Introduction

As the voting season is underway, scrutiny of company strategies and investor stances continues to rise. We discuss Fulcrum’s overall approach, highlighting key votes and engagements

Scrutiny of the environmental, social and governance (ESG) performance of companies has never been higher, and a growing number of investors are using their voting rights to hold companies to account. To the traditional votes on the appointment of directors or their pay, recent years have seen the addition of proposals calling on shareholders to endorse or reject companies’ sustainability strategies. We illustrate below some of the principles guiding Fulcrum’s approach to voting and select examples of votes at annual general meetings (AGMs)1.

Our approach

We believe in the importance of exercising our investor rights through voting and engagement as a means to unlock shareholder value. Our decision to increase the proportion of equities held directly (rather than via derivatives, which lack voting rights) and to appoint adviser Glass Lewis as a provider of independent proxy voting recommendations, testify to this commitment.

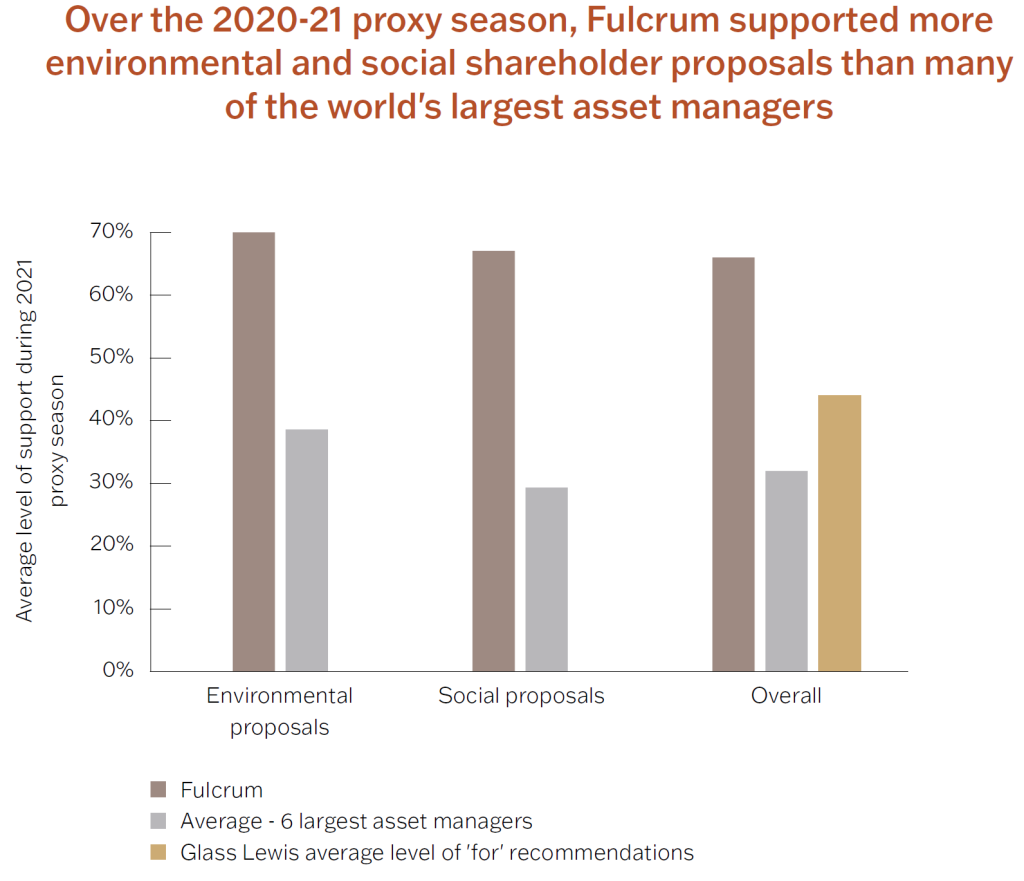

As illustrated by the research of ESG for Investors, improving ESG performance can trigger share price appreciation for companies. We have thus chosen to use Glass Lewis’ Climate Policy as our default set of recommendations (which holds companies to stronger sustainability standards compared to their ‘house view’), and we have been a strong supporter of ESG-related resolutions.

Sources: ShareAction, Voting matters 2021 (survey of the voting practices of the 65 largest asset managers, available here); Glass Lewis, Fulcrum AM

At the same time, not every ESG topic is material to companies. As ESG for Investors research has also highlighted, over half of the potential ESG-related shareholder value gains, on average, stem from companies improving performance on just two ESG variables. Exercising judgment and nuance are important here, which is why we do not support all ESG resolutions, and regularly discuss contentious votes in the Stewardship Committee (overseen by members of our management team). This means that on occasion we may override the recommendations of our adviser, reflecting our own view of the company and the issues at stake. Below, we provide some examples of our approach at select shareholder votes.

BP: charting a course for the energy transition

The role of oil companies is pivotal as the world seeks to accelerate the low-carbon transition. Fulcrum is one of the investors co-leading engagement with BP under Climate Action100+, the world’s largest engagement initiative on climate. The company has made several commitments to substantially curb its emissions and fossil fuel production and to increase its investments in ‘green’ technologies over the next decade, with a view to achieving carbon neutrality by 2050. We believe the company’s pledge to cut its production by circa 40% over the next decade is roughly in line with the latest science-based pathways compliant with the goals of the Paris Agreement2, and sets the company apart from its peers. Nonetheless, concerns had previously been raised around potential omissions in the company’s targets, most notably with regards to third-party products. In 2022, BP announced it is further strengthening and broadening its emissions targets (to include traded products), and that it is divesting its stake in Russian producer Rosneft, thus addressing, in our view, some of the most important gaps in its strategy. Fulcrum attended the company’s 2022 AGM and called on the board to accelerate its investments in clean energy, with the CEO and chair publicly commending our constructive engagement.

