21 November 2022

Author: Matthew Roberts

As an industry, we have lots of ideas on how to approach the challenge of ESG integration when it comes to investing in equities over the long run. In contrast, we have struggled for innovation in some shorter-term investment strategies; is there more we can do?

Physical ownership of equities permits well-practiced tactics for investors to effect positive change within corporations through engagement. It is a long-term approach that requires commitment and if successful, can lead to improved financial outcomes. For example, the company may enact new processes to reduce carbon emissions or to improve team diversity to drive improved business outcomes1.

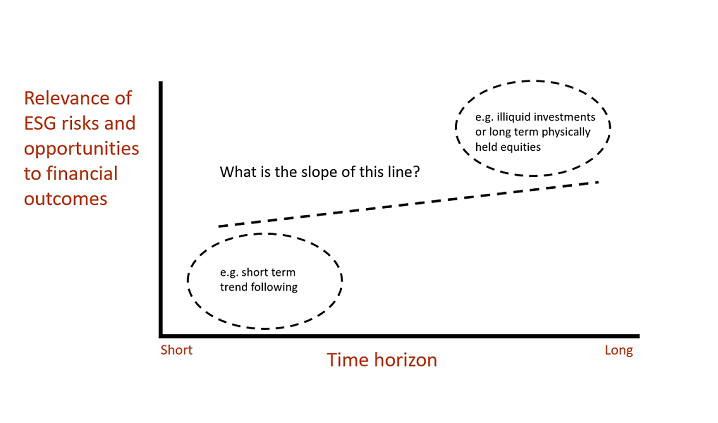

This is all well and good when looking at an asset class, like equities, on a standalone basis. However, when investing in different asset classes/strategies with different investment time horizons, the relevance of ESG risks and opportunities to financial outcomes can vary dramatically. This may be particularly true for derivative-based investment strategies like short-term trend following. Our instinct is that the shorter the time horizon, the less relevance ESG risks and opportunities have (see below illustration).

However, we want to be open-minded about this and would be interested in engaging in further industry dialogue on the topic.

Conceptual framework for ESG integration across time

At the top right of the chart, one finds illiquid strategies (i.e. private credit) and traditional long-only equities, where long-term ownership allows investors to engage with management and (where applicable) exercise proxy voting rights. Equally, physical ownership gives investors the choice to divest – and potentially pursue a short-selling strategy – if certain ESG factors do not improve over time i.e. questionable governance standards, treatment of workers, lack of willingness to improve the sustainability of supply chains, high energy emissions.

When investing on a directional basis in an asset class such as equities, we are able to develop clear sustainability objectives e.g. climate alignment (whilst doing no significant harm to other ESG factors). Considerations for strategies with a long-term time horizon might include:

- Detailed up-front due diligence including an assessment of ESG risks and opportunities

- Clear sustainability plans for the life of ownership

- Active engagement and, where relevant, proxy voting

- Scope of real-world difference

Conversely, when investing in shorter-term strategies – the bottom left area of the chart – there are deep philosophical questions about the very nature and purpose of certain activities. For example, imagine a short-term trading strategy in wheat futures – ‘is this a good thing to do for society and the environment?’ If one is investing in wheat futures, the charge of contributing to inflated food prices could hold true. The counterargument to this, however, is that one is providing liquidity to global wheat markets and helping farmers to hedge their inventories; in turn, helping to reduce volatility to some extent. As such, the case for investing in a short-term strategy incorporating wheat markets could be argued both positively and negatively.

These are abstract questions/challenges that may not ordinarily appear in a fund managers due diligence analysis when a new shorter-term model is being developed. Considerations for investing in strategies with a short-term time horizon might include:

- What might be the direct and indirect consequences of the investment strategy? For example, liquidity provision, market impact, energy consumption and recruitment

- Can we do a better job of acknowledging these risks and opportunities up front and sharing them with clients, particularly when launching a new strategy?

- Are there actions (within the strategies or within the firm) that can be taken to help clients achieve their outcomes whilst also being better stewards?

By asking these questions during the (re-)development of shorter-term investment strategies, there are a series of potential industry-wide benefits. It would enable better dialogue with investors, who are keen to understand the pros and cons. In turn, investors would be better equipped to make judgements around whether particular strategies fit with their values. It would also promote another level of industry engagement, encouraging asset managers to consider aspects they might otherwise not have.

We still hear phrases like ‘ESG is irrelevant for our strategy’ and sometimes see managers shrug their shoulders. Perhaps some of the ideas we share here might prompt further thinking for these ‘harder to quantify’ strategies. Sustainability: Definitely now!