Introduction

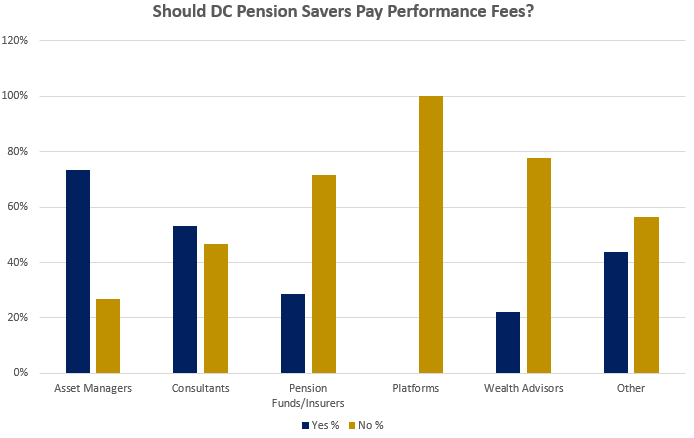

We recently conducted a poll on LinkedIn surveying whether DC savers should pay performance fees. The outcome was very close with 53% of participants saying yes and 47% saying no (114 votes in total).

It appears that the tight result masks an interesting (albeit intuitive) underlying dynamic. There is a clear difference between the allocators (Pension Funds, Insurers, Wealth Advisors) and the Asset Managers. The results for Investment Consultants and Other (including Banks, Media and Recruiters) are much more balanced. The results are profiled below:

For illustrative Purpose Only. Source: LinkedIn

We must caveat the analysis in that our sample size is not large enough to claim statistical significance (particularly in the Platform category where we just had a few votes). It appears (shock, horror) we have a case of the Agency Problem on our hands. The Asset Managers may well be feeling that ‘those DC pension schemes don’t know what’s good for them. Performance fees would improve alignment, broaden the opportunity set and improve outcomes’. On the other hand, the pension schemes likely feel that ‘this is just going to increase complexity and cost, which is the opposite of what savers need’.

Background

It is already possible for fund managers in the UK to charge performance fees in DC solutions, but this is constrained by the charge cap (currently set at 0.75% at the scheme level). Generally speaking, these structures have to be capped and/or negligible in size to pass muster. Consequently, fund structures with performance fees have regularly been considered more effort than they are worth and hence are rarely used. There is also the often-raised challenge surrounding inter-temporal fairness, which relates to how/whether these fees can be equitably charged to members given their specific cash flow profile.

Given all of this background, it is fair to say our poll question was over-simplifying the issue. In reality, the timely question (at least in the UK market) is whether performance fees should be included in the charge cap or not? This is the direction of travel for government and has been the subject of consultation. The consultation (results published at the end of March) received mixed responses. Perhaps this is further evidence of the aforementioned agency problem.

The Link to Illiquids - Neutral

The debate over performance fees is inextricably linked to the broad-based desire to introduce more (innovative) illiquid investments in DC, which typically have performance fees. This leads on to a number of related questions including whether performance fees should only be permitted for illiquid investments and whether performance fees should only be permitted if they have a certain fee structure (i.e. hurdle rate, calculation point, crystallisation point, clawback, deferral etc.)?

Our view is that there should not be a special case made for a particular asset class or set of asset classes. We feel this would increase the chances of ‘gaming the system’. We would also caution against being too prescriptive over permissible fee structures since the right structure may well very much depend on the investment under consideration. It is a can of worms best avoided.

An Increase in Opportunity Set? Potential Pro

However, in practice, moving performance fees to be outside the charge cap may not lead to a material improvement in the opportunity set for DC investors. There has already been some innovation with respect to developing flat fee solutions in alternatives for DC. Furthermore, fees (or rather, costs for the members) are incredibly important for DC schemes regardless of whether performance fees are charged/included in the charge cap or not. We would not expect, therefore, a wholesale shift to higher fee solutions if the regulation was loosened.

One potential consequence is that schemes could be drawn into certain performance fee structures to improve ‘fee optics’ for savers. This would be an unfortunate outcome. Another possible outcome is a ‘two-tier’ system, where a certain cohort of investors are willing to pay performance fees and others are not. Hopefully, innovation can help to solve this gradually over time.

