Introduction

Why carbon re-rating is already happening, and how companies can take advantage.

The ESG for Investors platform provides investors with tools to better help them maximise the impact and risk-adjusted returns, including an ‘engagement maximiser’ to identify the most material ESG factors that, if addressed, could make a positive impact on a company’s share price. In this post, we look more closely at the factor that this research has found to have the highest upside across all sectors – addressing CO2 emissions.

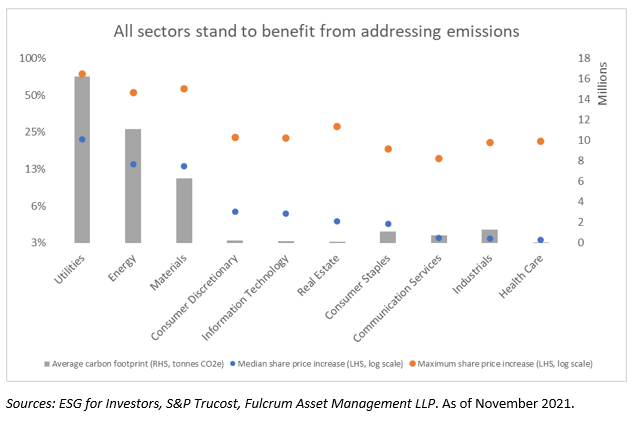

The chart below shows the median (in blue) and maximum (in orange) potential share price appreciation if companies within each GICS sector were to bring their emissions performance in line with their peers in the top decile.

What does this mean for investors? We identify three main implications.

1. Largest emitting sectors have the largest gap between leaders and laggards

Company action on climate is often presented as an insurance policy – if and when policy-makers introduce a global carbon price, companies may face significantly higher costs, which early action can reduce or avoid. This framing can be misleading, by placing the emphasis on a single future event (which may or may not happen). But the reality on the ground, today, is already more nuanced.

First, whilst short of a single, planetary price, the reach of carbon pricing is growing (currently covering 21% of global GHG emissions), as are the linkages between the various sub-, supra- and national pricing initiatives, and the price levels (with the EU carbon price offering the most dramatic illustration).

Second, as the chart illustrates, carbon re-rating is not a speculative scenario, but is already happening: this research suggests that companies which are the top-performers in terms of addressing their emissions are rewarded by the market with higher multiples. The median potential share price increase was at least 3% across all sectors¹. This result reinforces our belief that climate change represents a first-order investment issue, with risks and opportunities facing all sectors.

2. Largest emitting sectors have the largest gap between leaders and laggards

Emission reduction matters to all sectors, but not in the same way. The sectors whose business model is most directly linked to extracting or burning fossil fuels (utilities, energy and materials) show the highest median potential upside from reducing emissions (22%, 14%, and 13%, respectively). This makes intuitive sense, as the largest emitters also have the highest room to reduce emissions. However, more interestingly, this means that investors can benefit from using their capital to lead to immediate emission reductions within these sectors, given the high divergence between the leaders and laggards.

3. There is room for improvement across all sectors

Another important insight of the research is the need to look beyond the ‘usual suspects’ such as fossil fuel companies. Consumer discretionary, IT and real estate companies, on average, face a potential upside of 5% by addressing their emissions – with opportunities available across all sectors. Climate change is an issue that can only be solved if all sectors do their part.

Admittedly, the narrower gap between the median and the maximum uplift suggests there are fewer low-hanging fruit in lower-emissions sectors, but this should not be an excuse for complacency. Indeed, the growing discussions of the carbon footprint of everything from burgers to cryptocurrencies, points to increased public and regulatory ESG scrutiny that is spreading beyond the ‘usual suspects’ – and also to increased consumer demand for more sustainable goods and products.

In summary

More broadly, we believe these results provide a positive incentive for action across all GICS sectors – one of the reasons why Fulcrum supports CDP’s campaign calling on over 1600 large companies to set Science-Based Targets, and why we are encouraging companies to set science-based emission reduction targets.

The time to tackle emissions is now, helping companies and investors unlock value without locking in an unsustainable future for the planet.

Source: [1] with the exception of financials, who are not included in the analysis

This material is for your information only and is not intended to be used by anyone other than you. It is directed at professional clients and eligible counterparties only and is not intended for retail clients. The information contained herein should not be regarded as an offer to sell or as a solicitation of an offer to buy any financial products, including an interest in a fund, or an official confirmation of any transaction. Any such offer or solicitation will be made to qualified investors only by means of an offering memorandum and related subscription agreement. The material is intended only to facilitate your discussions with Fulcrum Asset Management as to the opportunities available to our clients. The given material is subject to change and, although based upon information which we consider reliable, it is not guaranteed as to accuracy or completeness and it should not be relied upon as such. The material is not intended to be used as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client’s account should or would be handled, as appropriate investment strategies depend upon client’s investment objectives. Funds managed by Fulcrum Asset Management LLP are in general managed using quantitative models though, where this is the case, Fulcrum Asset Management LLP can and do make discretionary decisions on a frequent basis and reserves the right to do so at any point. Past performance is not a guide to future performance. Future returns are not guaranteed and a loss of principal may occur. Fulcrum Asset Management LLP is authorised and regulated by the Financial Conduct Authority of the United Kingdom (No: 230683) and incorporated as a Limited Liability Partnership in England and Wales (No: OC306401) with its registered office at Marble Arch House, 66 Seymour Street, London, W1H 5BT. Fulcrum Asset Management LP is a wholly owned subsidiary of Fulcrum Asset Management LLP incorporated in the State of Delaware, operating from 350 Park Avenue, 13th Floor New York, NY 10022.

©2022 Fulcrum Asset Management LLP. All rights reserved

FC031W 120121

About the Author

Rahil Ram

Rahil Ram is a Director at Fulcrum Asset Management and is involved in portfolio strategy, portfolio implementation, research, sustainability and idea generation for the discretionary macro and thematic strategies. Prior to joining Fulcrum, Rahil was a strategist within the Asset Allocation team at Legal & General Investment Management for five years, during which time he completed his Masters’ in Actuarial Management from Cass Business School and qualified as an Actuary in 2017.

About the Author

Iancu Daramus