As at 9 January 2024

Author: Gavyn Davies, Executive Chairman

Main Points:

- Global asset markets have entered the new year continuing to anticipate a soft landing in the US, involving significant reductions in policy rates in the major advanced economies, excluding Japan. So far, the market pull-back from optimism about this broad scenario has been limited.

- In recent months, we have assigned a 65% probability to the soft-landing scenario taking hold in the opening months of 2024, though we are certainly aware that market prices already reflect this development to a very significant extent.

- Among the “unexpected” events that could upset the soft landing is a significant geopolitical shock. There are several candidates for such a shock, including the Presidential Election in Taiwan, which takes place on Saturday 13 January. This edition of “Chairman’s Views” discusses the possible effects of this election on cross-strait relations, US/China strains and the supply side of the global economy.

- We assume that the Presidency will be won by Lai Ching-Te, representing the incumbent Democratic Progressive Party (DPP) political grouping. Lai has been leading in the opinion polls throughout recent months, but the result is still somewhat in doubt. The DPP is viewed as pro-independence in Taiwan and is therefore disliked by the People’s Republic of China (PRC). A victory for the DPP might result in increased military exercises by the PRC, raising geopolitical tensions this year.

- With a DPP victory, there would be questions about how and when China might seek to achieve the “reunification” of China. This remains a prime objective of President Xi. While Xi has not ruled out military action and is clearly willing to ramp up military pressures in the Strait, it seems unlikely that a full scale military operation will be seen as feasible by the PRC in the next couple of years at least.

- A surprise victory for the opposition Kuonmintang (KMT) Party, under its candidate Hou Yu-ih, would be preferred by Beijing, and might therefore be liked by Taiwanese asset prices. However, since there is a strong political consensus within Taiwan for maintaining the status quo concerning relations with China – involving a claim to de facto independence with no change in the official constitutional set-up, based on the 1992 “One China” consensus – we do not see a major shift in Taiwan’s strategic objectives if the KMT were to win.

- Our current view is that this week’s election may not represent a seismic single event with dramatic immediate consequences for geopolitical risk. Instead, it should be viewed on a continuum of risk which is gradually building over a series of years.

Taiwan Election on 13 January – the Key Facts

Global news media have been very focused on the upcoming election in Taiwan, in part because the result is still uncertain, and in part because the outcome could have important consequences for cross-strait military risks, US/China relations and the supply of advanced semiconductors to the US, China and world markets. Given the importance of each of these issues for geopolitical risks, it is not surprising that 13 January looms large in the risk calendar for 2024.

The Presidential Election will be contested by three candidates and will be won by a simple plurality of the national popular vote. Inauguration of the new President will occur on 20 May. Although there is also an election for the national assembly, held on a broadly proportional voting system, this is of secondary interest, because the Presidency gains control of military and foreign affairs, which is the main area of risk. It is possible that no single party will gain a majority in the assembly (the Legislative Yuan), though the opposition parties together may well prevent the DPP from holding a majority.

The three candidates for the Presidency are:

- Lai Ching-Te of the DPP Party, which has been in power for the past 8 years under outgoing President Tsai Ing-Wen. The DPP is viewed as hostile to the PRC and is in favour of Taiwanese “independence”, defined as a de facto reality. Lai, the incumbent Vice President, is a mainstream politician within the DPP tradition. His Vice-Presidential running mate is Hsiao Bi-khim, who is half American (distantly descended from The Mayflower settlers themselves) and who is seen as very sympathetic to the US.

- Hou Yu-ih of the KMT Party, which is viewed as pro-China. The KMT ran Taiwan as a one-party dictatorship until 1989 and was formed by Chiang Kai-Shek from the rump of the Nationalists after their defeat by the Communists in Mainland China during the second phase of the Chinese Civil War of 1945-49. The party is still viewed by the electorate as culturally leaning towards its mainland Chinese origins and sympathetic to the PRC.

- Ko Wen-je of the Taiwan People’s Party (TPP), who is a third-party candidate. This grouping is built around Ko’s rather oddball personality which appeals to younger voters. (For entertainment, watch his campaign rap video here.) Apart from his status as a Hip Hop artist, he tries to argue for “rationality,” somewhere between the DPP and KMT on the question of China. He tried to conclude an electoral pact with the KMT, but this fell apart for the Presidential election amid personal infighting. The pact remains in place for the legislative elections.

