Introduction

In light of the latest inflation and unemployment data, the ECB now believes that the risks to the inflation outlook are tilted to the upside. Madame Lagarde, head of the ECB, said that the Central Bank is data dependent and that going into the March 2022 meeting will “use all instruments, all optionalities as the situation has indeed changed”.

The Eurozone economy delivered its fair share of surprises last week (week ending 4th of February 2022), at least to the European Central Bank (ECB). Both inflation and unemployment data exceeded their expectations by a wide margin, with the former much higher than expected and the latter much lower.

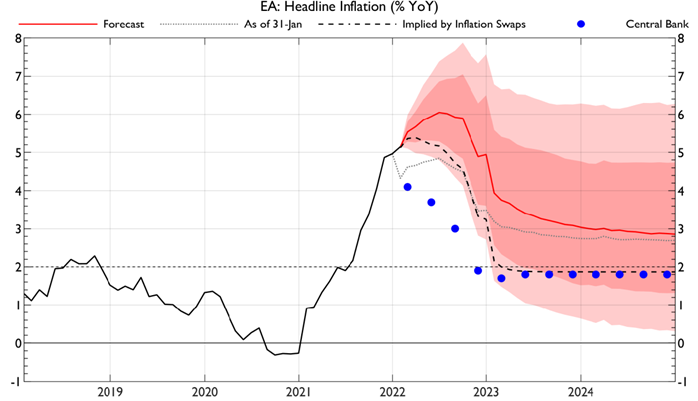

January CPI inflation was 5.1% year-on-year (YoY), much higher than 4.4% expected by consensus. Core inflation was also much higher than expected, printing 2.3% YoY versus expectation of 1.9%. After four months of consecutive positive surprises for both indicators, headline inflation has increased from 3.4% in September to 5.1% in January and core inflation from 1.9% in September to 2.3%.

Inflation is now well above the ECB December projections and the fastest it has ever been since inception of the Monetary Union. Reflecting these surprises, and the persistence of inflationary forces, Fulcrum models project that inflation will accelerate further to 6.0% YoY and will remain above 3.0% until the end of 2024, thereby overshooting the ECB’s 2.0% target for at least three consecutive years.

Source: Haver Analytics, Fulcrum Asset Management

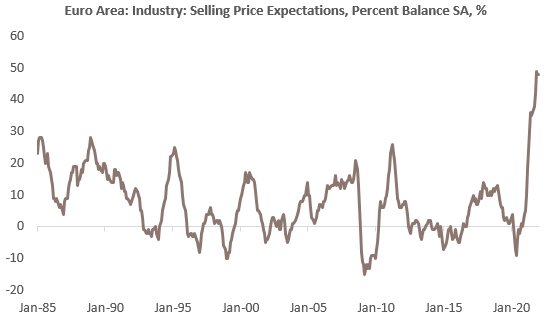

Elsewhere, although nominal wage growth has remained subdued, inflation expectations have increased. 5-year inflation swap markets are now pricing in a rate of 2.1-2.2%, close to the 2.0% ECB target. Survey-based expectations have also surged, especially among firms in the manufacturing sector.

Source: Haver Analytics, Fulcrum Asset Management

In light of these developments, the ECB now believes that the risks to the inflation outlook are tilted to the upside. Madame Lagarde, head of the ECB, said that the Central Bank is data dependent and that going into the March 2022 meeting will “use all instruments, all optionalities as the situation has indeed changed”. To paraphrase J.R.R. Tolkien’s Lord of the Rings novels, persistent inflation and unemployment surprises might have just awoken Smaug, the sleeping dragon.

This material is for your information only and is not intended to be used by anyone other than you. It is directed at professional clients and eligible counterparties only and is not intended for retail clients. The information contained herein should not be regarded as an offer to sell or as a solicitation of an offer to buy any financial products, including an interest in a fund, or an official confirmation of any transaction. Any such offer or solicitation will be made to qualified investors only by means of an offering memorandum and related subscription agreement. The material is intended only to facilitate your discussions with Fulcrum Asset Management as to the opportunities available to our clients. The given material is subject to change and, although based upon information which we consider reliable, it is not guaranteed as to accuracy or completeness and it should not be relied upon as such. The material is not intended to be used as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client’s account should or would be handled, as appropriate investment strategies depend upon client’s investment objectives. Funds managed by Fulcrum Asset Management LLP are in general managed using quantitative models though, where this is the case, Fulcrum Asset Management LLP can and do make discretionary decisions on a frequent basis and reserves the right to do so at any point. Past performance is not a guide to future performance. Future returns are not guaranteed and a loss of principal may occur. Fulcrum Asset Management LLP is authorised and regulated by the Financial Conduct Authority of the United Kingdom (No: 230683) and incorporated as a Limited Liability Partnership in England and Wales (No: OC306401) with its registered office at Marble Arch House, 66 Seymour Street, London, W1H 5BT. Fulcrum Asset Management LP is a wholly owned subsidiary of Fulcrum Asset Management LLP incorporated in the State of Delaware, operating from 350 Park Avenue, 13th Floor New York, NY 10022.

©2022 Fulcrum Asset Management LLP. All rights reserved

FC040W 080222

About the Author

Filippo Cartiglia

Filippo is a member of the Investment Team. Before joining Fulcrum in 2020, he was the chief economist at Arrowgrass Capital Partners LLP. Prior to this, Filippo was Managing Director at Goldman Sachs, partner at Newman Ragazzi LLP, and an economist at the International Monetary Fund in Washington. Filippo graduated from Bocconi University in Milan in 1988 and gained a PhD in Economics from Columbia University in New York in 1992.

About the Author

Rahil Ram

Rahil Ram is a Director at Fulcrum Asset Management and is involved in portfolio strategy, portfolio implementation, research, sustainability and idea generation for the discretionary macro and thematic strategies. Prior to joining Fulcrum, Rahil was a strategist within the Asset Allocation team at Legal & General Investment Management for five years, during which time he completed his Masters’ in Actuarial Management from Cass Business School and qualified as an Actuary in 2017.