Introduction

We investigate the potential for ESG-linked share price increases, from the perspective of company size.

The ESG for Investors platform’s engagement maximiser leverages academic research to identify ‘ESG upside’ – potential share price improvements from companies bringing environmental, social and governance performance in line with top-rated peers. In previous posts, we have looked at some of the implications for companies in different sectors. In what follows, we consider the issue from the perspective of company size.

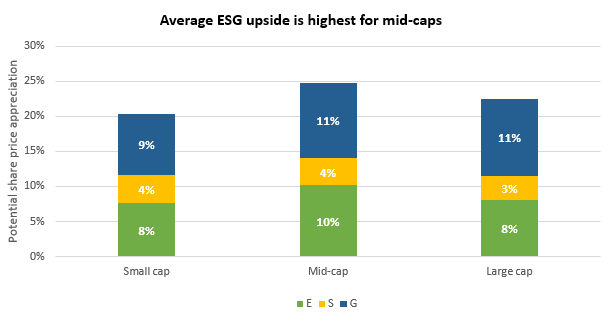

The golden middle

Source: ESG for Investors, as of March 2022

That might seem easier said that done. Indeed, one common challenge well-known to company secretaries (which we discussed in a recent webinar) is that larger companies have comparably more resources to devote to improved ESG reporting. Smaller companies may struggle to meet the requirements of an ‘alphabet soup’ of reporting frameworks (CDP, IR, GRI, TCFD, SASB, to name just a few), and may thus have lower ESG scores from third-party providers simply as a result of comparatively poor disclosure, rather than performance.

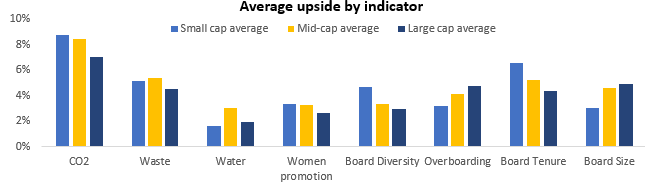

It is thus worth clarifying that this analysis does not rely on aggregate ESG scores – but is built bottom-up from individual, quantifiable metrics – such as the length of companies’ board tenure, or the level of their emissions. Looking at the individual indicators in more detail, mid-cap companies can unlock more value than large caps on most environmental and social metrics (CO2, water, waste, promotion of women and board diversity).

Source: ESG for Investors, as of March 2022

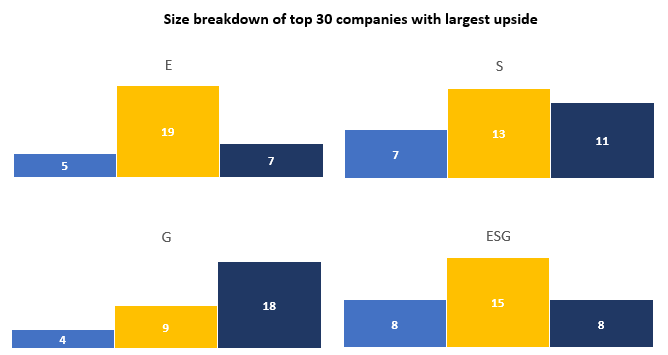

Going from averages to the top, mid-caps also dominate the rankings of the 30 companies with the highest potential upside. We illustrate below the number of small, mid-, and large cap companies (left-to-right) in the top 30. For simplicity, we have aggregated the 8 individual metrics into E, S, G and overall ESG upside.

Source: ESG for Investors, as of March 2022

Governance and growth

The notable exception, of course, is around governance. As shown above, the analysis suggests that improving the functionality of boards in terms of tenure, size, and time commitment (aka ‘overboarding’) can yield higher benefits for the largest companies. Whilst further research would be needed to establish causality, we offer several hypotheses that could explain this result:

- Fewer ‘low-hanging fruit’: Improvements in the carbon footprint or water efficiency of a major multinational company may be more costly than for a smaller company with a more localised supply chain, for example.

- The role of intangibles: Some research suggests that ‘intangible assets’ (such as brand value) are playing a growing role in company valuations. This in turn raises the value of the governance structures that can help protect and grow that intangible value. Put differently, the larger the company, the more costly a governance failure can be for investors.

In sum, mid-cap companies can practice their ‘Midas touch’, turning improvements in ESG performance into share price appreciation! Log onto the Engagement Maximiser to find out more about the dynamics of specific companies, regions, and sectors.

Source [1] Mid-caps are defined as having a market capitalisation between USD 5.6-17.5 bn (as of November 2021). Companies below/above that range are defined as small/large cap, respectively. For companies in emerging markets, the upper and lower thresholds were reduced by 50%, reflecting lower average company sizes.

This material is for your information only and is not intended to be used by anyone other than you. It is directed at professional clients and eligible counterparties only and is not intended for retail clients. The information contained herein should not be regarded as an offer to sell or as a solicitation of an offer to buy any financial products, including an interest in a fund, or an official confirmation of any transaction. Any such offer or solicitation will be made to qualified investors only by means of an offering memorandum and related subscription agreement. The material is intended only to facilitate your discussions with Fulcrum Asset Management as to the opportunities available to our clients. The given material is subject to change and, although based upon information which we consider reliable, it is not guaranteed as to accuracy or completeness and it should not be relied upon as such. The material is not intended to be used as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client’s account should or would be handled, as appropriate investment strategies depend upon client’s investment objectives. Funds managed by Fulcrum Asset Management LLP are in general managed using quantitative models though, where this is the case, Fulcrum Asset Management LLP can and do make discretionary decisions on a frequent basis and reserves the right to do so at any point. Past performance is not a guide to future performance. Future returns are not guaranteed and a loss of principal may occur. Fulcrum Asset Management LLP is authorised and regulated by the Financial Conduct Authority of the United Kingdom (No: 230683) and incorporated as a Limited Liability Partnership in England and Wales (No: OC306401) with its registered office at Marble Arch House, 66 Seymour Street, London, W1H 5BT. Fulcrum Asset Management LP is a wholly owned subsidiary of Fulcrum Asset Management LLP incorporated in the State of Delaware, operating from 350 Park Avenue, 13th Floor New York, NY 10022.

©2022 Fulcrum Asset Management LLP. All rights reserved

About the Author

Rahil Ram

Rahil Ram is a Director at Fulcrum Asset Management and is involved in portfolio strategy, portfolio implementation, research, sustainability and idea generation for the discretionary macro and thematic strategies. Prior to joining Fulcrum, Rahil was a strategist within the Asset Allocation team at Legal & General Investment Management for five years, during which time he completed his Masters’ in Actuarial Management from Cass Business School and qualified as an Actuary in 2017.

About the Author

Iancu Daramus