In Short

We hosted a webinar discussing the concept of Strategy Cycles in more detail on 2 December 2020.

Click here to watch the recording.

We propose that investment strategies move in cycles. From the initial seed of the idea, wherever that comes from, through to either its ultimate “expiry”, or possibly a “reincarnation”.

It is clear to us that ESG (for want of a more clear and cohesive term) funds are very much in vogue at present and entering their Growth phase of the Strategy Cycle. Maximising the long-term chances of success for ESG funds is going to be pivotal in achieving individual and collective objectives.

So, what lessons can be learnt from previous investment Strategy Cycles and what are the consequences for the ensuing growth of ESG funds? We explore these questions in this article, but first, a little more on the Strategy Cycle itself.

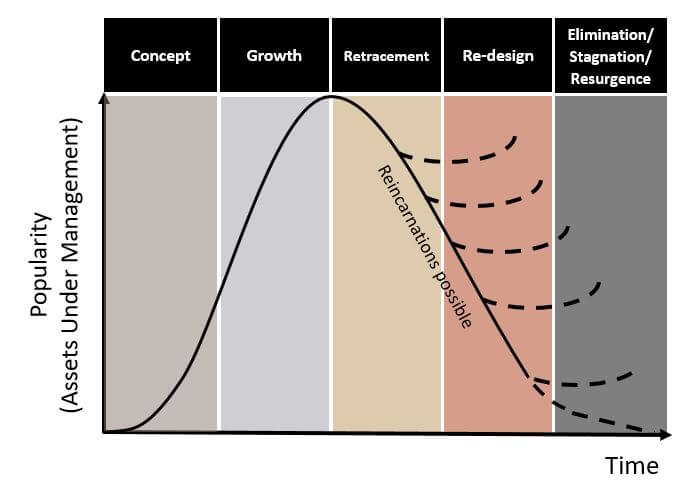

Figure 1: The Strategy Cycle – an illustration

There are five key phases to this cycle:

- Concept – the initial idea, which could come from any number of participants in the financial markets, including an investment bank, asset manager, a consultant or asset owner. On occasion, it may develop as a ‘multiple discovery’, with simultaneous inventions occurring in different organisations. It can take many years for a strategy to gain traction, and many ideas never achieve enough of a foothold to move to the next phase.

- Growth – typified by huge product proliferation and a rapid increase in overall Assets Under Management. Often, products developed in the Concept phase experience the most growth, though fierce competition ensues. The idea is shared amongst more and more investors and the herding effect is in full flow.

- Retracement – the Growth phase leads into what seems to be an inevitable saturation point. Frequently, some combination of factors (valuation/performance, personnel change, capacity limits, regulatory change etc) leads to a reduction in overall Assets Under Management and a corresponding reallocation to other strategies.

- Re-design – changes are forced upon strategies via market dynamics. There is a period of introspection. This phase will involve re-examining aspects such as costs, fund terms and the underlying investment and risk parameters of the strategy itself. There are regrets, either about the initial design of the strategy or the more recent decision to sell. The number of competitors reduces. Reincarnations (see the upward slopping dotted lines in Figure 1) can appear at any point during the Strategy Cycle, but this is most common during the Re-design phase.

- Elimination/Stagnation/Resurgence – ultimately, the re-design will either result in a new cycle via an amended version of the strategy, the prolonged (albeit much diminished) existence of the strategy in its original form or the elimination from portfolios completely, with the strategy consigned to the annals of history.

To be clear, we do not view the end of a Strategy Cycle as inherently negative; a strategy may well have served a very positive purpose during its life with an inevitable natural conclusion. However, there have certainly been some unfortunate episodes as well; for example, leveraged structured credit in the build up to 2008. Great investment ideas can present themselves during any phase of the Strategy Cycle. We are open minded about this, though we spend a lot of time searching for ideas in the Concept and the Retracement phases; we find this is often the most fertile ground – investors can be prone to overreaction too.

We assert that there is causality/contingency in the Strategy Cycle. For example, the Growth phase may well be a leading cause of the Retracement phase. Additionally, you are less likely to re-design a strategy that hasn’t been through a Retracement. We also feel there is, on some level, predictability in the Strategy Cycle, which is why we are writing this article with specific reference to ESG funds.

