As at 9 October 2023

Whilst the S&P 500 has been declining over the past several weeks, it has still returned over +13%¹ on a year-to-date basis, compared to an almost -20% drop in 2022. This is particularly surprising given the +100bps rise in long-term real interest rates² since the start of 2023, which may have been expected to weigh on valuations. As some commentators have noted however, there has been a significant outperformance of the headline S&P 500, also known as the Value-Weighted (VW) index, versus its Equal-Weighted (EW) counterpart. In contrast to the double-digit gains in the VW index, the EW index has returned just +1.4%³ year-to-date.

Source: Fulcrum Asset Management LLP

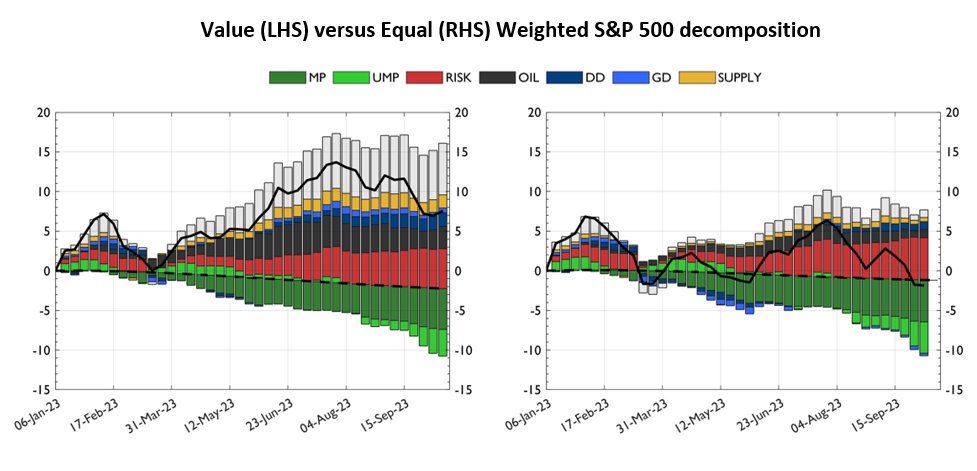

One common explanation for this disparity is that the VW index is dominated by large technology companies such as Microsoft and Nvidia that have been buoyed by optimism around Artificial Intelligence. We decided to investigate this claim more formally using our high-frequency decomposition of asset price movements. Using a Bayesian Structural Vector Auto-Regression with sign and narrative restrictions, the model identifies 8 separate shocks: Monetary Policy (MP), Unconventional Monetary Policy (UMP), risk sentiment (RISK), oil supply (OIL), Domestic Demand (DD), Global Demand (GD), aggregate supply (SUPPLY) and an unknown shock.

The above figure decomposes the moves in the VW and EW price-to-dividend ratios since the start of the year into contributions from these fundamental shocks. Overall, we see a much larger unexplained component (signified by the grey bars) in the VW index. This lends support to the claim that this year’s rally may be less to do with traditional macroeconomic drivers and more related to idiosyncratic developments in the technology sector.

Overall, on both a US and global basis, most attention is usually paid to the returns from the VW index, as this more accurately represents the characteristics of the investment universe. However, when large discrepancies appear between VW and EW equities, investors have an interest in understanding why this has occurred, and assessing what it means for the durability of returns going forward.