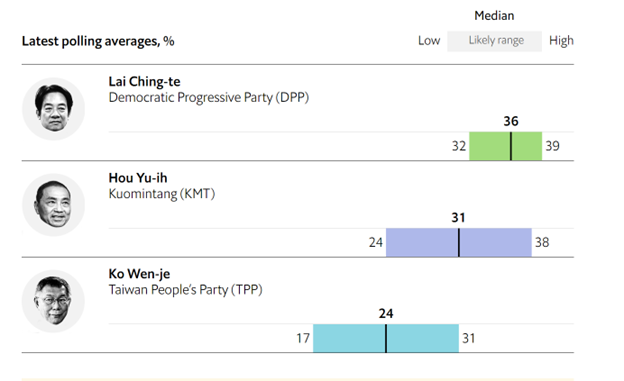

Lai (DPP) leads recent opinion polling by about 5 points over Hou (KMT), and by about 12 points over Ko. However, the election result could swing towards Hou if the Ko vote is squeezed in the final days of the campaign. Furthermore, the PRC has tried to influence the electorate by suggesting that a victory for the DPP ticket would inflame relations with China and has signaled that this might make military intervention more likely. The vast majority of the electorate favours the status quo on cross-strait relationships, i.e. they want to remain politically independent from China on a de facto basis but do not want to increase the risk of military conflict. Chart 1 below is from The Economist:

Chart 1: Taiwan Presidential Election Polls

Source: The Economist

The most likely result of the election is a victory for the DPP in the Presidential race, with a hung legislature or even a majority in the legislature for the KMT. This would lead to a weak and divided government compared to the last 8 years. But other results are still entirely feasible in both the electoral contests.

Impact on Cross-Strait Tensions

This is the focus of attention from global investors. The DPP has been in power for the last 8 years, during which time there have been no direct talks with the PRC at an official level. The DPP does not accept the One China Consensus agreed in 1992 between the PRC and the Republican of China (ROC, Taiwan), which is regarded by Beijing as essential for any future relationship. However, the DPP has stopped short of arguing for full constitutional independence from China, saying instead that the issue does not arise since Taiwan is already politically independent. This line has been followed throughout her term by President Tsai, and Lai has repeated the approach in the current election campaign, though with some elements of confusion.

China regards the new DPP Presidential ticket as even more hostile to the PRC, and even more in favour of the US, than the Tsai Presidency has been, in part because of the overtly pro-western stance of the new Vice President (VP) candidate, Hsiao. To destabilise the election campaign, Beijing has increased the intensity of military exercises in the strait and has raised tariffs on a small number of Taiwanese exports to China, though conspicuously not including semiconductors.

Beijing’s overt and covert stance has been designed to promote the likelihood that the KMT will win the election, or at least prevent the DPP from holding both the Presidency and a majority in the Yuan under its “unacceptable” new leadership ticket. The KMT and its candidate Huo have continued to accept the One China Consensus and would like to re-open direct communications with the PRC. However, the KMT has always used the Consensus as a means of avoiding a major potential conflict with Beijing about the ultimate sovereignty over Taiwan. Beijing argues that “One China” is intended to imply the complete sovereignty of the Communist Party over the entire geographical region of China, including Taiwan. The KMT, on the other hand, believes that “One China” implies a unified Chinese state under the leadership and ideas of the Nationalists, not the Communists. This is something that can never be accepted by the current Chinese regime. However, China and the KMT have agreed since 1992 to develop a political relationship while deliberately overlooking the inherent conflict over the meaning of “One China”.

Third party candidate Ko has tried to walk a fine line between the opposing positions of the DPP and the KMT, arguing for the maintenance of the status quo in cross-strait relationships, but also emphasising that an open dialogue is needed with China so that political differences can begin to be addressed. Ko is unlikely to have much influence on international affairs after the election, but his party could have some influence on domestic economic policy via its minority position in the Legislative Yuan.

Given the persistence of opinion poll leads for Lai (DPP), and the breakdown of the electoral pact planned by KMT/TPP candidates opposed to the DPP, it seems likely that Lai will win the Presidency on 13 January. This means that China will need to plan to conduct its cross-strait strategy for the next 4 years against the background of what it calls “pro-independence” politicians in control in Taipei.

The Importance of the Taiwan Semiconductors Manufacturing Company (TSMC) for the Strategic Decisions Faced by China and the US

Although political factors connected to sovereignty over Taiwan have played an increasingly important role in determining Chinese cross-strait strategy in the past few years, with President Xi adopting much more strident language than past leaders, there is another equally important factor at play. This is the dominant role of TSMC in the global production and supply of advanced semi-conductors. Put simply, the US and China are both fully aware that they rely heavily on imports from TSMC, and from onshored TSMC manufacturing facilities, for the development of their own Information Technology (IT) industries, especially Artificial Intelligence (AI), in the civilian and military spheres.

