Introduction

Inflation was already accelerating before the disruptions caused by the invasion of Ukraine

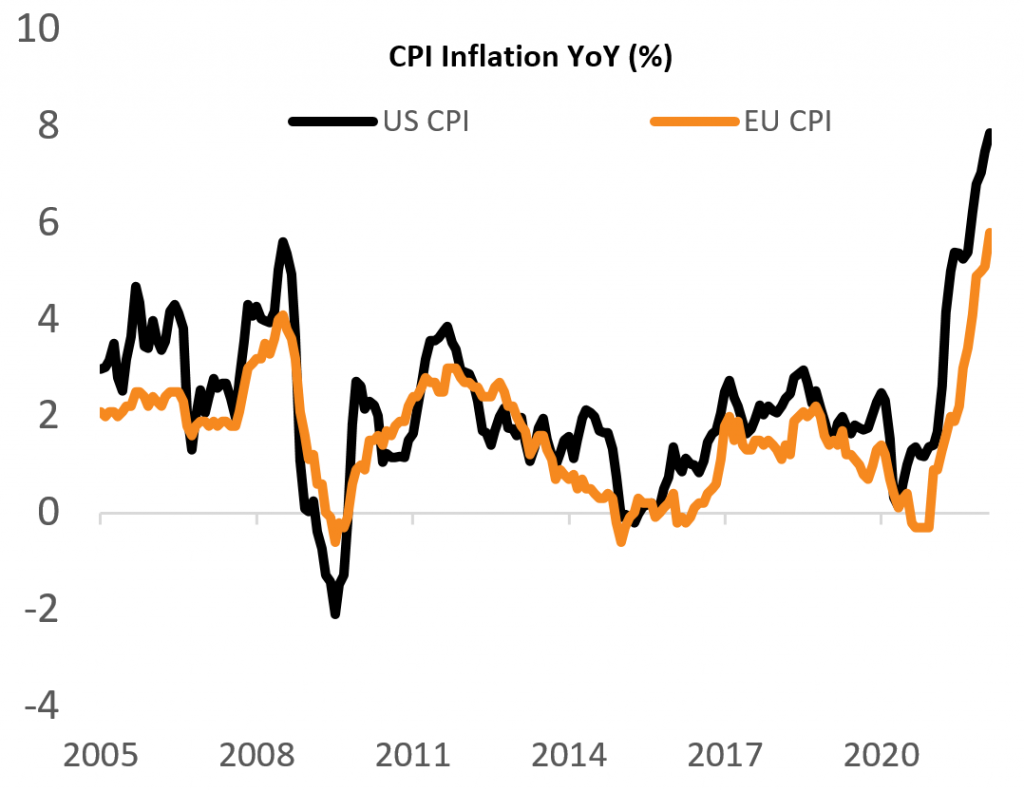

February was a month where we needed to appreciate the humanity of events unfolding alongside our cold objective analysis of financial and market impacts. As the invasion of Ukraine began on February 24th, the February CPI data gave a good snapshot of inflation dynamics just before the beginning of the war. Worryingly, they show that consumer prices were already accelerating both in the US and in the Eurozone, contrary to the Fed and the ECB expectations.

In the US, CPI inflation reached 7.9% YoY, up from 7.5% YoY in January. Core inflation (which excludes food and energy and is a better indicator of underlying pressures) was 6.4% YoY, up from 6.0% YoY in January; on an annualised seasonal adjusted basis it was 6.9% in the three months to February relative to the previous three months, up from 4.3% in the three months to November relative to the previous three months.

