Introduction

An exploration of the relevance of ESG risk and opportunities to financial outcomes over time

As an industry, we have lots of ideas on how to approach the challenge of ESG integration when it comes to investing in equities over the long run. In contrast, we have struggled for innovation in some shorter-term investment strategies; is there more we can do?

Physical ownership of equities permits well-practiced tactics for investors to effect positive change within corporations through engagement. It is a long-term approach that requires commitment and if successful, can lead to improved financial outcomes. For example, the company may enact new processes to reduce carbon emissions or to improve team diversity to drive improved business outcomes1.

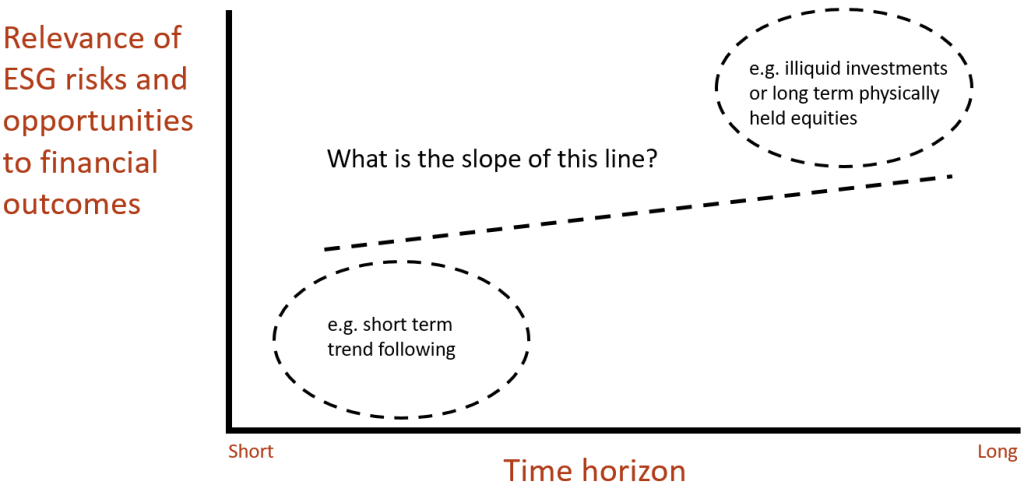

This is all well and good when looking at an asset class, like equities, on a standalone basis. However, when investing in different asset classes/strategies with different investment time horizons, the relevance of ESG risks and opportunities to financial outcomes can vary dramatically. This may be particularly true for derivative-based investment strategies like short-term trend following. Our instinct is that the shorter the time horizon, the less relevance ESG risks and opportunities have (see below illustration).

Conceptual framework for ESG integration across time

At the top right of the chart, one finds illiquid strategies (i.e. private credit) and traditional long-only equities, where long-term ownership allows investors to engage with management and (where applicable) exercise proxy voting rights. Equally, physical ownership gives investors the choice to divest – and potentially pursue a short-selling strategy – if certain ESG factors do not improve over time i.e. questionable governance standards, treatment of workers, lack of willingness to improve the sustainability of supply chains, high energy emissions.

- Detailed up-front due diligence including an assessment of ESG risks and opportunities

- Clear sustainability plans for the life of ownership

- Active engagement and, where relevant, proxy voting

- Scope of real-world difference

Conversely, when investing in shorter-term strategies – the bottom left area of the chart – there are deep philosophical questions about the very nature and purpose of certain activities. For example, imagine a short-term trading strategy in wheat futures – ‘is this a good thing to do for society and the environment?’ If one is investing in wheat futures, the charge of contributing to inflated food prices could hold true. The counterargument to this, however, is that one is providing liquidity to global wheat markets and helping farmers to hedge their inventories; in turn, helping to reduce volatility to some extent. As such, the case for investing in a short-term strategy incorporating wheat markets could be argued both positively and negatively.

These are abstract questions/challenges that may not ordinarily appear in a fund managers due diligence analysis when a new shorter-term model is being developed. Considerations for investing in strategies with a short-term time horizon might include:

- What might be the direct and indirect consequences of the investment strategy? For example, liquidity provision, market impact, energy consumption and recruitment

- Can we do a better job of acknowledging these risks and opportunities up front and sharing them with clients, particularly when launching a new strategy?

- Are there actions (within the strategies or within the firm) that can be taken to help clients achieve their outcomes whilst also being better stewards?

By asking these questions during the (re-)development of shorter-term investment strategies, there are a series of potential industry-wide benefits. It would enable better dialogue with investors, who are keen to understand the pros and cons. In turn, investors would be better equipped to make judgements around whether particular strategies fit with their values. It would also promote another level of industry engagement, encouraging asset managers to consider aspects they might otherwise not have.

1 “Successful [ESG] engagements are followed by positive […] abnormal returns”. Dimson et al (2015)

“We document about 4.1-4.6% increase in annual abnormal stock returns at target firms within the first two years after the engagement initiation”. Dimson et al (2021)

This material is for your information only and is not intended to be used by anyone other than you. It is directed at professional clients and eligible counterparties only and is not intended for retail clients. The information contained herein should not be regarded as an offer to sell or as a solicitation of an offer to buy any financial products, including an interest in a fund, or an official confirmation of any transaction. Any such offer or solicitation will be made to qualified investors only by means of an offering memorandum and related subscription agreement. The material is intended only to facilitate your discussions with Fulcrum Asset Management as to the opportunities available to our clients. The given material is subject to change and, although based upon information which we consider reliable, it is not guaranteed as to accuracy or completeness and it should not be relied upon as such. The material is not intended to be used as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client’s account should or would be handled, as appropriate investment strategies depend upon client’s investment objectives. Funds managed by Fulcrum Asset Management LLP are in general managed using quantitative models though, where this is the case, Fulcrum Asset Management LLP can and do make discretionary decisions on a frequent basis and reserves the right to do so at any point. Past performance is not a guide to future performance. Future returns are not guaranteed and a loss of principal may occur. Fulcrum Asset Management LLP is authorised and regulated by the Financial Conduct Authority of the United Kingdom (No: 230683) and incorporated as a Limited Liability Partnership in England and Wales (No: OC306401) with its registered office at Marble Arch House, 66 Seymour Street, London, W1H 5BT. Fulcrum Asset Management LP is a wholly owned subsidiary of Fulcrum Asset Management LLP incorporated in the State of Delaware, operating from 350 Park Avenue, 13th Floor New York, NY 10022.

©2022 Fulcrum Asset Management LLP. All rights reserved

FC137 181722

About the Author

Matthew is Head of Fulcrum Alternative Solutions. Before joining Fulcrum in 2018 to run Fulcrum Alternative Solutions, Matthew had been a Portfolio Manager for the Towers Watson Partners Fund since 2014 and before that a manager researcher in fixed income, hedge funds and other alternatives since 2005. Matthew holds a BSc in Economics and Finance (2005) from University of Bristol. He has been a CFA charterholder since 2009.