Neither the US nor China can risk losing access to TSMC production at any time in the near future, though both are attempting to grow their domestic chip design and production capabilities to make themselves less dependent on Taiwanese production. The global economy is also extremely dependent on Taiwanese chip production, and any interruption in chip supply would have adverse effects on global markets which would resemble the negative supply shocks previously seen from higher oil prices.

The main recent development in the US has been the passing by Congress of the Chips Act in 2022. This offers very significant subsidies to chip manufacturers, including TSMC, for the location of advanced semiconductor facilities in the US. In addition, the Chips Act attempts to forbid TSMC and other chip makers from exporting categories of their advanced chips, and their technological know-how to foreign economies, especially China.

So far, the US strategy seems to be having some success, with TSMC having decided to locate a major production facility in Arizona, in return for the receipt of $17 billion of subsidy payments from the US government. As a condition of these subsidy payments, there are likely to be restrictions placed on the sale of advanced chips and chip manufacturing equipment to China by TSMC, though these restrictions have not yet been material.

China’s strategy in response to these actions by the US has been to encourage the development of indigenous semiconductor manufacturing plants, though it has also encouraged the location of TSMC production facilities inside China.

For the next few years, both China and the US seem destined to remain dependent on TSMC advanced semiconductors while they engage in a kind of “arms race” to develop their own domestic supply.

China’s Possible Reactions to the Taiwan Result

Beijing’s stated objectives for the reunification of territorial “China” have become progressively more hawkish during President Xi’s term of office. In 2012, the new President announced that reunification would be a key part of the “rejuvenation” of the country, which he said should be achieved by 2049. In 2017, he said that the People’s Liberation Army (PLA) should be “modernised” by 2035, and in 2020 he said that the deadline for such readiness should be 2027. Finally, in his New Year Adress in 2024, Xi said that reunification with Taiwan is “inevitable”.

This progressive change of tone has caused strong reactions among military hawks in Washington, but it is noteworthy that Xi has made no direct threat of military action by any given deadline. Last year, Xi continued to suggest that peaceful reunification was the preferred route, while refusing to rule out the military option entirely.

It is not clear whether Beijing thinks it has the military capacity to occupy Taiwan in the near future, whether or not the US actively supports the Taiwanese defence forces with military aid or equipment. Whether or not the PLA is able to conduct such an operation, it would certainly be extremely costly in both military and economic terms and would be a major distraction from the need to focus attention on economic development within mainland China at a time of low household and business confidence and rising financial stress.

Of course, dictatorial regimes have an unnerving habit of making significant strategic miscalculations by launching wars, as President Putin’s invasion of the Ukraine reminds us. With the US distracted by the Ukraine and the Middle Eastern conflicts, there is a possibility that President Xi might think this provides an opportunity to strike against Taiwan. However, in our view, there is a strong case for arguing that China is not able to contemplate a full-scale attempt to force a reunification of the PRC and ROC in 2024.

It is encouraging that relations with the US, which were extremely strained in the first part of President Biden’s term, have improved significantly in recent months, leading to much less hostile rhetoric on both sides.

Biden has also shifted US language on the willingness of the US to use military support to maintain the independence of Taiwan in the case of an armed attack by China. Since 1979, US Presidents have generally employed a strategy of deliberate ambiguity about this possibility, but Biden has suggested strongly that the US would intervene if required. This change is presumably intended to deter any action by China that might be based on a miscalculation of the likely US response.

A wild card in this situation would be the re-election of President Trump in November. Trump was critical of Taiwan’s “dominance” of semiconductor production during his previous period in the White House, and of course he also initiated a tariff war against mainland China. When questioned last year on US military support for Taiwan, he refused to say whether this would be forthcoming under his Presidency and appeared to return to the previous American stance of deliberate ambiguity. It is possible that Beijing might see a Trump Presidency as less likely to offer military support to Taiwan, in which case there would be a case for delaying any planned military action by China until after the November 2024 US elections, but the effect of this factor on Beijing’s strategic thinking is likely to be marginal.

Conclusion

In summary, we conclude that the political situation in Taiwan would not change very much after a Lai victory on Saturday, compared to the policies pursued by outgoing President Tsai. Certainly, this might provoke a show of military strength by China in order to reinforce their “red line” over constitutional independence for Taiwan, but Lai is unlikely to do anything new to provoke this. With the status quo likely to be broadly maintained in Taiwan whoever wins the Presidency this week, China’s decisions will depend mainly on the strategic economic and military considerations discussed in this note, none of which will have been changed by the arrival of a new President in Taipei. Though very concerning in the long run, these considerations are likely to play out over years or decades, not in a matter of months from now.