As at 23 January 2024

The underperformance of the European economy has been a persistent theme over the past several years. Relative to the US, Europe has a lower ‘trend’ growth rate, meaning that it is expected to grow more slowly over time. The region also saw a much sharper contraction during the Covid-19 crisis and had more acute exposure to the 2022 energy price shock. This left the Euro Area economy just 3% larger than its end 2019 level, compared to over 7% for the US, as of the end of Q3 2023¹.

Given the lags in quarterly GDP data, as well as the volatility of individual data series, at Fulcrum, we rely on a Bayesian Dynamic Factor Model to gauge the near-term health of major economies. This model uses state-of-the-art methods to arrive at a near real-time assessment of economic activity, and several of its key features were incorporated in the New York Fed’s revamped nowcasting model.

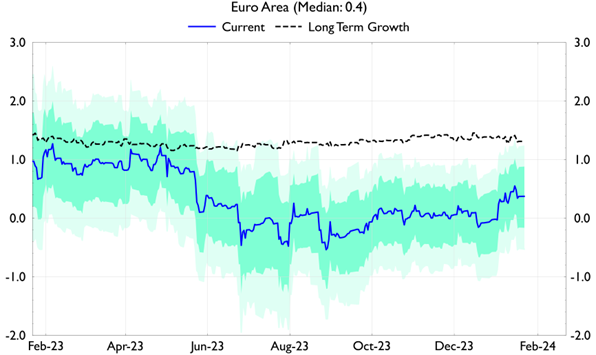

Source: Fulcrum Asset Management

Note: The thick blue line represents the model’s median projection for the current annualised growth rate, whilst the dark and light blue shaded areas show the 68% and 90% confidence intervals, respectively. The dashed black line shows the model’s estimate of the long-term trend growth rate.

The figure shows our real-time assessment of the Euro Area economy over the past 12 months. We see that over the second half of last year, the currency bloc was hovering between stagnation and contraction. The proximate cause of this was moribund consumer spending, dire business sentiment and weakness in the German manufacturing sector. Since the start of 2024 however, there has been a moderate but noticeable uptick in estimated activity growth to 0.4% annualised, marking its fastest rate since May 2023. The cause of this was an improvement in labour market data – which in general has been robust despite weak output overall – as well as signs of a rebound in business confidence.

Going into 2024, the state of the Euro Area economy will be a crucial factor for policymakers. The weakness until now had concerned some officials at the European Central Bank (ECB) and contributed to market conviction that the ECB would soon embark on significant interest rate cuts. If the recovery continues, which is possible given the recent acceleration in real income growth and large stock of household savings, it could prompt a shift in the ECB’s near-term policy path.