Our industry’s collective march towards ESG investing carries with it a great burden of responsibility including in fundamentally important areas, such as Climate Change. If the ESG Strategy Cycle is robust to Retracements in the long term, creating a thriving environment of innovation and genuine problem solving, we will all be able to give ourselves a collective pat on the back.

So, how can we maximise the chances of this outcome? To answer this, we analysed several historic Strategy Cycles to see if there were any common features leading to major corrections or an ultimate Elimination, which should be useful context as ESG funds and their various derivatives enter the Growth phase.

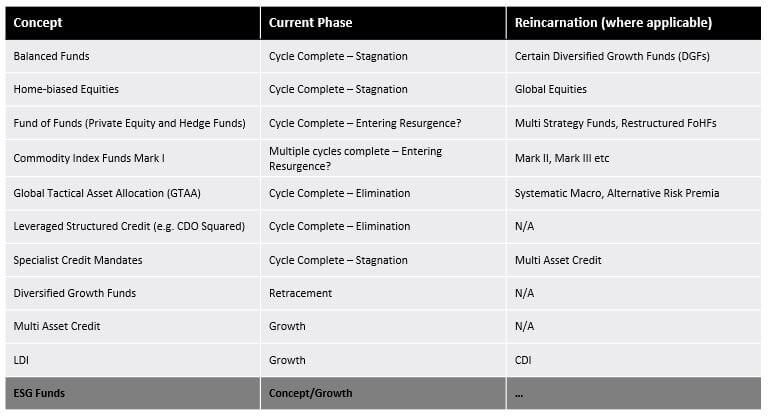

Figure 2: A short history of Strategy Cycles

We note from the above that several strategies suffered from excessive leverage and inappropriate diversification in their initial design, ultimately leading to a violent Retracement phase. The learning outcomes from these are clear. In other cases, such as with Balanced Funds and the globalisation of equity portfolios, the Retracement has been more orderly. There will be learning points here too, but they may be less obvious.

To help build a more complete picture, we called upon some highly experienced industry experts to hear their wisdom on three of these Concepts and how they fit into our proposed Strategy Cycle framework.

We first asked Jane Welsh about her views on Balanced funds. Jane has held leadership positions in manager research teams of two major consulting firms over the last 35 years and is Founder and Project Manager for The Diversity Project:

“…into the 2000s, balanced management went into decline. There were a number of reasons including:

- Ongoing disappointment with performance of managers who might outperform the average for a while and then underperform. Clients got caught in a hiring and firing cycle that benefited no one other than the brokers who gained from portfolio churn. Dominant managers got very large and their desire to run similar portfolios across all their client accounts meant that they were increasingly restricted to investing in the very largest companies.

- Specialist management took off and a number of US asset management companies, pitching specialist mandates, began to win business in the UK. The dominance of the big four balanced houses was broken.

- Pension funds began to recognise the importance of asset/liability modelling and fund-specific benchmarks rather than following an arbitrary average asset allocation…”

We asked Chris Keen for his perspective with regards to Fund of Funds; Chris ran a Fund of Hedge Funds for over 15 years and has worked in the finance industry for over 40 years. He is currently Chairman of a UK children’s charity.

“The bandwagon effect is clearly visible in financial asset price behaviour. The most mature example of a Strategy Cycle I can think of in the Fund of Funds space is private equity. These were originally designed to provide differentiated exposure to investments that were hard to access. Ultimately, however, the larger investors, with the help of their advisors, overcame the governance challenge and were able to do this themselves. In hedge fund space, the industrialisation process meant that hedge fund managers upped their game and reduced their volatility. The excessive second layer of fees was also a prime driver of the decline of Fund of Funds.”

We recently wrote this article on the topic of Fund of Funds. It includes our views on the reasons for the challenges this strategy experienced and how they can be overcome.

“…We started looking at various sleeves including leveraged loans, high yield bonds and securitised credit. To solve the governance challenge of allocating to all these different components, it became clear that we needed managers who would be able to pull all of this together and hopefully add a bit on top through asset allocation. I find it harder to see the investment case for Multi Asset Credit now; is fixed income a good place to be? It feels less diverse than ever, yields are very low, and we haven’t seen the full credit fallout from the pandemic yet. Having said that, the central bank support might mean this takes a long while to play out…”

She added, “…There is a concern, or at least there should be, that some asset managers are jumping on the ESG bandwagon as a way of saving their business models, especially the pressure from passive investment products. It reminds me a bit of the late 1990s, when all you had to do was allocate to the dot.com boom without any evidence of understanding exactly what was under the bonnet.