Fulcrum therefore voted in favour of the company’s energy transition plan, which a majority of shareholders also endorsed. We will continue our engagements with the company, focused on ensuring the execution of the ambitious strategy they have outlined.

Glencore and Holcim: a material world

Materials companies represent another core group whose strategies and actions reverberate across sectors ranging from buildings to transport and industry. One such significant company is mining major Glencore. The company has made progress on the issue in recent years, including by adopting a comprehensive 2050 net zero target. However, we remain concerned that the company’s interim emission targets (particularly for its coal assets) are not aligned with science-based pathways for fossil fuel production3, and have raised this directly with the company. We have since opposed the company’s energy transition strategy and the re-election of four directors at the 2022 AGM, where almost a quarter of shareholders4 also voted against the transition plan. By contrast, at a different Swiss-based materials company – cement producer Holcim – we decided to support their energy transition strategy in light of the company having set independently verified interim and long-term science-based targets for all their emissions (Scopes 1, 2 and 3, in climate lingo).

Microsoft: bringing macro transparency

The company has faced controversy with regards to employees alleging sexual harassment in the workplace. It had previously committed to provide more public reporting on this issue, but had at the time of the AGM last year had still not done so. We therefore supported, alongside a majority of shareholders, a resolution asking Microsoft to report on the effectiveness of its anti-harassment policies. We also decided to override our proxy adviser’s recommendations by supporting a motion for a review of whether the company’s lobbying activities (particularly through third-party associations) are in line with the company’s official positions.

Tyson: a wrap for plastic?

At food giant Tyson Foods, shareholders have put forward a proposal calling on the company to report on its plans to reduce absolute packaging use. Noting that some of the company’s biggest clients have set targets to curb their plastic footprint – as well as the increased consumer and regulatory focus on single-use plastics (e.g. the recent international commitment by governments to adopt a legally binding treaty) – we believed that it would be in the interest of shareholders for the company to address this issue which is rapidly rising up the agenda. We therefore voted in favour of the proposal, and also opposed the re-election of several directors due to governance concerns (including ‘overboarding’, i.e. the situation where directors’ multiple roles pose potential challenges to the effective discharge of oversight duties, which is one of the material governance factors identified by ESG for Investors research).

We remain committed to using our votes as shareholders to encourage companies to raise their standards. And, as a signatory to the UK Stewardship Code, we believe in the importance of transparency: future reports, blogs and disclosures will aim to shed more light on our ongoing engagement, voting, and the actions taken to promote sustainability on behalf of our clients.

1 – All company names in this document are for illustrative purposes, and do not represent a recommendation to invest.

2 – The Intergovernmental Panel on Climate Change (IPCC) sees global oil demand declining by 10-25% to 2030 relative to 2019 levels if the world is to meet the 1.5°C climate target of the Paris Agreement. Source: Table TS.2 in IPCC – Climate Change 2022: Mitigation of climate change.

3 – The latest IPCC report estimates coal usage must drop by 65-80% by 2030 in 1.5°C-consistent pathways with ‘no overshoot’.

4 – The percent of independent shareholders opposing may actually be higher, given that the company has a significant proportion of insiders (including former CEO) as shareholders.

This material is for your information only and is not intended to be used by anyone other than you. Information provided does not constitute investment advice and should not be relied upon as a basis for investment decisions. Where necessary, speak to a financial advisor It is directed at professional clients and eligible counterparties only and is not intended for retail clients. The information contained herein should not be regarded as an offer to sell or as a solicitation of an offer to buy any financial products, including an interest in a fund, or an official confirmation of any transaction. Any such offer or solicitation will be made to qualified investors only by means of an offering memorandum and related subscription agreement. The material is intended only to facilitate your discussions with Fulcrum Asset Management as to the opportunities available to our clients. The given material is subject to change and, although based upon information which we consider reliable, it is not guaranteed as to accuracy or completeness and it should not be relied upon as such. The material is not intended to be used as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client’s account should or would be handled, as appropriate investment strategies depend upon client’s investment objectives. Funds managed by Fulcrum Asset Management LLP are in general managed using quantitative models though, where this is the case, Fulcrum Asset Management LLP can and do make discretionary decisions on a frequent basis and reserves the right to do so at any point. Past performance is not a guide to future performance. Future returns are not guaranteed and a loss of principal may occur. Fulcrum Asset Management LLP is authorised and regulated by the Financial Conduct Authority of the United Kingdom (No: 230683) and incorporated as a Limited Liability Partnership in England and Wales (No: OC306401) with its registered office at Marble Arch House, 66 Seymour Street, London, W1H 5BT. Fulcrum Asset Management LP is a wholly owned subsidiary of Fulcrum Asset Management LLP incorporated in the State of Delaware, operating from 350 Park Avenue, 13th Floor New York, NY 10022.

©2022 Fulcrum Asset Management LLP. All rights reserved

FC070W 230522