5 December 2023

Author: Helen Roughsedge

The outlook for the global economy over the next 12-18 months.

At the present time, the US is proving to be the driver of global growth. We have been thinking about the near-term outlook for the global economy in terms of whether the Federal Reserve in the US can manage interest rates to achieve a ‘soft landing’, whereby economic growth slows, and inflation decelerates significantly to the 2% target. The risks around this scenario are that the economy experiences a ‘hard landing’ (a recessionary scenario) or even ‘no landing’ (where economic growth remains strong and inflation stays above the 2% target, with a tight labour market and rising long-term interest rates).

On a 6 to 12-month horizon, we believe that the most likely outcome is that the US is successful in achieving a soft landing, and that we’re likely to see declining interest rates, a continued weakening of the dollar and higher equity valuations (notwithstanding the already very high equity valuations).

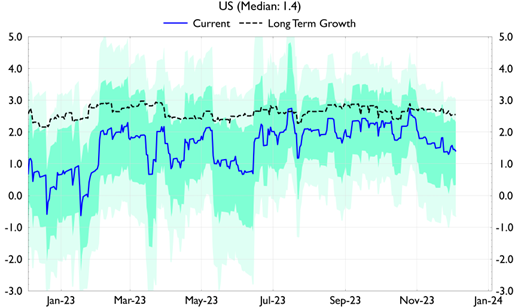

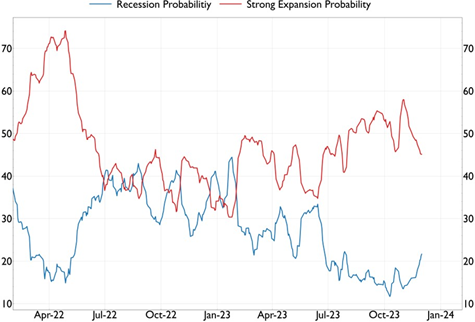

This view is supported by our current ‘nowcast’ of economic growth, which points to limited near-term recession risk, despite a weakening in momentum recently (Figure 1 and Figure 2). The spending power of US households remains strong, and we expect to see positive real income growth, as well as supportive fiscal policy.

Figure 1: US GDP Nowcast (%, Annualised)

Source: Fulcrum Asset Management

In Europe, the current data points to a recession in Germany and stagnation elsewhere, although we anticipate that the current downturn will be relatively shallow. In China, we see a deeply depressed property sector and a structural slowdown in long-run growth, although the government appears to be providing policy support where necessary.

In our view, the main risk to global growth is a renewed deterioration in the energy supply side, either due to an escalation of conflicts or increased production restraint from global oil producers. This could put renewed pressure on real incomes and interest rates. There is also the possibility that the lagged effect of interest-rate hikes is yet to be felt in developed markets, which, if true, would imply a more fragile growth outlook going forward.

Figure 2: US Recession and Expansion Probabilities (%)

Source: Fulcrum Asset Management

The view on Inflation and Interest Rates over the next 12-18 months.

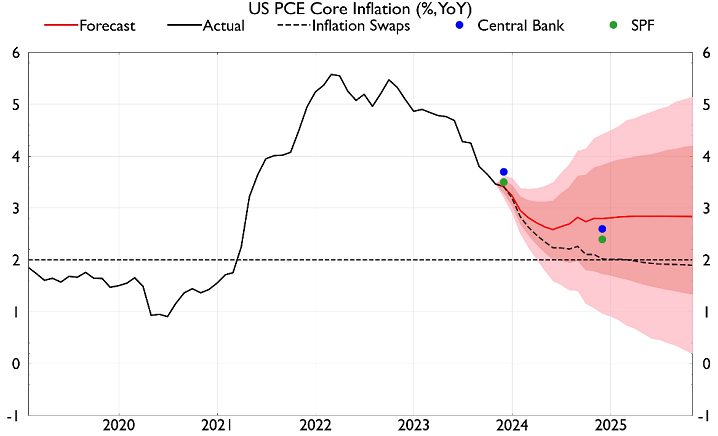

Our baseline view continues to be that, while U.S. inflation is likely to fall in the near term, it will remain more elevated than expected by markets (dotted line on Figure 3) and policymakers (blue dots on Figure 3). This, combined with a relatively strong growth backdrop, would lessen the Federal Reserve’s willingness to cut interest rates.

Figure 3: US Core PCE Forecast (%, YoY)

Source: Fulcrum Asset Management

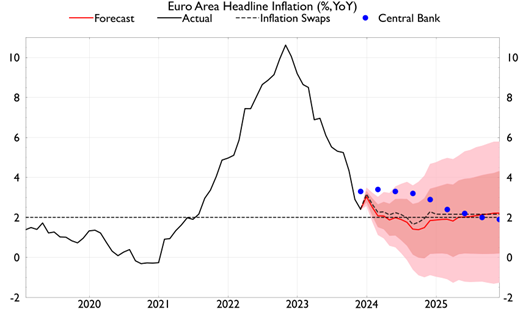

The situation is similar in the UK, which is likely to experience a significant decline in inflation over the next couple of months but, in our view, is unlikely to see inflation at target over the next couple of years. In contrast, we view it as more likely that the European Central Bank will reach its 2% inflation target, with recent data pointing to a sharp deceleration in inflation momentum (see Figure 4).

Figure 4: Euro Area Headline CPI Forecast (%, YoY)

Source: Fulcrum Asset Management

The US and the UK have experienced more persistent inflationary dynamics compared to the Euro Area, driven by a stronger transmission mechanism to domestically oriented sources of inflation such as housing and non-energy services.

Conditional on these forecasts being correct, we would expect to see an increased interest rate differential between the UK and US relative to the Euro Area.

The most compelling opportunities in the asset class in the coming 1-2 years.

In terms of building an ‘all weather’ portfolio that targets absolute returns, it is important to find a broad range of investment ideas that span a range of asset classes and time horizons, and to try to protect the portfolio against possible shocks.

While many of the discretionary macro views expressed are more tactical and short term in nature, we do express longer-term views in our equity market neutral sleeve, where the investment themes are typically based on a two to three year time horizon. This wide range of ideas includes the positive opportunities that we see for Japanese banks and obesity drug manufacturers, the overlooked second tier of US tech companies and numerous other thematic relative value ideas.

The long-only asset allocation element of the portfolio draws from the work of our research team and guides us to near-term views on whether the most compelling investments are in equities, bonds or commodities. Drawing on a wealth of data sources to understand everything from valuation to macroeconomic impacts, to momentum and volatility, we form a view on how to allocate between these asset classes.

Whilst bonds have done well recently, they still have a high hurdle to clear, given the rates of return on offer from cash (short-term bills) and the level of volatility in the asset class. In the longer term, bonds would become more attractive if the yield curve were to steepen in line with historical averages, though this is yet to happen.

Ultimately, if the US achieves a soft landing, with GDP growth gradually slowing, inflation remaining below recent peaks but still sticky, and interest rates slowly declining from here, we believe that equities and commodities will fare well, and bonds will struggle. If the level of inflation and interest rates comes down faster, barring any shocks to energy markets, we believe that bonds will fare relatively better compared to commodities.