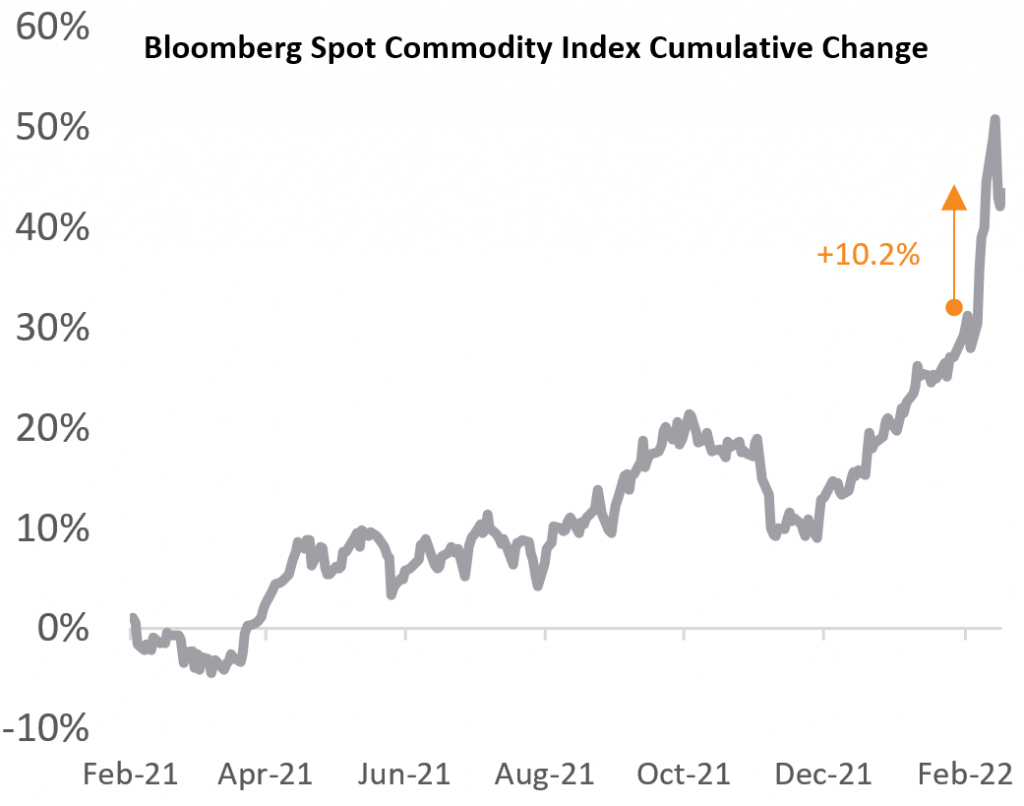

Making the task ahead for the central banks even more difficult since February 23rd commodity prices have surged. For example, both WTI oil in USD terms and Brent oil in EUR terms are up by about 10%. The Bloomberg Commodity Spot Index – a weighted average of 37 individual spot commodity prices – had increased by 10.2% as of March 11th.

Prices have been increasing before Ukraine invasion.

Source: Bloomberg LLP, Fulcrum Asset Management LLP

Prices have been increasing before Ukraine invasion.

Source: Bloomberg LLP, Fulcrum Asset Management LLP

This material is for your information only and is not intended to be used by anyone other than you. It is directed at professional clients and eligible counterparties only and is not intended for retail clients. The information contained herein should not be regarded as an offer to sell or as a solicitation of an offer to buy any financial products, including an interest in a fund, or an official confirmation of any transaction. Any such offer or solicitation will be made to qualified investors only by means of an offering memorandum and related subscription agreement. The material is intended only to facilitate your discussions with Fulcrum Asset Management as to the opportunities available to our clients. The given material is subject to change and, although based upon information which we consider reliable, it is not guaranteed as to accuracy or completeness and it should not be relied upon as such. The material is not intended to be used as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client’s account should or would be handled, as appropriate investment strategies depend upon client’s investment objectives. Funds managed by Fulcrum Asset Management LLP are in general managed using quantitative models though, where this is the case, Fulcrum Asset Management LLP can and do make discretionary decisions on a frequent basis and reserves the right to do so at any point. Past performance is not a guide to future performance. Future returns are not guaranteed and a loss of principal may occur. Fulcrum Asset Management LLP is authorised and regulated by the Financial Conduct Authority of the United Kingdom (No: 230683) and incorporated as a Limited Liability Partnership in England and Wales (No: OC306401) with its registered office at Marble Arch House, 66 Seymour Street, London, W1H 5BT. Fulcrum Asset Management LP is a wholly owned subsidiary of Fulcrum Asset Management LLP incorporated in the State of Delaware, operating from 350 Park Avenue, 13th Floor New York, NY 10022.

©2022 Fulcrum Asset Management LLP. All rights reserved

FC054W 170322

About the Author

Filippo Cartiglia

Filippo is a member of the Investment Team. Before joining Fulcrum in 2020, he was the chief economist at Arrowgrass Capital Partners LLP. Prior to this, Filippo was Managing Director at Goldman Sachs, partner at Newman Ragazzi LLP, and an economist at the International Monetary Fund in Washington. Filippo graduated from Bocconi University in Milan in 1988 and gained a PhD in Economics from Columbia University in New York in 1992.

About the Author

Rahil Ram

Rahil Ram is a Director at Fulcrum Asset Management and is involved in portfolio strategy, portfolio implementation, research, sustainability and idea generation for the discretionary macro and thematic strategies. Prior to joining Fulcrum, Rahil was a strategist within the Asset Allocation team at Legal & General Investment Management for five years, during which time he completed his Masters’ in Actuarial Management from Cass Business School and qualified as an Actuary in 2017.