Improved Alignment? Potential Pro

Overall, we would suggest there is potential for improvement in alignment although this is highly nuanced and certainly not always the case. For example, some performance fee structures can encourage excessive risk taking. There can also be a netting issue – when you combine several managers charging performance fees and some of them do well, some do poorly. The net result can be flat or negative performance at the portfolio level, yet performance fees will likely still have been charged on certain individual investments. In the world of private markets and other alternatives, we are also mindful of the potential for performance fees to be paid on market beta or as a result of financial engineering (i.e. leverage). It would be a shame if we transferred all of the issues that the institutional marketplace has, when it comes to these fees, into the DC market (particularly given we have a close-to-blank sheet of paper to start with).

Loss of Bargaining Power? Potential Con

We do feel that the charge cap has, in some cases, been a useful negotiation tool for DC schemes when it comes to agreeing fees with fund managers. This would be weakened if performance fees were separated and more generally, could lead to unusual structures where there are particularly low management fees and particularly high performance fees (a further example of potential system ‘gaming’).

Inter-temporal fairness - Potential Con

The nature of DC creates a particular issue relating to inter-temporal fairness. In DB schemes, members have a benefit promise which is down to the sponsor to meet. In DC, the retirement outcome for a member depends directly on the performance of their assets. So, different members paying different fees for the same investment is a challenge. Perhaps this is a question of materiality.

We are big believers in DC being a crucial cog in the machine that ‘brings saving to the masses’. As such, the protection that the charge cap has brought for the previously over-charged members generally invested through some of the legacy contract-based arrangements, should be savoured in our view.

Transparency/Complexity - Potential Con

We have always felt that transparency is particularly important in DC. Imagine the scenario where a member asks to understand all the fees across their holdings. Performance fees can be much harder to calculate for an individual member and harder still to explain. As such, clear disclosure will be essential. There is also the issue as to whether private market firms are disclosing and calculating these fees correctly (see this SEC speech).

Operational issues - Neutral

These have been a huge challenge for many DC schemes more broadly; the pre-existing rules meant it was close-to-impossible to invest in, for example, monthly dealt funds. However, with the recent introduction of the Long Term Asset Fund (LTAF) structure and amendments to permitted links rules, they should now be solvable. The very existence of the new LTAF structure should go some way to alleviating some of the barriers to investment in alternative assets.

To Conclude - What is our view and what are we doing?

This material is for your information only and is not intended to be used by anyone other than you. It is directed at professional clients and eligible counterparties only and is not intended for retail clients. The information contained herein should not be regarded as an offer to sell or as a solicitation of an offer to buy any financial products, including an interest in a fund, or an official confirmation of any transaction. Any such offer or solicitation will be made to qualified investors only by means of an offering memorandum and related subscription agreement. The material is intended only to facilitate your discussions with Fulcrum Asset Management as to the opportunities available to our clients. The given material is subject to change and, although based upon information which we consider reliable, it is not guaranteed as to accuracy or completeness and it should not be relied upon as such. The material is not intended to be used as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client’s account should or would be handled, as appropriate investment strategies depend upon client’s investment objectives. Funds managed by Fulcrum Asset Management LLP are in general managed using quantitative models though, where this is the case, Fulcrum Asset Management LLP can and do make discretionary decisions on a frequent basis and reserves the right to do so at any point. Past performance is not a guide to future performance. Future returns are not guaranteed and a loss of principal may occur. Fulcrum Asset Management LLP is authorised and regulated by the Financial Conduct Authority of the United Kingdom (No: 230683) and incorporated as a Limited Liability Partnership in England and Wales (No: OC306401) with its registered office at Marble Arch House, 66 Seymour Street, London, W1H 5BT. Fulcrum Asset Management LP is a wholly owned subsidiary of Fulcrum Asset Management LLP incorporated in the State of Delaware, operating from 350 Park Avenue, 13th Floor New York, NY 10022.

©2022 Fulcrum Asset Management LLP. All rights reserved

FC062W 130422

About the Author

Matthew is Head of Fulcrum Alternative Solutions. Before joining Fulcrum in 2018 to run Fulcrum Alternative Solutions, Matthew had been a Portfolio Manager for the Towers Watson Partners Fund since 2014 and before that a manager researcher in fixed income, hedge funds and other alternatives since 2005. Matthew holds a BSc in Economics and Finance (2005) from University of Bristol. He has been a CFA charterholder since 2009.