From what I can see thus far, many strategies focus on the “E’ but fail to adequately deal with “S” and “G” as risk factors, much less return drivers. Hence the embarrassment of seeing BooHoo and Wirecard embedded in some ESG screened products. Asset owners need to be clear about what they expect from their managers in the ESG space and hold them to account for managing expectations, as well as risk and return…”

The more experts we speak with, the more it is clear to us that common features keep cropping up through Strategy Cycles. So, what lessons can we take out of all of this?

Common features for success – the lessons for ESG funds:

Clear Objectives – these help to create an understandable monitoring framework for a strategy. Having clear objectives for an ESG fund may be a slightly more complex task than usual given the broader-than-just financial components. Objectives should be realistic and measurable and reporting should be transparent and clearly communicated. What specific financial and non-financial goals are being targeted in relation to ESG funds you are considering allocating to? How do these link to your broader strategic objectives? What problem is this solving? This was clearly an issue, for example, in the Strategy Cycle of Balanced Funds.

Mandate Design – working hard to ensure the right mandate design is developed at the outset is mission-critical. It minimises time wasted in any future Re-design phases. This involves investment guidelines, implementation (e.g. active vs passive), fees, liquidity profiles and so on. Time and again, we have seen great problem-solving ideas falter through poor mandate design. Does the ESG fund you are considering have a mandate design likely to give it longevity as the opportunity evolves in the years ahead? Is there clarity on how ESG risks are being considered and what definitions are being used? Is there an appropriate level of flexibility embedded in the fund to maximise the chances of long-term success?

Retracements are key moments in any Strategy Cycle and it is completely possible that ESG funds will reach a saturation point in the next 5-10 years. This may lead to a cohort of securities being (temporarily at least) over-valued/crowded or abandoned/cheap and ultimately this could lead to a Retracement. Setting clear objectives and having a well-designed mandate are key to helping investors through those challenging times and they will be pivotal in the formation of a healthy Strategy Cycle for ESG funds.

Verifiability – the fund you buy needs to do what it said it was going to do and you need to be able to cross-reference this. In other words, when you dig deeper, does the ESG fund you are considering match your initial understanding of what you were being offered? Will it continue to do so? In addition to the usual questions around voting practices and engagement, a thorough periodic review of underlying holdings may help here.

Differentiation – excess commonality across managers/products has been an issue in many Strategy Cycles. It will be interesting to see if a diverse range of ESG funds materialises or if they converge to an accepted standard. Questions around the business motivations and imperatives for launching such funds can be informative. Furthermore, where relevant, asking questions such as ‘Are these risks also important for the non-ESG version of this fund?’ can help frame the conversation and may lead to further positive discussions about investment process at the manager.

How has this research impacted our own thinking?

We have recently launched our own Climate Change strategy at Fulcrum. We are also regular early stage investors in new funds launched by third party managers and have seeded several ESG funds. This brief foray into Strategy Cycles has re-emphasized to us the importance of the above common features. They are integral to the design of our Climate Change strategy and we deeply consider them all when allocating to third-party managers.

In conclusion

It is clear to us that ESG funds are entering their Growth phase. In order to maximise the chances of positive end outcomes for investors in these funds, there are a number of lessons we can take from historic Strategy Cycles including setting clear objectives, robust mandate design, verifying the strategy does what it says it is going to do and ensuring that it is positively differentiated.

Working hard to take these aspects into account when conducting research should help to promote a healthy future for ESG funds and their various future reincarnations and enable investors to achieve their individual and collective objectives.

About the Author

Matthew is Head of Fulcrum Alternative Solutions. Before joining Fulcrum in 2018 to run Fulcrum Alternative Solutions, Matthew had been a Portfolio Manager for the Towers Watson Partners Fund since 2014 and before that a manager researcher in fixed income, hedge funds and other alternatives since 2005. Matthew holds a BSc in Economics and Finance (2005) from University of Bristol. He has been a CFA charterholder since 2009.