As at 5 December 2023

Over the past month, markets have generally shifted towards the idea that major central banks are close to cutting interest rates. This has been supported by several months of declining inflation across developed economies, as well as more supportive language from policymakers around the possibility of future rate cuts. The impacts of this have been significant for all liquid assets, in particular short-to-medium term government bonds that tend to be particularly policy sensitive. In the UK, however, as has been the case throughout 2023, bond yields have not undergone the large declines seen in the US and Euro Area.

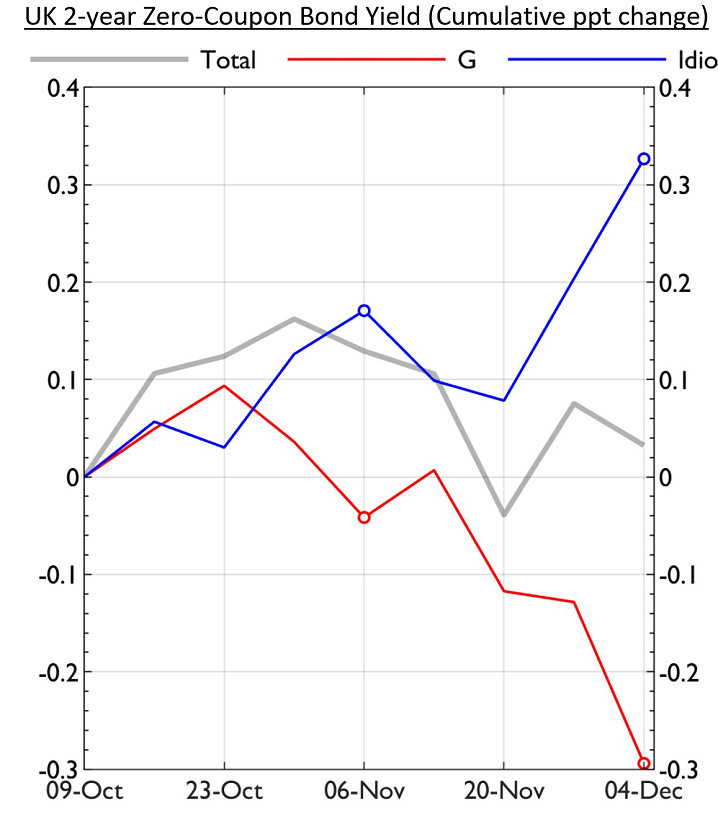

Source: Fulcrum Asset Management

To quantify this, we use a Bayesian factor model, the results of which are shown in the figure. The model sees the 2-year yields in major developed markets following a single global factor (G in the figure), as well as a country-specific idiosyncratic component (Idio in the figure). Using this, we can see how much the total move in yields can be attributable to the common global factor. We see from the figure that the global factor exerted a strong negative impact on UK yields, consistent with the general perception of easing monetary policy expectations across major economies. Importantly however, this was more than offset by a large idiosyncratic increase, which accelerated after Bank of England Governor Bailey pushed back against the idea of imminent interest rate cuts.

There is no question that global factors have been play in recent market moves, resulting in large co-movements across asset classes and localities. As this piece has shown however, different regions have differing sensitivities to these factors. For investors looking to manage their exposures, both in the UK and abroad, it is vital to pay attention to these idiosyncrasies, for both the risks and opportunities they represent.