“Voting Matters”, 2021 and 2022 editions), Fulcrum Asset Management, Glass Lewis

We believe such statistics support our ongoing ambitions as a signatory to the UK Stewardship Code, which enjoins signatories to “systematically integrate stewardship and investment, including material environmental, social and governance issues, and climate change, to fulfil their responsibilities” and to “actively exercise their rights and responsibilities” associated with investments. We were pleased to have been confirmed as a signatory to the Code for the second year running – you can find our latest report here and our voting records and rationales for key votes are publicly available here.

At the same time, as stated in previous articles, we aim to apply nuance in this space, reflecting our own views about what is likely to be material in a given company or sector, as well as independent analysis. The slight levels of decrease in our support for environmental resolutions partly reflect an increase in shareholder proposals which we deemed as being too prescriptive. For example, we would generally support shareholder proposals calling on companies to report on efforts to reduce plastic use (at Amazon) or deforestation in the supply chain (at Home Depot), or to set targets for their emissions (as we did at transport company UPS or oil majors Shell and Equinor). However, it is likely that companies themselves, rather than shareholders, are in a better position to determine the specific strategy changes needed to deliver on the overall targets. We have therefore been more reluctant to endorse prescriptive proposals – e.g. halting all new fossil fuel financing by major banks. Such resolutions often appealed to the International Energy Agency’s Net Zero Emissions by 2050 scenario, which suggested that already sanctioned oil and gas projects are sufficient in a world which swiftly implemented policies to bring emissions to net zero. However, we believe the key conditional (if policies, then no exploration needed) does not currently hold true, particularly in the aftermath of Ukraine. Absent such policies – which would simultaneously see both demand for fossil fuels drop and supply of clean energy ramp up sufficiently fast – unilateral financing restrictions may have unintended consequences in terms of price spikes.

Whilst we did not believe in restrictions as a one-size-fits-all rule, there may be individual cases where we would be supportive: we have recently joined forces with investors managing over $1 trillion in assets, calling on French financial giant BNP Paribas to stop the financing of new oil and gas fields. In our view, a cleaner loan portfolio would help improve the bank’s cost of capital, reduce reputational risk and support the company’s stated ambitions to be a leader in sustainable financing.

Direct director aim

2022 was the first full proxy season where the Glass Lewis Climate Policy, chosen as our default set of voting recommendations, was in operation. An important rationale for choosing this policy is to go beyond whatever shareholder resolutions happen to be on the ballot, by codifying certain high-level principles that we would expect all or most companies to meet.

Having independent directors (particularly on key board committees), disclosing your company’s greenhouse gas emissions, ensuring remuneration criteria do not undermine a company’s sustainability objectives – these are some of the requirements that can trigger a voting sanction. By sanctioning a director or their pay, we believe we may sometimes send a stronger signal than merely by supporting shareholder proposals (which are often advisory). Throughout 2022, we have cast:

Taking the temperature

Another notable feature of discussions around the past proxy season is increased polarisation. Some critics accuse asset managers of abdicating or abusing their responsibilities (by relying on proxy advisors, instead of doing their own due diligence or allowing full voting control to the end beneficiaries of funds). However, many areas of investing require balancing in-house and external expertise. A fund manager may model the creditworthiness of a particular company in detail, but for a portfolio of hundreds or thousands of names, the opinion of credit ratings agencies is likely to feature more prominently. Similarly in the context of voting, the informational requirements grow exponentially (for some asset managers the resolution tally can range up to hundreds of thousands per proxy season). Proxy voting agencies can help bridge this gap by providing independent analysis and benchmarking of companies, as well as, as already highlighted, a degree of customization.

Far from abdicating responsibility, the Fulcrum Stewardship Committee regularly reviews contentious votes: in 2022, we have overridden the recommendations of our proxy advisor in around a third of the 150 votes discussed, where we believed company-specific circumstances merited additional consideration.

A separate critique is whether encouraging companies to go beyond mere legal compliance in areas such as sustainability means that asset managers are pursuing a ‘political agenda’ divorced from shareholder value. In response, it is worth revisiting arguably the most influential articulation of this idea – Milton Friedman’s famous injunction that ‘The Social Responsibility Of Business Is to Increase Its Profits’ (incidentally, an article partly prompted by sustainability-related shareholder proposals filed in the 1970s). Friedman made an impassioned case for maintaining a focus on shareholder primacy at the expense of more vaguely defined stakeholder or societal goals. Less appreciated, however, is Friedman’s full formulation of the duty of the corporate executive: “to make as much money as possible while conforming to the basic rules of the society, both those embodied in law and those embodied in ethical custom.” (my emphasis). Clearly, when it comes to sustainability, both the law and social expectations are evolving.

Fulcrum Asset Management LLP. This document represents a marketing communication (non-independent research). It has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Fulcrum Asset Management LLP (‘Fulcrum’) defines marketing communication as market commentary consisting of illustrative, critically educational explanatory notes written to discuss or equally support an article or other presentation previously published. This document is also considered to be a minor non-monetary (‘MNMB’) benefit under Directive 2014/65/EU on Markets in Financial Instruments Directive (‘MiFID II’). Fulcrum defines MNMBs as documentation relating to a financial instrument or an investment service which is generic in nature and may be simultaneously made available to any investment firm wishing to receive it or to the general public. The following information may have been disseminated in conferences, seminars and other training events on the benefits and features of a specific financial instrument or an investment service provided by Fulcrum.

Any views and opinions expressed are for informational and/or similarly educational purposes only and are a reflection of the author’s best judgment, based upon information available at the time obtained from sources believed to be reliable and providing information in good faith, but no responsibility is accepted for any errors or omissions. The information contained herein is only as current as of the date indicated, and may be superseded by subsequent market events or for other reasons. Charts and graphs provided herein are for illustrative purposes only. The information in this document has been developed internally and/or obtained from sources believed to be reliable; however, Fulcrum does not guarantee the accuracy, adequacy or completeness of such information.

Redistribution or reproduction of this material in whole or in part is strictly prohibited without prior written permission of Fulcrum Asset Management LLP, authorised and regulated by the Financial Conduct Authority (No: 230683) © 2023 Fulcrum Asset Management LLP. All rights reserved.

FC166 130323