6 February 2024

Author: Griffin Tory

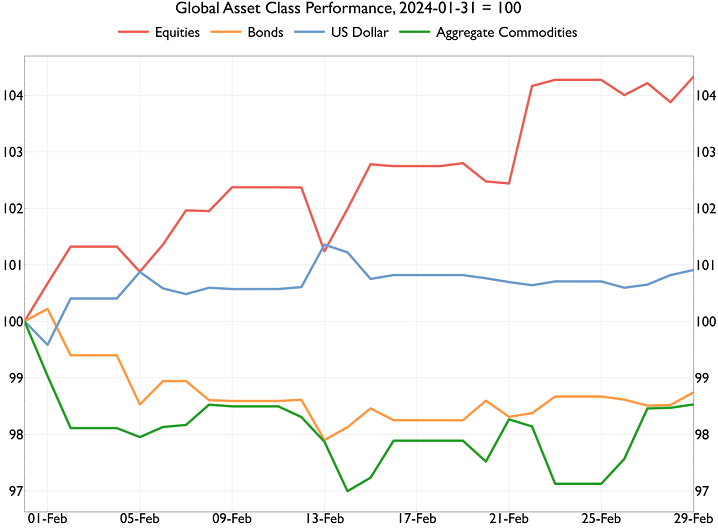

In February, markets were impacted by several large – and at times conflicting – cross-currents. In the first half of the month, a sequence of upside surprises in US inflation data led to a significant move in short-term interest rates, with market pricing falling from 4 to 3 Federal Reserve rate cuts by the end of 2024. While this had negative implications in the global fixed income space, equity markets continued to build on their strong start to the year. This came alongside continued economic optimism in the US, centred around AI-related companies and bolstered by very strong earnings results reported by chipmaker Nvidia. Moreover, survey data pointed to a general upturn in global manufacturing activity, which had been in a state of contraction for several months. Different regions have participated in this upturn to varying extents, with our nowcasts pointing to robust growth in Canada, Brazil, and Korea, whilst the UK and Euro Area remain around stagnation territory. Overall, our high-frequency modelling of market moves has assigned a greater role for growth expectations in driving developed markets, in contrast to the last two years that were often led by policy and geopolitical shocks.

Policy moves in Japan continued to be asynchronous with other developed markets, with Bank of Japan officials hinting at a forthcoming interest rate increase in April on the back of robust inflation. If followed through, this would mark an exit from 8-years of negative short-term interest rates, though officials continued to emphasise that any hiking cycle will be gradual. Meanwhile, Chinese markets rebounded somewhat from their recent lows, though general economic sentiment remained weak, and this was compounded by data showing deflation in consumer prices.

Against this backdrop, global equities were up by +4.3%1 over the month, with bonds returning -1.3%2. Strong US growth sentiment, combined with stickier-than-expected inflation, helped push the dollar up +0.9%3. Commodities were down -1.5%4 overall, though there was significant dispersion among sub-aggregates, with energy rising significantly whilst precious metals, industrial metals and agricultural commodities declined. Even within energy there were notable differences, with oil rising on the improving global growth backdrop but natural gas prices seeing double-digit declines.

Source: Bloomberg