1 September 2023

Author: Helen Roughsedge

Diversification improves investment outcomes

It is well known that diversification reduces portfolio risk and improves investment outcomes. By combining different assets that have a low or negative correlation to one another, the end result is worth more than the sum of its parts; that is, the overall volatility profile is reduced without necessarily sacrificing returns.

Static portfolios remain unchanged in terms of their asset allocation, as one finds in a traditional 60/40 portfolio holding stocks and bonds. This works well during certain macroeconomic environments, but not others. Evolving macroeconomic conditions and uncertainties call for a dynamic approach to asset allocation.

But the nature of diversification is not fixed

We can think about specific moments in history, where the two main asset classes – equities and bonds – have exhibited a positive or negative correlation relative to each other. Going back to the Financial Crisis of 2008 and its aftermath, bonds and equities had strong diversification benefits due to the prevalence of demand shocks. As the economy went into recession and equities declined, central banks cut interest rates, which lifted bond valuations.

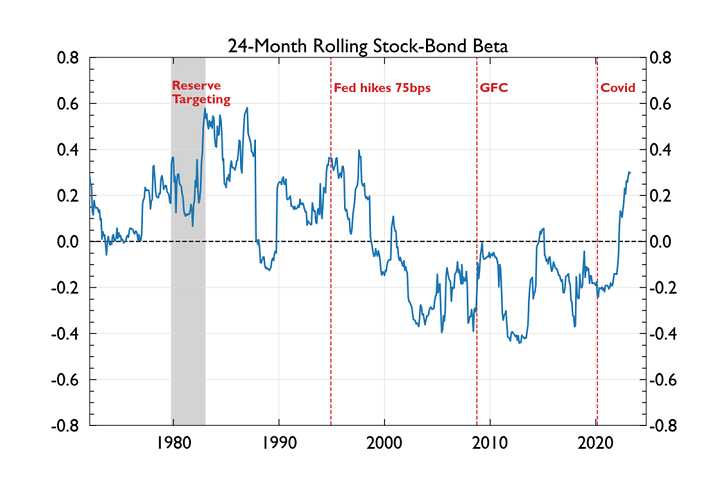

Figure 1: 24-Month Rolling Stock-Bond Beta

Source: Fulcrum Asset Management, Haver Analytics

On the flip side, when demand began to recover, the market anticipated that the economy would improve, which raised equity prices. At the same time, this led to an expectation that central banks would normalise interest rates. Bond prices, which move inversely with interest rates, fell. In both the recession and recovery phase therefore, it was beneficial to hold bonds and equities together because they were negatively correlated (see period after GFC in Figure 1).

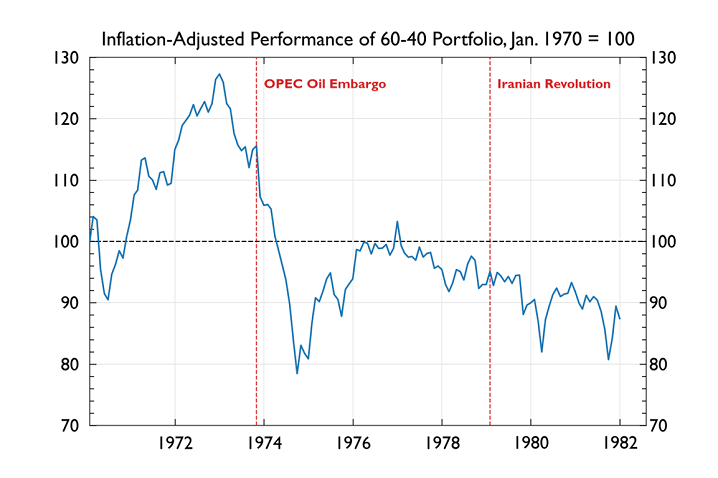

A more relevant historical scenario to consider in relation to 2022 is the 1970s, where the primary risks were inflation risk and interest rate risk resulting from energy supply shocks. During this period, the primary mover of the stock market was interest rate expectations. As interest rate expectations rose due to higher inflation, equity valuations suffered. At the same time, higher rates hit bond returns, leading to a positive correlation between the two asset classes. This meant that the traditional 60-40 portfolio performed poorly in this environment (see Figure 2).

Figure 2: Inflation-Adjusted 60-40 Performance

Source: Fulcrum Asset Management, Haver Analytics

This is where commodities can bring diversification benefits. Indeed, the period of supply shocks and rising inflation in the 1970s was one where commodities worked well in a multi-asset portfolio. Last year was similar to the 1970s scenario in terms of covariance patterns between these different asset classes, with commodities providing an effective hedge against the supply shocks induced by war in Eastern Europe.

Understanding the macro environment is crucial

Active diversification across bonds, equities and commodities can be enhanced by the application of state-of-the-art macro research capabilities, using both market information and economic data to tell you what kind of environment you’re facing.

Sophisticated macro-econometric models can be used to study the co-movement of asset prices and macroeconomic aggregates. Crucially, at the heart of these models is the identification of fundamental macroeconomic shocks, and the recognition that asset prices are the outcome of such shocks. For example, positive (negative) shocks to global demand are likely to move oil up (down) and equity valuations up (down), whereas a positive (negative) shock to oil supply should move oil down (up) and equities up (down).

These models are at the heart of Fulcrum’s approach to dynamic asset allocation and are used to inform debate and discussion around our discretionary positions.

Looking ahead

Currently, we believe that interest rate risk remains substantial, and the path of inflation is uncertain. Although inflation has declined recently, it remains material to central bank target rates and vulnerable to future commodity price shocks. Moreover, resilient US economic activity has fueled talk of persistently higher real interest rates going forward. This complicates the investment picture and reinforces the importance of being able to identify and react to evolving macroeconomic conditions.

In light of this, we prefer an investment approach that is diversified across strategies. While our Discretionary Macro approach provides a stream of returns that is less correlated to traditional asset classes, it is complemented by our Dynamic Asset Allocation approach, which provides varying degrees of long exposure to bonds and equities, with some level of commodity allocation to protect against supply shocks. When combined with an allocation to a world class trend-following strategy, and a rigorous approach to risk management, we believe that a blend of these strategies can provide robust risk-adjusted returns throughout a changing macroeconomic environment.