25 July 2018

In this article, we provide our current macro outlook in the context of policy and economic normalisation and its implications for asset markets.

Four trends that would need to be maintained for our theme of normalisation to continue: the return of global activity to a higher level than has prevailed over recent years, inflation reverting towards higher levels more consistent with central bank objectives, interest rates (including term premia) gradually increasing and volatility across financial markets settling at higher levels as central banks withdraw stimulus. We review the progress on these four areas below and assess their implications on financial markets and our discretionary portfolio.

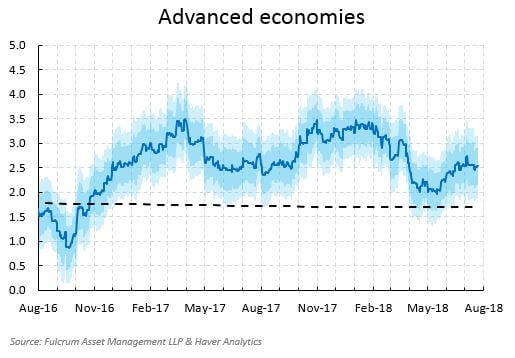

Firstly, global economic activity, according to Fulcrum’s nowcasts, remains robust, with broad-based improvements in real data across world economies. Consensus expectations of global growth have been revised higher both for this year and 2019 which continues to go against the trend of previous years and is consistent with growth returning to more “normal” levels.

Despite a soft patch in the April data, global economic activity continues to track above trend at +4.0% annualised with advanced economies at 2.5%. Underlying growth in the US remains significantly above trend, and has accelerated to 3.5%. In Europe, the latest economic indicators and survey results are weaker, but remain consistent with ongoing solid and broad-based economic growth. Worries about slowing credit growth notwithstanding, indicators of real economic activity in China have tended to be volatile but emerging economy growth also remains close to trend.

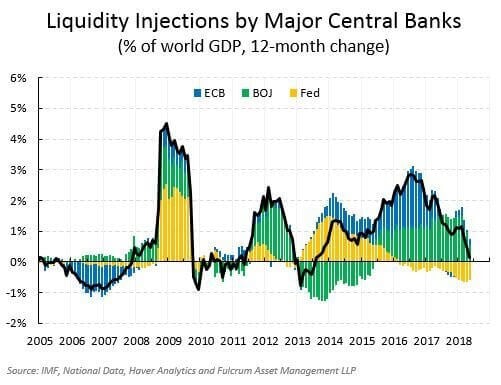

Secondly, the theme of interest rate and policy normalisation continued in the second quarter of 2018, with the Federal Reserve increasing the Fed Funds rate again to a range of 1.75-2%, the European Central Bank laying out plans to end its asset purchase programme, the Bank of England preparing to tighten policy and even the Bank of Japan looking for ways to adjust its yield cap policy. As the chart below highlights the major central banks are reducing liquidity back to more normal levels, consistent with the improving global growth backdrop.

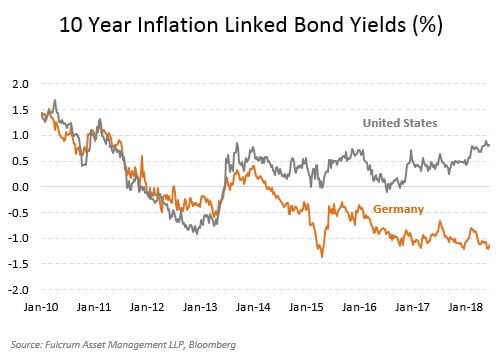

Thirdly, the progress on inflation continues to be very gradual. Oil prices pushed up headline inflation over the second quarter, but over the medium term inflation forecasts in the main advanced economies remain at or below central bank targets and are likely to remain at similar levels for the foreseeable future. This appears to be particularly the case in Japan more recently with inflation numbers falling back and remaining well below central bank targets. Importantly, inflation remains at levels that do not warrant concerns about price stability. As a result, we continue to view monetary policy as still predominantly responding to robust activity rather than trying to fend off higher inflation. The latter would probably be more negative for markets.

The current environment of solid global growth and anchored inflation should be supportive for equities and emerging markets, while posing modest upside risks to fixed income yields. In the US, bond yields have already risen to levels more consistent with normalisation, but yields in other core markets, such as Germany, have retraced to prior depressed levels; the spread between US and European yields is at highly attractive levels (chart below) and we remain positioned for convergence.

Fourthly, the road towards normalisation is not without challenges and consequent dislocations, which in turn creates opportunities. While the increase in volatility in the first quarter was concentrated in developed market equities, the second quarter saw a more widespread increase. Once again, concerns about trade wars dominated the fluctuations in investor sentiment and triggered a broad-based loss of confidence in emerging market assets, which were perceived to be the most damaged by trade wars and US dollar strength. We will expand our views further on this topic as well as China’s economy in another Discretionary View.

So far, this loss of confidence does not reflect underlying macroeconomic fundamentals, but a reassessment of “Margins of Safety”: investors now require additional compensation to hold emerging market assets – a phenomenon that is consistent with normalisation. Therefore, when allocating to emerging markets, we have selected countries that offer high real yields, have solid fundamentals and attractive valuations. Our favoured regions continue to be South Africa, Indonesia, Mexico and Brazil.

As mentioned above we will be covering different topics in the next Discretionary View notes but will no doubt return to the theme and implications of normalisation in coming months and quarters.