As at 12 February 2024

On Friday, February 2nd, the closely watched non-farm payrolls report in the US showed +350k jobs added, almost double consensus expectations. The 2-year Treasury yield, which is often influenced by expectations of Federal Reserve policy, jumped over 15 basis points on the day of the release. This likely reflected the upward re-assessment of US growth prospects, with markets pricing a slower rate of interest rate cuts in response.

Source: Fulcrum Asset Management

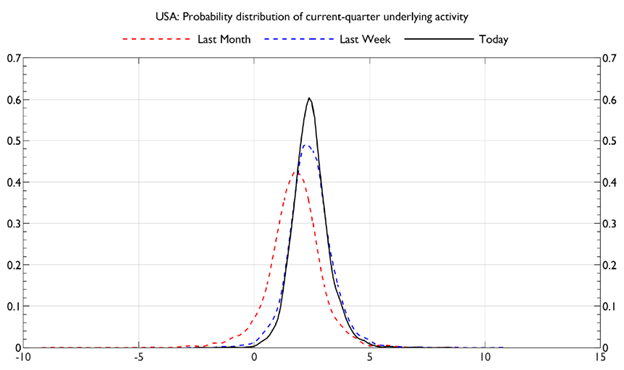

Note: The black line signifies the latest estimate of the distribution of underlying economic activity in the US, produced by Fulcrum’s nowcasting model. The dashed red and blue lines show the same estimate as of one month and one week ago, respectively.

Given the lags in quarterly GDP data, as well as the volatility of individual data series, at Fulcrum we rely on a Bayesian Dynamic Factor Model to gauge the near-term health of major economies. This model uses state-of-the-art methods to arrive at a near real-time assessment of economic activity, and several of its key features were incorporated in the New York Fed’s revamped nowcasting model. Importantly, releases such as non-farm payrolls are incorporated into the nowcast immediately. Given the probabilistic framework of the model, this allows us to gauge not only the impact of such releases on our central growth estimate, but also how the distribution of around this point has changed.

Despite the upward surprise in payrolls, our model’s central projection of growth held steady at around 2.5% (QoQ, Annualized). This was because, given the strength of previous data, the model had already revised upwards its estimate of activity. What did change, however, was the level of certainty around this estimate. This is shown by the updated activity distribution given by the black line, which displays a significant increase in height relative to the previous distributions, reflecting a higher probability assigned to the central range.

Taken together, this is part of a several years long trend of declining macro volatility as the impacts of Covid-19 and the 2022 energy shock fade. If sustained, a less volatile macro-outlook should help to improve forecast accuracy among policymakers and market participants alike. This should facilitate a greater degree of predictability in future monetary policy, which has been a key area of uncertainty over the past several years.