As at 15 September 2023

Last week, the Federal Reserve Bank of New York resumed publishing its nowcast of US economic activity, which had been suspended since September 2021 owing to modelling challenges raised by the pandemic. The new model is described in detail in a staff paper and incorporates several key features first developed by Antolin-Diaz, Drechsel and Petrella (2017) as part of Fulcrum’s Nowcasting Research programme. These features include accounting for richer lead-lag dynamics in the propagation of macroeconomic shocks, modelling long-run growth as a time-varying process and including an outlier detection procedure, which is particularly valuable during the Covid period. Fulcrum’s current nowcasting model incorporates these and additional innovations which have been developed post the pandemic.

Both Fulcrum and the New York Fed use a Bayesian Dynamic Factor Model (DFM), which extracts one or multiple latent activity ‘factors’ using a large cross-section of economic data at mixed frequencies. The Atlanta Fed has a measure that incorporates some DFM features alongside a more granular approach that forecasts each of the 13 sub-components of GDP.

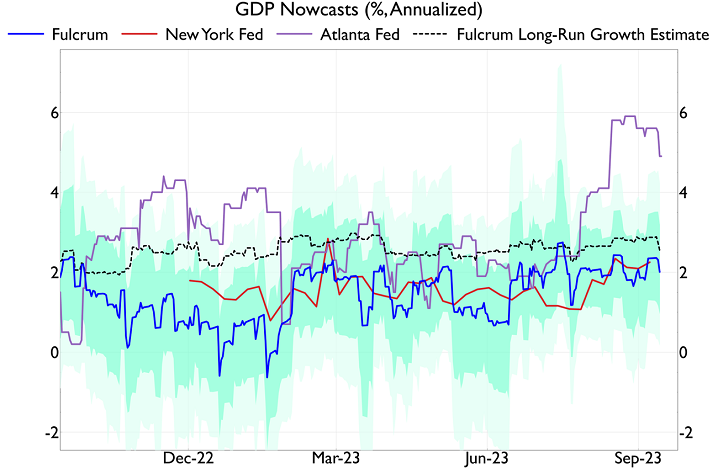

Source: Fulcrum Asset Management, Federal Reserve Bank of New York, Federal Reserve Bank of Atlanta

Recently, all three of the models shown have pointed to growth that is either at or above its long-term trend. Notable data releases that have contributed to this include the ISM Services report for the month of August, as well as strong readings for retail sales, personal spending, and industrial production in July. The Atlanta Fed measure has been particularly high as of late, pointing to a GDP forecast for Q3 at around 5%, well above most estimates of trend growth. A significant portion of the Atlanta Fed divergence, however, is led by international trade and inventories components, which are historically volatile and given less weight in the ‘pure’ DFM approach of Fulcrum and the New York Fed. Taken together, these measures all point to a robust near-term growth outlook, particularly on a relative basis given that our estimates of UK and Euro Area activity are at 0% and -0.3%, respectively.

Going forward, the pace of US growth will be a critical point of focus for the Federal Reserve when it comes to setting interest rate policy. This in turn will have significant implications for valuations across equity, fixed income, and foreign exchange markets. As such, it is vital to use cutting-edge techniques, as us and others have done, to arrive at a timely estimate of current economic activity.