6 February 2024

Author: Griffin Tory

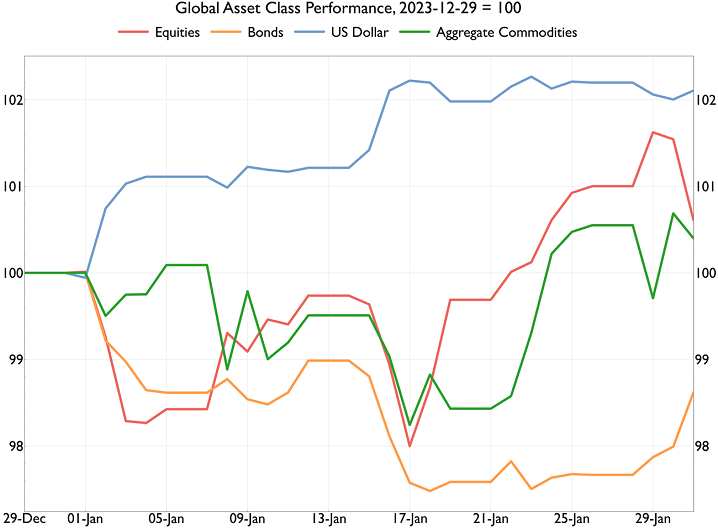

Compared to previous months, market moves were relatively muted in January, with gains in equities and commodities coming alongside a move lower in fixed income. There was a general pickup in economic sentiment, particularly in the US, where Q4 2023 GDP growth came in markedly higher than expected. This was accompanied by continuing declines in inflation, with the growth rate in the core Personal Consumption Expenditures price index falling to a 2-year low. Meanwhile, the Euro Area also saw some improvement in data, though this was concentrated in Spain, Italy, and France, with Germany displaying persistent economic weakness. Members of the Federal Open Market Committee signalled that a decline in US interest rates this year is probable, although pushed back against the idea of a March cut. Officials’ reticence to endorse large interest rate cuts can be attributed to their assessment of ‘solid’ economic activity growth, allowing them to adopt a ‘no rush’ approach. Policymakers at the Bank of England and European Central Bank adopted a similar tone, displaying optimism about inflation whilst stressing the need to see further declines in price and wage growth.

Elsewhere, sentiment deteriorated in China, with the domestic stock market declining -6.3%1, marking a -15.3% slump over the past 6 months. This occurred alongside continuing weakness in the property sector, as well as weak household confidence and deflation in consumer prices, with only moderate stimulus coming from the central government. In contrast, the Bank of Japan expressed growing confidence of inflation stabilising at 2%, though opted to keep its ultra-loose policy on hold for the time being.

Against this backdrop, global equities returned +0.6%2 and bonds saw a -1.4%3 decline. Given the upward reassessment of the US growth and interest rate outlook, the dollar jumped +2.1%4 , reversing several months of declines. Global commodities returned +0.4%5, led by a sharp increase in energy prices as geopolitical tensions increased, though this was offset by falls in industrial metals and agricultural commodities.

Source: Bloomberg